Monday August 21: Five things the markets are talking about

This week, top central bankers including the Fed’s Yellen and ECB President Draghi will gather for the Jackson Hole economic symposium.

Central bankers gather Thursday through Saturday in Wyoming and the markets focus will be on Yellen’s speech Friday morning on financial stability, while Draghi will speak Friday afternoon.

Note: The symposium has become a staging ground for policy makers to expand and explain complicated new policies.

Will Draghi provide some clarity on ending euro QE? ECB watchers think his upcoming appearance will give him an opportunity to set out the case for bringing it to an end in 2018.

In Europe, the eurozone economy had a surprisingly strong H1, and many expect to see indications over the coming week that growth is continuing at only a slightly slower pace during Q3. Key data this week will be the flash composite PMI’s (Wednesday). The UK and Germany (Thursday and Friday) will post revised estimates of Q2 GDP. Also in Germany, both the ZEW (Tuesday 5 am EDT) and Ifo survey (Friday 4 am EDT) results for August will be published.

Stateside, on Thursday (10:00 am EDT) the NAR releases July existing-home sales report which will offer insight into whether the tight supply of homes and rising prices are deterring prospective homebuyers. On Friday (08:30 am EDT), July’s durable goods report will show how investment expenditure is shaping up.

1. Stocks extend their declines

Equities extended declines overnight amid growing unease about persistent low inflation.

In Japan, stocks fell to a fresh 3-1/2-month low Monday, as investors remained cautious amid worries over whether the Trump administration will be able to implement growth-boosting measures. The Nikkei ended down -0.4% while the broader Topix index fell -0.1% with volumes about -16% below the 30-day intraday average.

In Hong Kong, shares finished higher on Monday, supported by strong performance in energy and telecoms firms. The Hang Seng index ended up +0.4%, while the China Enterprises Index gained +0.5%. In China, the CSI 300 index rose +0.3%, while the Shanghai Composite Index gained +0.2%.

In South Korea, the KOSPI index lost -0.1%, while down-under Australia’s S&P/ASX 200 Index dropped -0.4%.

In Europe, indices trade lower across the board with the exception of the Swiss SMI as the global Geo-Political tensions weigh on a light day for corporate and macro data.

U.S. stocks are set to open in the red (-0.2%).

Indices: STOXX 600 -0.2% at 373.4, FTSE -0.5% at 7308, DAX %-0.4 at 12114X, CAC 40 -0.5% at 5088, IBEX 35 -0.1% at 10373, FTSE MIB -0.3% at 21751, SMI +0.3% at 8898, S&P 500 Futures -0.2%

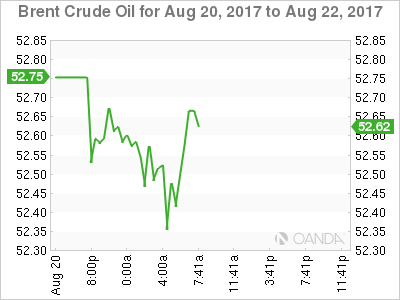

2. Oil dips on rising U.S output, gold steady

Ahead of the U.S. open, oil prices have dipped, weighed down by rising U.S output.

Note: A -13% decline in U.S. crude inventories since March indicates a gradually tightening market.

Brent crude futures are at +$52.64 per barrel, down -8c or -0.2% from Friday’s close. U.S. West Texas Intermediate (WTI) crude futures are at +$48.47 a barrel, down -4c or -0.1%. The moves follow a sharp +3% rally in prices on Friday.

Note: U.S. production has broken through +9.5m bpd, it’s highest since July 2015.

Nevertheless, there are signs that U.S. output may soon slow – Friday’s Baker Hughes report showed that energy firms cut rigs drilling for new oil for a second consecutive week (-5 oil rigs in the week to Aug. 18), bringing the total count down to 763.

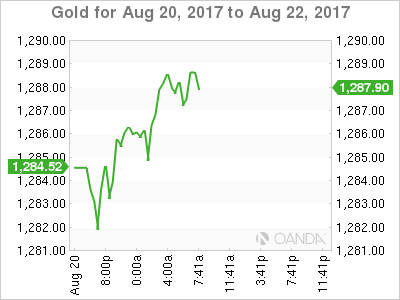

Gold prices are little changed as the market seeks direction after a week of geopolitical uncertainty in the U.S and Europe and ahead of a meeting of central bankers later this week. Spot gold has edged up +0.1% to +$1,286.01 an ounce. The ‘yellow’ metal surged to its highest since November on Friday when political and security concerns in the U.S. and Spain rattled investor nerves and supported demand.

3. Yields unchanged ahead of Jackson Hole

U.S. government bonds have strengthened this year, reflecting investors’ continuing demand for relatively safe-assets and their doubts about the prospect of strong U.S. economic growth and inflation under President Trump.

The yield on the 10-Year Treasury note settled at +2.196% Friday, down from a peak above +2.6% in March and compared with +2.446% at the end of 2016.

In Japan, benchmark JGB’s were steady overnight, underpinned by firmer U.S. Treasuries and weaker Japanese stocks. The 10-Year cash JGB yield was flat at +0.035%.

In Europe, Germany’s10-Year yield declined -1 bps to +0.41%, while the UK's 10-Year Gilt yield decreased -1 bps to +1.08%.

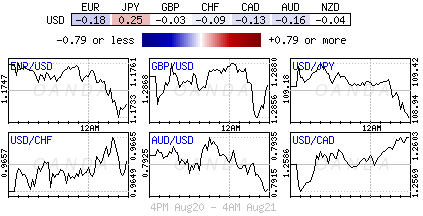

4. Dollar steady ahead of central bankers speeches

The FX market starts the week little changed with the focus on the upcoming Jackson Hole conference that begins on Thursday.

Note: ECB’s Draghi will attend, but will give a speech in Germany on Wednesday (3am EDT).

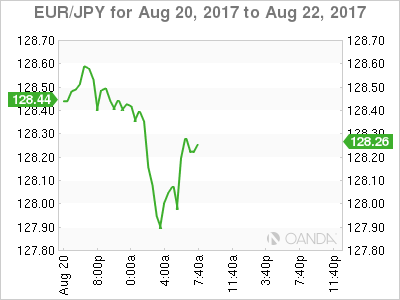

The market is speculating that there may be some sort of announcement of the tapering of its QE program, which is expected to be a two-step process that is split between September and October. The ‘single’ unit continues to hover atop of Friday’s closing €1.1740.

USD/JPY (¥109.03) is trading around the psychological ¥109 handle with the JPY currency remaining firm on safe-haven flows as the U.S. and South Korean begin a 10-day joint military exercise.

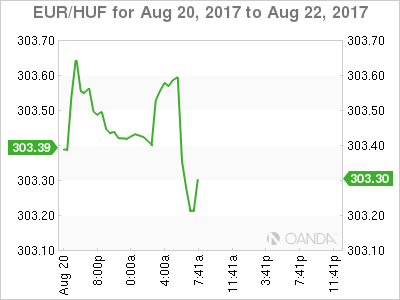

Elsewhere, emerging currencies (EM) such as the ZAR ($13.2130) is on the back-foot, slipping around -0.4% outright. Emerging European currencies are also failing to make headway against the EUR – CZK (€26.0805) has slipped -0.2% after last week’s rally. The HUF (€303.51) is trading atop of its three-week highs ahead of tomorrow’s central bank rate-setting meeting. The Hungarian national bank (MNB) is expected to keep its base rate on hold at a record low of +0.9%.

5. Germany’s Bundesbank sees strong German growth continuing

In its latest market update this morning, the Bundesbank expects the German economy to continue its strong growth trend in Q3 on the back of industrial exports.

The comments follow official data last week that showed the German economy growing by +0.6% q/q, or +2.5% y/y in Q2, following annualized growth of +2.9% in Q1.

The central bank said that record sentiment in manufacturing, strong new orders, and a significant stock of orders still being worked through all “suggest that industrial output can be expected to grow significantly again in the current quarter.”

The Bundesbank said that recent developments in the construction sector suggest slowing momentum. For consumers, the outlook, however, remains bright amid a strong labor market and positive income outlook.