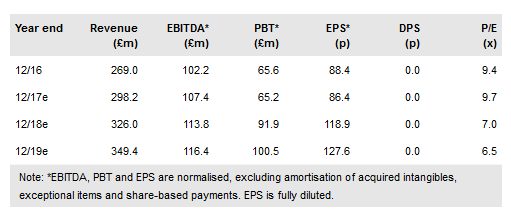

Jackpotjoy plc (LON:JPJ) has made another significant step towards the improvement of its capital structure, by securing a c £388.5m senior secured term and revolving credit facility. The facility will replace its existing first and second lien term notes and, although 2017e gross debt increases by c £40m, cash interest costs should decline by c 33% pa. We estimate that pro forma adjusted net leverage of 3.4x (3.35x at Q317) will fall to 2.4x in 2018 and 1.6x in 2019. We have increased our 2018 and 2019 EPS by c 10%. JPJ’s shares have risen 39% since the January listing in London, but still trade at a meaningful discount to peers at 7.0x P/E, 8.0x EV/EBITDA and 13.3% free cash flow yield for 2018e.

Continued improvement of the capital structure

During 2017, JPJ has paid a £94.2m earnout to Gamesys and made significant progress in simplifying its balance sheet. The refinancing and replacement of its first and second lien term loans is another major step in improving the capital structure. The £388.5m senior secured term loan (£375m) and revolving credit facility (£13.5m) will be available from mid-December 2017. S&P and Moody’s are expected to issue new credit ratings: S&P is anticipated to maintain its B+ rating and Moody’s to upgrade to B1.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI