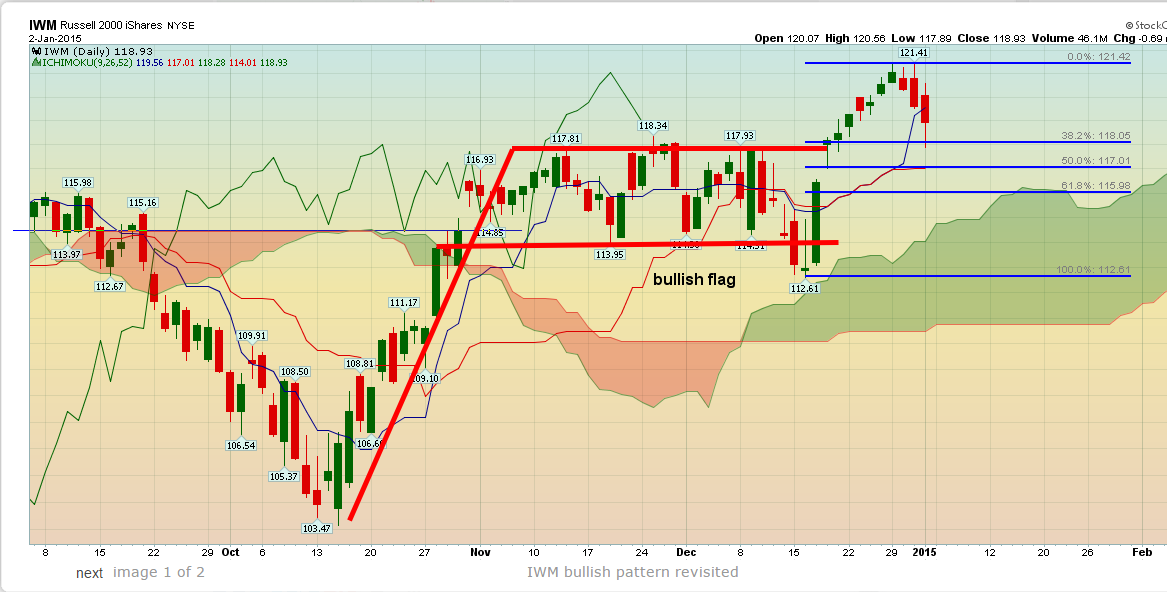

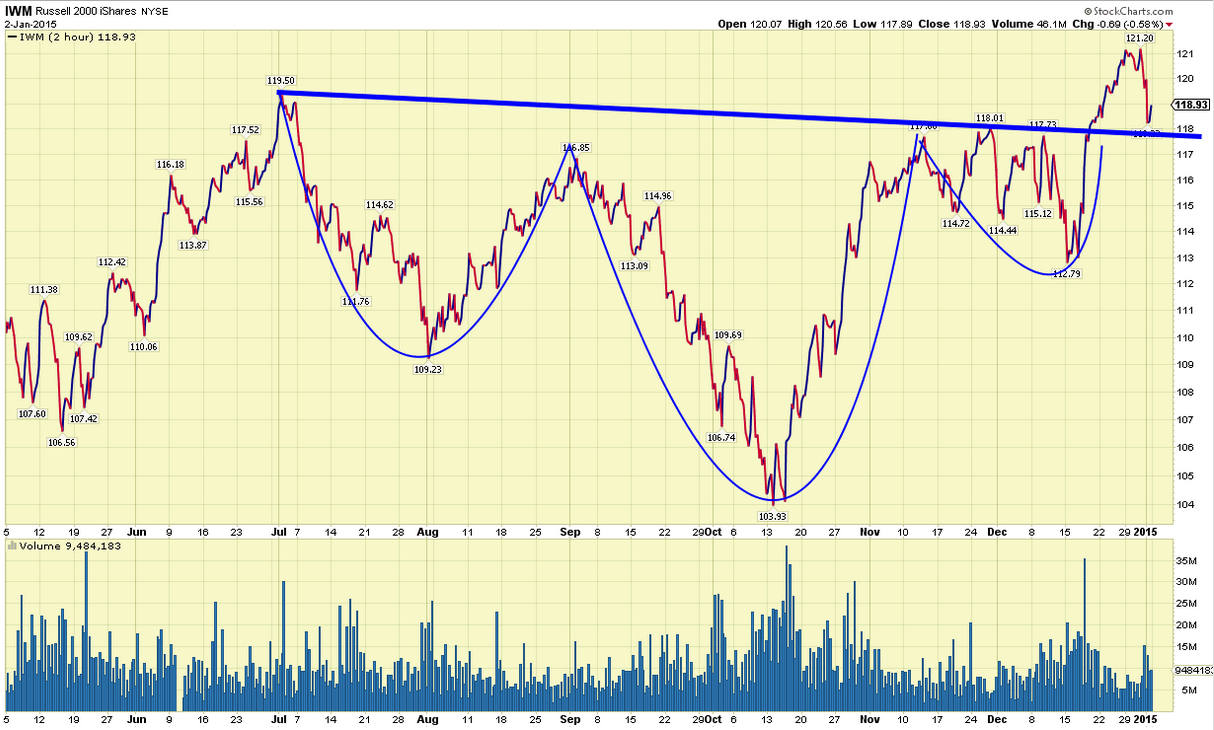

Last week I posted my analysis and bullish view on the iShares Russell 2000 Index (ARCA:IWM) with the inverted Head and Shoulders pattern with the neckline at $118. As I mentioned in my previous analysis, I was expecting a backtest of the breakout area and neckline at $118. This is exactly what followed as prices made a pull back with the rest of the market towards $118.

IWM has managed to reach the 38% retracement which was my target and I believe we could very well have seen the end of the downward correction. Worst case scenario, if we break below $117.89 (latest low) we could push towards the 61.8% retracement and the cloud support at $116.

I believe the $118 level is very strong support and I do not see many chances of breaking below it. IWM price bounced strongly after reaching and back testing the neckline support at $118. Breaking above $120.50 will increase the chances that the low is in and a new upward move towards $124-125 has started.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.