Fed’s Daly says 50-point rate cut in September may not be warranted - WSJ

For the first time this year, eurozone countries have to submit their budget drafts for review to the European Commission (EC) before national Parliaments discuss them. This is prescribed by the “Two Pack”, another brick of the new eurozone governance.

Pro-growth measures without relaxing budget targets

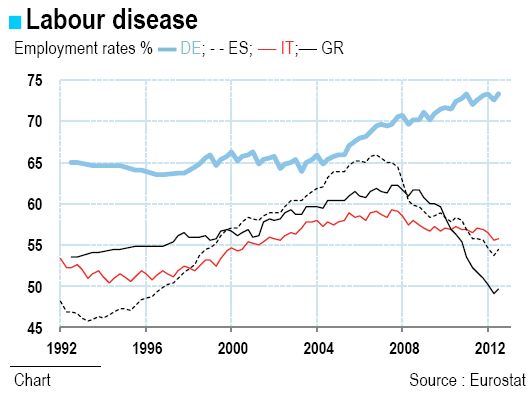

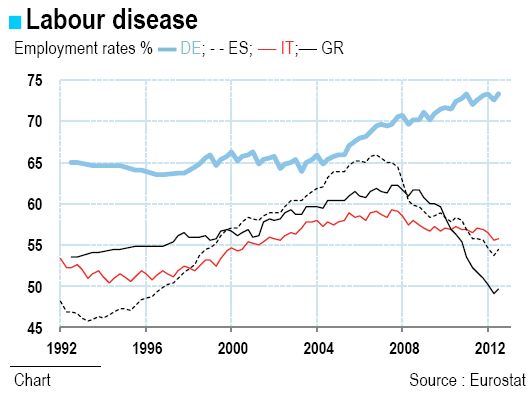

In compliance with the Two Pack the Letta’s cabinet presented this week its 2014 budget law which actually spans over 3 years. The bill contains measures aiming at both consolidating public finances and promoting growth. In this regard the Cabinet adopted measures to boost employment. Low labour participation rates (mainly female) and low employment rates have been undermining growth over past decades. At 55.7%, the employment rate is among the lowest within the eurozone. Only Greece and Spain, which suffers from the collapse of the construction sector during the crisis, perform worse. Rigidities and dualities in the labour market are among the factors constraining employment growth. Last year the Monti’s Cabinet took measures to solve these problems, making it easier to hire and fire new staffs and favouring permanent rather than fixed term contracts. This time the Government addressed another issue of the labour market, the extremely high labour costs.

The Cabinet decided to reduce labour costs by EUR 10.6bn (almost equally spilt between workers, and employers) over the coming three years. Although welcome, these measures are probably unlikely to cause the competitive shock which Italy needs. The resources devoted will not be enough to bring labour costs in line with the eurozone’s. Currently, the tax wedge on labour is around 4pp of GDP above the eurozone average. Italy cannot use freely its fiscal instrument as it is constrained by the state of its public finances. The debt ratio is above 130% of GDP and interest payments amount to 5% of GDP, against an average of 3% within the zone. Italy therefore has to continue the process of consolidating its public finances. The measures had therefore to be covered by savings in public expenditures. According to the bill, the bulk of these savings will come from a new wave of spending review that former head of IMF fiscal affairs division, Mr Carlo Cottarelli, will conduct over the coming three years. These measures should produce economies worth EUR 16.1 bn over three years. In addition the government intends to raise revenues throughout a new comprehensive tax replacing the property tax on residential property, sales of state assets and a reduction on current expenditures. The bill sets a wage freeze for civil servants for next year, a freeze of the indexation of pensions above EUR 3000 per month and a social contribution for pensions above EUR 100 000 per year. On these latest measures unions threatened to go on strike.

These new fresh measures should allow Italy to meet its deficit targets this and next year (3% and 2.5%, respectively). This is also welcome news, as markets have been starting questioning the ability of Italy to meet its fiscal obligations. With a deficit exciding 3%, the EC would be forced to re-open an excessive deficit procedure against Italy, just one year after that the Italy exited the previous one, undermining its credibility in managing public finances. Going forwards, however, Italy has no other alternative, but push on reforms to boost growth. The risk remains that the current majority supporting Mr Letta will not be strong enough to deliver them.

Box: The Two-Pack starts biting

The financial and debt crisis uncovered several shortcomings in the economic governance and budgetary surveillance at the EU level. In particular both the preventive and corrective arms of the Stability and Growth Pact (SGP) had to be strengthened. The Six-Pack, the Treaty on Stability, Coordination and Governance, whose fiscal part is known as Fiscal Compact, address these weaknesses, strengthening the SGP, throughout compulsory fiscal rules. The two-pack, which entered into force on May the 30th 2013, strengthens the SGP and fiscal discipline among Member States (MS) as well, but from another angle. It is based on two regulations; the first one tries to enhance coordination, surveillance and mutual control of MS on national budgets.

In particular, this regulation aims at avoiding that national budgets that deviate substantially from their medium-term objective might put at risk the stability of the country and, through spill-over effects, the stability of the eurozone as a whole. Under the Two-Pack, Member States have to submit their budget drafts for review to the European Commission (EC) before October the 15th of each year. The Commission analyses if the draft is in line with the SGP and with the recommendation from the European Semester that countries have received in May/June. Should the EC reveal that the budget draft is not in line with the SGP and the previous recommendation, it could ask the government to modify it. Yet, the opinion of the EC is not mandatory; national Parliaments remain fully sovereign regarding the design of national budgets. However, the opinion of the EC will be discussed at the Eurogroup, and this will increase pressures from eurozone peers.

The second regulation aims at strengthening the surveillance for those countries that are receiving financial assistance and those that are exiting a financial assistance program.

BY Clemente DE LUCIA

Pro-growth measures without relaxing budget targets

In compliance with the Two Pack the Letta’s cabinet presented this week its 2014 budget law which actually spans over 3 years. The bill contains measures aiming at both consolidating public finances and promoting growth. In this regard the Cabinet adopted measures to boost employment. Low labour participation rates (mainly female) and low employment rates have been undermining growth over past decades. At 55.7%, the employment rate is among the lowest within the eurozone. Only Greece and Spain, which suffers from the collapse of the construction sector during the crisis, perform worse. Rigidities and dualities in the labour market are among the factors constraining employment growth. Last year the Monti’s Cabinet took measures to solve these problems, making it easier to hire and fire new staffs and favouring permanent rather than fixed term contracts. This time the Government addressed another issue of the labour market, the extremely high labour costs.

The Cabinet decided to reduce labour costs by EUR 10.6bn (almost equally spilt between workers, and employers) over the coming three years. Although welcome, these measures are probably unlikely to cause the competitive shock which Italy needs. The resources devoted will not be enough to bring labour costs in line with the eurozone’s. Currently, the tax wedge on labour is around 4pp of GDP above the eurozone average. Italy cannot use freely its fiscal instrument as it is constrained by the state of its public finances. The debt ratio is above 130% of GDP and interest payments amount to 5% of GDP, against an average of 3% within the zone. Italy therefore has to continue the process of consolidating its public finances. The measures had therefore to be covered by savings in public expenditures. According to the bill, the bulk of these savings will come from a new wave of spending review that former head of IMF fiscal affairs division, Mr Carlo Cottarelli, will conduct over the coming three years. These measures should produce economies worth EUR 16.1 bn over three years. In addition the government intends to raise revenues throughout a new comprehensive tax replacing the property tax on residential property, sales of state assets and a reduction on current expenditures. The bill sets a wage freeze for civil servants for next year, a freeze of the indexation of pensions above EUR 3000 per month and a social contribution for pensions above EUR 100 000 per year. On these latest measures unions threatened to go on strike.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

These new fresh measures should allow Italy to meet its deficit targets this and next year (3% and 2.5%, respectively). This is also welcome news, as markets have been starting questioning the ability of Italy to meet its fiscal obligations. With a deficit exciding 3%, the EC would be forced to re-open an excessive deficit procedure against Italy, just one year after that the Italy exited the previous one, undermining its credibility in managing public finances. Going forwards, however, Italy has no other alternative, but push on reforms to boost growth. The risk remains that the current majority supporting Mr Letta will not be strong enough to deliver them.

Box: The Two-Pack starts biting

The financial and debt crisis uncovered several shortcomings in the economic governance and budgetary surveillance at the EU level. In particular both the preventive and corrective arms of the Stability and Growth Pact (SGP) had to be strengthened. The Six-Pack, the Treaty on Stability, Coordination and Governance, whose fiscal part is known as Fiscal Compact, address these weaknesses, strengthening the SGP, throughout compulsory fiscal rules. The two-pack, which entered into force on May the 30th 2013, strengthens the SGP and fiscal discipline among Member States (MS) as well, but from another angle. It is based on two regulations; the first one tries to enhance coordination, surveillance and mutual control of MS on national budgets.

In particular, this regulation aims at avoiding that national budgets that deviate substantially from their medium-term objective might put at risk the stability of the country and, through spill-over effects, the stability of the eurozone as a whole. Under the Two-Pack, Member States have to submit their budget drafts for review to the European Commission (EC) before October the 15th of each year. The Commission analyses if the draft is in line with the SGP and with the recommendation from the European Semester that countries have received in May/June. Should the EC reveal that the budget draft is not in line with the SGP and the previous recommendation, it could ask the government to modify it. Yet, the opinion of the EC is not mandatory; national Parliaments remain fully sovereign regarding the design of national budgets. However, the opinion of the EC will be discussed at the Eurogroup, and this will increase pressures from eurozone peers.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The second regulation aims at strengthening the surveillance for those countries that are receiving financial assistance and those that are exiting a financial assistance program.

BY Clemente DE LUCIA

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI