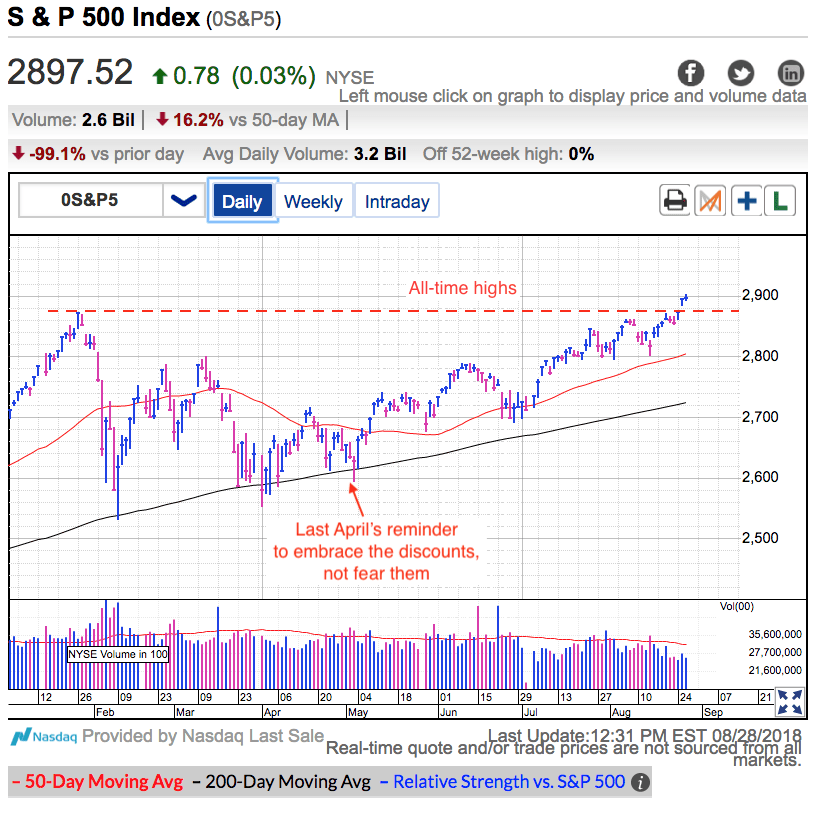

Tuesday morning the S&P 500 poked its head above 2,900 for the first time in history. The market continues basking in the after-glow of Trump’s Mexican deal that triggered Monday’s breakout to all-time highs. Unfortunately Mexico is only one piece in a much larger puzzle. Canada’s, Europe’s, and China’s trade deals remain elusive. All the work ahead of us is why the celebration was shortlived and we slipped under the psychologically significant 2,900 level in late-morning trade.

That said, 2,900 is a major milestone no matter how you cut it. This strength is impressive and caught a lot of people off guard. Not long ago the crowd was overrun by doom and gloom and predictions of the market’s collapse were everywhere. Between trade wars, rate hikes, rising interest rates, Turkey, Italy, Iran, and all the other drama thrown our way this year, it is no surprise traders were so negative.

Luckily regular readers of this blog knew better. Four months ago when the market was teetering on the edge of collapse and on the verge of making new lows for the year, I wrote the following:

Predicting the market isn’t hard if you know what to look for because the same thing keeps happening over and over. But just because we know what is going to happen doesn’t make trading easy. Far and away the hardest part is getting the timing right. That is where experience and confidence comes in. Several months ago investors were begging for a pullback so they could jump aboard this raging bull market. But now that prices dipped, rather than embrace the discounts, these same people are running scared. Markets dip and bounce all the time, but we only make money if we time our trades well.

The most important thing to remember is risk is a function of height. The higher we are, the greater the risks. By that measure, Tuesday’s dip near the 2018 lows was actually one of the safest times to buy stocks this year. Did it feel that way? Of course not. But that is why most people lose money in the stock market. If most people were selling Tuesday, and most people lose money, then shouldn’t we have been buying? Given the market’s reaction today, the answer is a pretty resounding yes.

Make sure you sign up for Free Email Alerts so you don’t miss profitable insights like these.

The S&P 500 is up 10% since I wrote those words back in April. 10% is a great result by itself. It is even better if a person took advantage of leveraged ETFs. But far and away the best trade of the year was profiting from these fantastic swings between optimism and pessimism by buying weakness and selling strength. Buy the dip, sell the rip, and repeat until a good year becomes a great year.

While it is fun to look back at my successful trading calls, what readers really want to know is what comes next. Luckily for us today’s strength doesn’t change anything. The best trade is still buying weakness and selling strength. The problem with today’s hope is it will be replaced by disappointment in a few days. Today we see light, in a few days we come across another stumbling block. And like clockwork, the market continues its swings between hope and despair.

If the best trade is buying weakness and selling strength, no matter how safe 2,900 feels, this is definitely the wrong time to be buying. Resist the temptation to chase these prices higher because recent gains made this a far riskier place to be adding new money. The risk/reward shifted away from us because a big chunk of the upside has already been realized while the risks of a normal and healthy dip increase with every point higher. In fact, if the best trade is buying weakness and selling strength, this is actually a darn good time to start thinking about locking-in profits. Remember, we only make money when we sell our winners and it is impossible to buy the next dip if we don’t have cash.

While I am cautious with my short-term swing-trades, this market is acting well and there is no reason to abandon our favorite medium- and long-term investments. We are still setting up for a strong rally into year-end and the only thing to do is patiently watch the profits pile up in our favorite long-term investments.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI