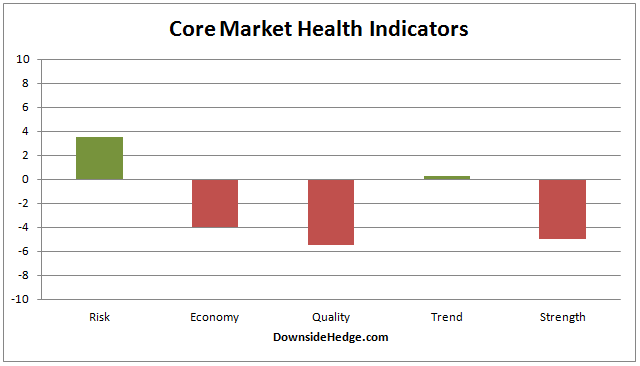

Throughout this last week all of our core market health indicators were rising…until Friday. The decline is doing serious damage to the strength we saw in internal indicators during the week. All of the categories except for our measures of the economy fell again. Our measures of trend continue to hang by the slightest of a thread. As long as it holds into the close (which I suspect it will) there will be no changes to our core portfolio allocations. We’ll still be 40% long and 60% cash in the Long/Cash portfolios and 70% long and 30% short the S&P 500 index in the hedged portfolio.

Silver Lining

One thing to note is that our measures of risk and our Market Risk indicator aren’t showing a lot of concern for an accelerated market decline. This is consistent with normal rotation in the market. However Friday I saw some signs of a more dangerous market ahead. The stocks that had been the beneficiaries of the money coming out of the momentum names are being sold heavily today. Take a look at Microsoft, Oracle, Cisco, Qualcomm, Hewlett-Packard etc. and you’ll see some ugly daily candles.

The fact that market internals couldn’t hold up during the week and the “safe” stocks are now being sold with the momentum names makes for a very fragile market.