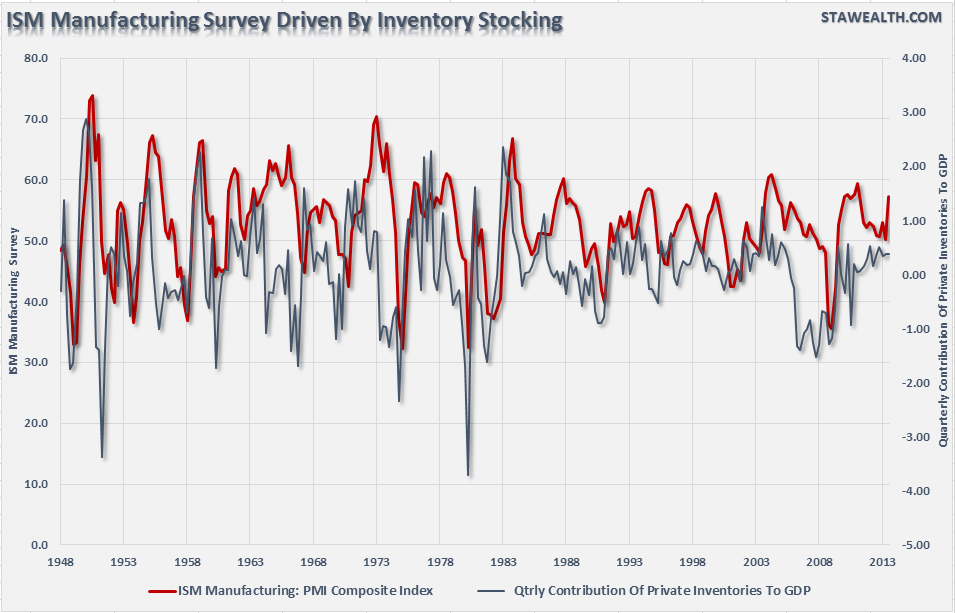

Lately, there has been a significant uptick in the ISM Manufacturing Survey's that have raised hopes that economic growth will finally, after three years of disappointment, begin to accelerate. David Rosenberg just recently wrote in his daily missive that:

"The U.S. is in clear expansionary mode."

However, before we get too terribly excited it is important to remember a couple of things. First, the ISM survey is a sentiment survey of how manufacturers currently "feel" about their business. If they are very busy producing products, then it is not surprising that sentiment would increase.

As I discussed recently in "Q3 GDP An Inventory Restocking Story:"

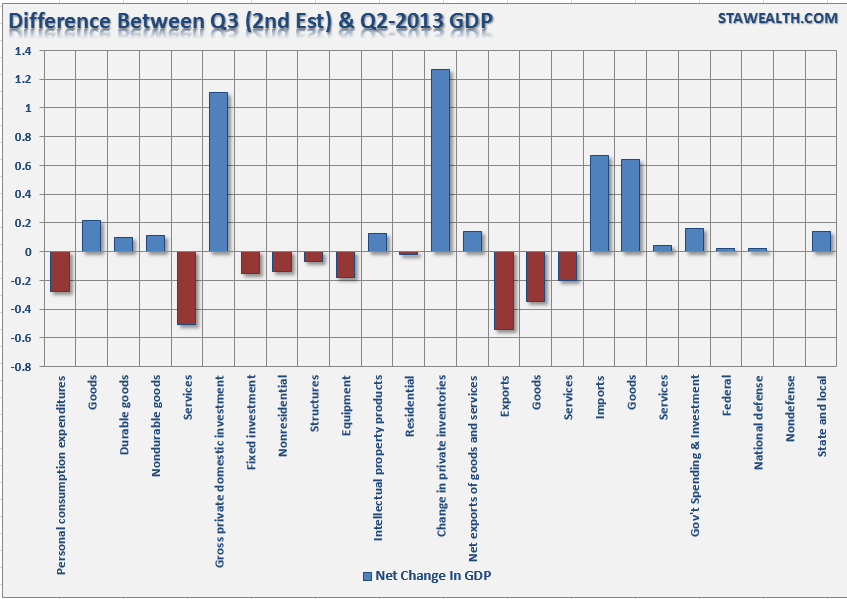

"That 'restocking cycle' was clearly evident in the GDP report. The chart below shows the raw change from Q2 to Q3 of the components of the GDP report. Notice the large change in private inventories."

(Also, notice the drop in personal consumption expenditures which I will touch on more in a moment.)

"The surge in inventories was expected due to sluggish Q4 growth in 2012 and Q1 of 2013 which led to an inventory drawdown as businesses remained on the defensive. The last few months have seen a surge in orders and activity for manufacturers as orders were placed to restock. This bounce in activity has led to hopes that the activity will be sustained going into the end of the year, but the weakness in the underlying consumer trends brings this into question."

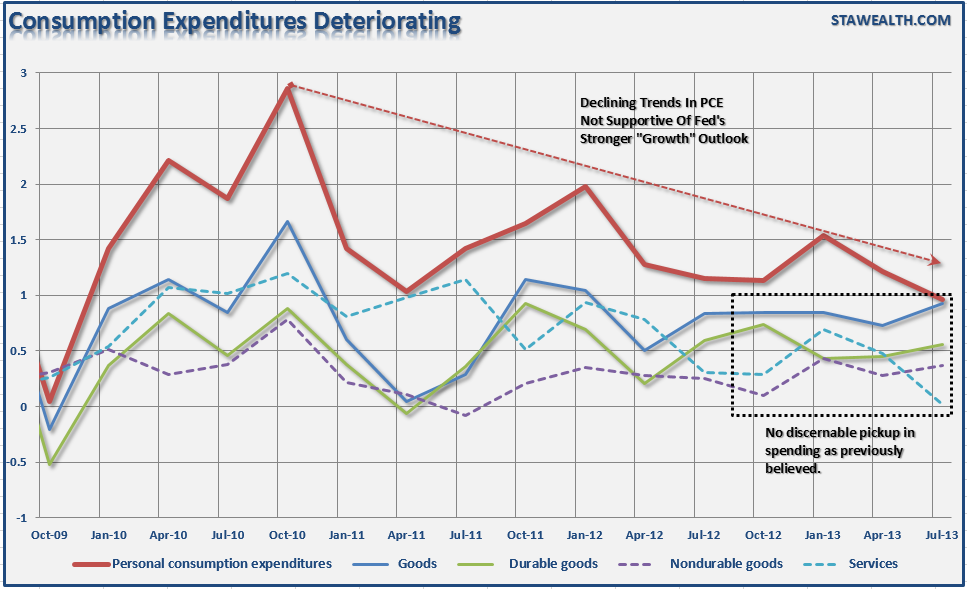

"Furthermore, as shown in the next chart, consumer spending has continued to weaken since its peak in 2010. The last couple of quarters has shown a noticeable decline is services related spending as budgets tighten due to lack of income growth as disposable personal incomes declined in the latest report. The slowdown in dividends, wages and salaries were partially offset by a rise in social welfare and government benefits. Unfortunately, rising incomes derived from government benefits does not lead to stronger economic growth."

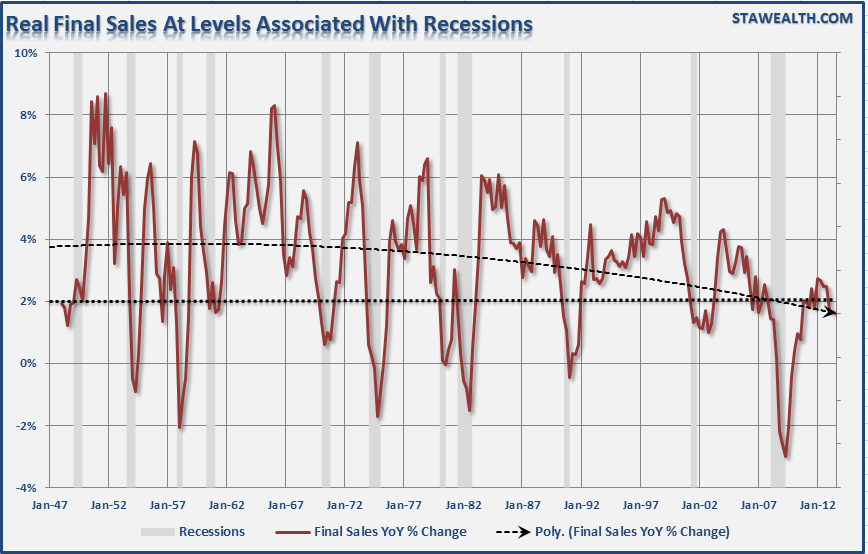

"The chart of real final sales below shows the underlying problem. Real final sales in the economy peaked in early 2012 and has since been on the decline despite the ongoing interventions of the Federal Reserve. The lack of transmission into the real economy is clearly evident."

"The current level of real final sales at 1.62% is the third straight quarter of below 2% growth. Historically, three quarters of below 2% growth in real final sales have been more consistent with economic recessions."

The most recent release of the BEA's GDP report confirms my ongoing suspicions that the private sector remains weak and has likely weakened further in recent months. While the 2nd estimate of GDP growth in the third quarter was 3.6%, which was way above the BEA's preliminary estimate of 2.8% and above Wall Street's consensus estimate of 3.1%, inventory builds accounted for 54% of the increase. Inventories increased $116.5 billion which was up from an initial estimate of $86 billion.

However, the real concern in the report is that Personal consumption growth slowed to just 0.96% from Q2. PCE comprises almost 70% of the GDP calculation and with the U.S. consumer showing signs of weakness this leaves little "wiggle room" for the economy to absorb an exogenous shock. Furthermore, as I discussed recently, the weakness in consumer spending and incomes bodes poorly for the upcoming holiday season.

This brings us back to the ISM Manufacturing Survey. In general, survey's such as the ISM, are more of a coincident rather than a leading indicator. When business is brisk, business owners tend to extrapolate the current environment into the future. However, sentiment, as shown in the chart below, can turn negative very quickly. Not surprisingly, there is a historically high correlation between the ISM Manufacturing Survey and the net contribution of the change in private inventories to the economy.

The potential issue with consumer spending on the decline, is that the buildup in inventories will likely begin to weigh on manufacturers sentiment. However, as shown in the chart above, it would not be unusual to see a sharp decline in sentiment in the coming months given the current detachment of manufacturers outlooks from the underlying economic fundamentals.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI