Apple edges up premarket as investors weigh estimated tariff costs, iPhone sales

The recent release of the ISM Non-Manufacturing survey showed a small pickup in November rising to 54.7 from 54.2 previously. Econoday wrote:

"The non-manufacturing sector picked up steam in November but the gains did not lead to new hiring. The ISM's index rose five tenths to 54.7 with business activity over 60 for the first time since February. New orders are near 60 at 58.1 for a more than three point gain and the best reading since March. But employment is barely over 50, at 50.3 for a nearly five point monthly dip for the worst reading since July. Businesses are doing more with less as seen in this morning's productivity report and in the details of this report. But still, the gain in activity and orders is good news."

Doing more with less has now been the mantra of businesses since the financial crisis, and despite the $30+ trillion dollars thrown at the economy since that time, there has been little movement by businesses to become more aggressive. Of course, this is not surprising considering the numerous headwinds that businesses face from the threat of higher taxes, higher healthcare costs, and tighter regulations from the current Administration. Respondents were very mixed in their assessment of the current business environment:

- "Cautiously optimistic is the best way to describe customer sentiment. Revenue continues to remain well below last year, but seems to have finally reached a point of stability. Price pressures are beginning to ease and customer traffic is once again picking up." (Arts, Entertainment & Recreation)

- "We have experienced an estimated 25 percent [increase] in new job orders, and in new hires for services." (Professional, Scientific & Technical Services)

- "Some companies seemed slower to make hiring decisions and/or place new positions on hold due to uncertainty in the economy and political climate." (Management of Companies & Support Services)

- "Worries about global slowdown persist; however, the housing market appears to have hit its lows and is beginning to climb. This is good news for governmental tax base projections." (Public Administration)

- "Hurricane Sandy has impacted our business activity tremendously. This emergency should not be misconstrued as a positive increase in business as usual; we merely facilitated emergency equipment and supplies to be delivered to the affected areas and the emergency responders." (Wholesale Trade)

- "Sales continue to lag, but there are signs of improvement." (Retail Trade)

- While New Orders rose to 58.1 from 54.8 last month; employment fell sharply from 54.9 to 50.3.

- Supplier Deliveries declined from 51.5 to 49 as Inventories increased to 47 from 46.5.

- Prices eased considerably from 65.6 to 57 but Inventory Sentiment fell from 64 to 62.5.

- Backlogs of Orders rose to 53.5 from 49 but New Export Orders are still contracting at 48.

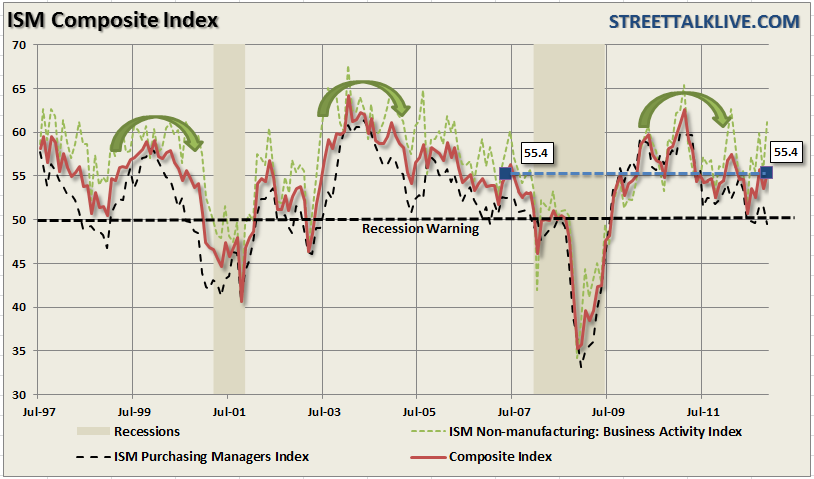

While the composite index has now regained its pre-financial crisis levels of 55.4. However, more important than the current level is the trend of the data since the peak in 2010. I have noted the previous peaks of data and while the index is volatile from one month to the next the declining trend of the data should be concerning to those paying attention. As we have stated in the past "economic change occurs at the margin" so the focus on a single data point can be very misleading.

With estimates for Q4 GDP being ratcheted down sharply to roughly 1% from Q3's 2.7% annualized rate - it is very likely that the latest print in the ISM Composite index is likely the peak that we will see for several months. Furthermore, the ongoing debates on the "fiscal cliff" and the debt ceiling are likely to weigh heavily on business owner sentiment through the end of the year and well into the first quarter of 2013. The December report, which will be produced in early January, should be very telling about the overall direction of business sentiment in the months ahead and I would not be surprised to see a fairly sharp reversal of sentiment if the holiday shopping season comes in weaker than expected.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI