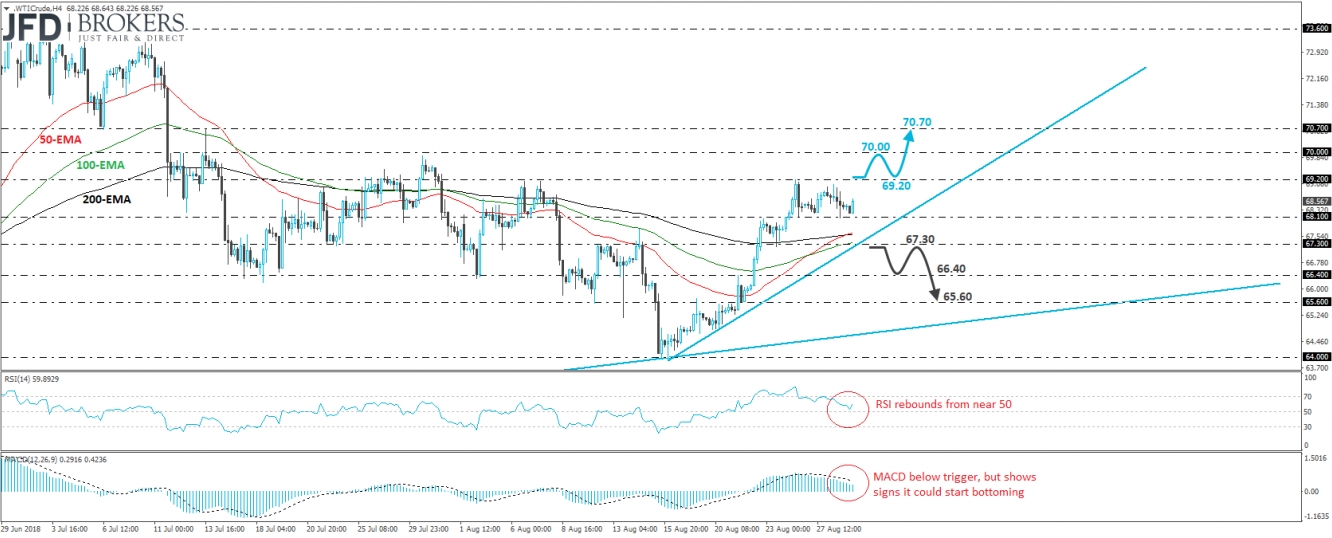

WTI has been trading in a sideways manner between 68.10 and 69.20 since Friday but it remains above the short-term tentative uptrend line taken from the low of the 16th of August. That day, the black liquid rebounded from near 64.00, the lower end of a broader sideways range that’s been containing the price action since the 10th of April, as well as from the long-term uptrend line drawn from the low of the 21st of June 2017. So, having all these technical signs in mind, we believe that WTI could resume its latest recovery soon.

A clear and decisive break above 69.20 could confirm the case as it would signal a forthcoming higher high on the 4-hour chart. Such a break is likely to set the stage for the psychological round figure of 70.00, which hasn’t been reached for more than a month now. Another move above that hurdle is possible to pave the way towards our next short-term resistance, at around 70.70, marked by the peak of the 13th of July, as well as by the inside swing low of the 6th of the same month.

Shifting attention to our short-term oscillators, we see that the RSI turned up after hitting support slightly above its 50 line, while the MACD, even though below its trigger line, shows signs that it could start bottoming within its positive territory. These indicators corroborate our view that the price could regain some upside momentum soon.

On the downside, we would like to see a clear dip below 67.30 before we abandon the bullish case, at least in the short run. Such a move could confirm a break below the aforementioned short-term uptrend line drawn from the low of the 16th of August and could initially aim for our next support of 66.40. Another dip below 66.40 could trigger more declines, perhaps towards 65.60 or the long-term uptrend line taken from the low of the 21st of June 2017.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI