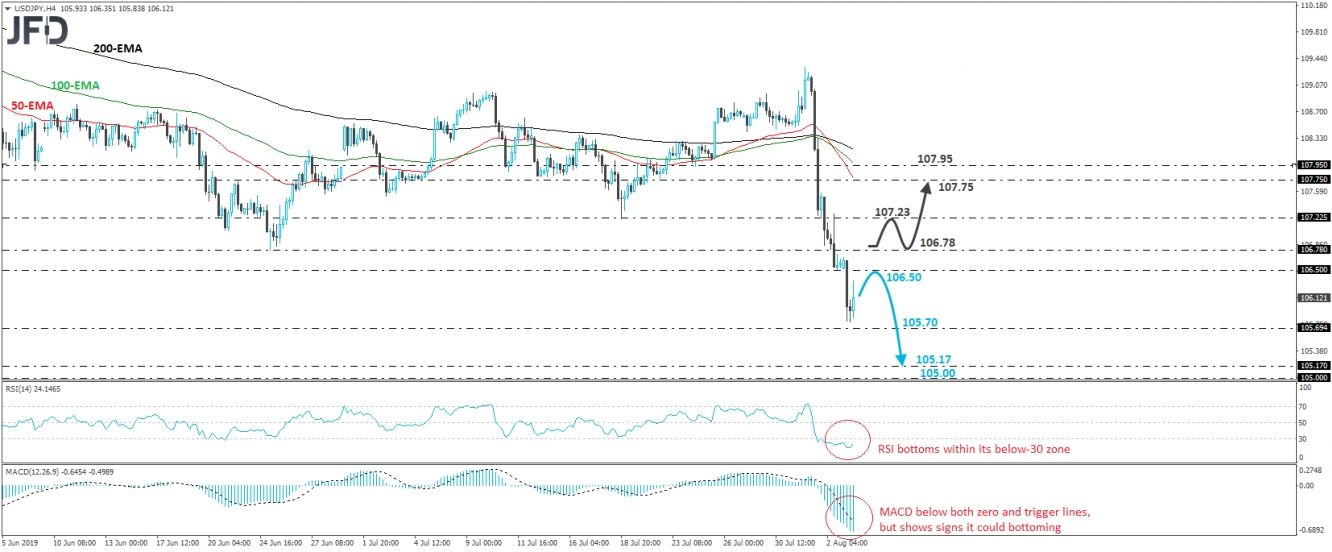

USD/JPY collapsed last week, breaking several important support barriers on its way south. The slide continued today, but the rate found a temporary support slightly above the 105.70 barrier, marked by the lows of April 2nd and 3rd last year, and then it rebounded somewhat. That said, in the absence of a clear reversal signal, we will stay bearish with regards to the short-term outlook and we would class the current rebound, or any minor continuation of it, as a corrective move.

As we already noted, the recovery may continue for a while more, but we see decent chances for the bears to jump back into the action from near Friday’s low of 106.50, or the 106.78 zone, which is marked by the inside swing low of June 25th. If so, the forthcoming negative wave could aim for a test near the 105.70 territory, which if broken, may set the stage for extensions towards the 105.17 obstacle, defined by the “flash crash” low of January 2nd, or the psychological figure of 105.00.

Taking a look at our short-term oscillators, we see that the RSI has bottomed within its below-30 zone, while the MACD, although below both its zero and trigger lines, has started to show signs of bottoming as well. These indicators suggest slowing downside speed and support somewhat the notion for some further recovery before, and if, the bears decide to shoot again.

In order to start examining the case of a larger correction to the upside, we would like to see a clear break above 106.78, the low of June 25th. Such a break could allow USD/JPY to recover towards the low of July 18th, near 107.23, which if fails to halt the advance, may allow extensions towards our next resistance zone, at around 107.75.