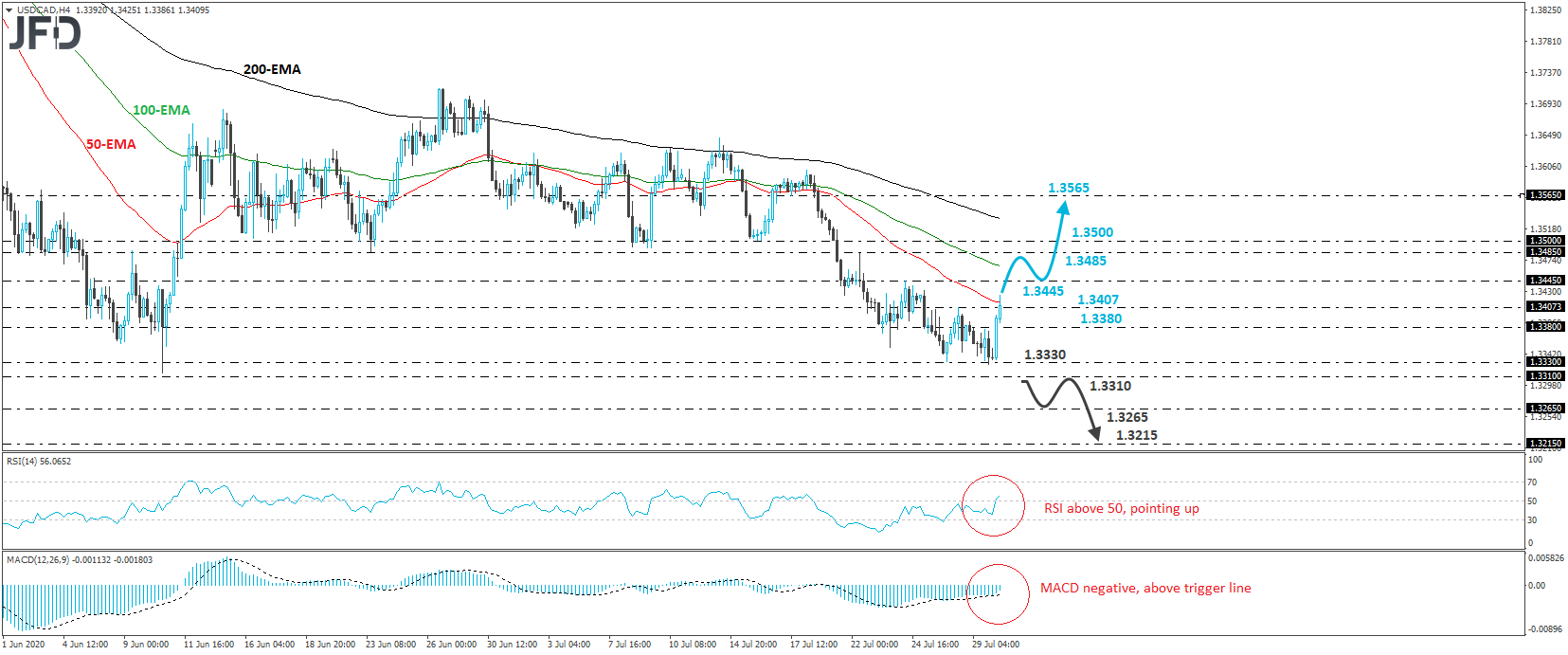

USD/CAD rebounded strongly on Thursday, breaking above the 1.3407 resistance, marked by Tuesday’s high, thereby completing a possible “double bottom” formation. The completion of the pattern has confirmed a forthcoming higher high and suggests that the short-term outlook has turned somewhat positive.

If the bulls are willing to stay in the driver’s seat, we may soon see them aiming for the 1.3445 level marked by the high of July 24th, where another break may extend the advance towards the peak of July 22nd, at around 1.3485. That said, in order to get confident on larger bullish extensions, we would like to see a decisive move above the psychological barrier of 1.3500. Such a move may pave the way towards the 1.3565 area, which is marked as a resistance by the inside swing low of July 17th.

Looking at our short-term oscillators, we see that the RSI lies above 50, pointing up, while the MACD, although slightly negative, lies above its trigger line, and points north as well. Both indicators suggest that the rate may start picking up upside speed soon, which corroborates our view for some further near-term advances.

On the downside, we would like to see a decisive dip below 1.3310, before we start examining the resumption of the prevailing downtrend. Such a move would confirm a forthcoming lower low and may initially aim for the 1.3265 zone, which is the low of February 25th. Another break, below 1.3265, could encourage the bears to extend the slide towards the 1.3215 area, which provided decent support between February 19th and 21st.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI