Stock market today: S&P 500 in weekly win as Fed shakeup stokes rate-cut hopes

So many traders and investors have been waiting for a pullback. Some for a quick one to be able to buy a little cheaper after missing a lot of the run higher. Some are looking for doomsday.

Price action in the S&P500 SPDR ETF (SPY) is a great way to look at this. The short term chart shows a break of the one month consolidation channel to the downside after hitting a 161.8% extension of the last move lower. And it is getting everyone’s panties in a bunch. I see a pullback, with good support nearby.

It may turn out to be something more, then again it may not. With the 50 day Simple Moving Average (SMA) still below the price and that coinciding with a retracement back to 100% of the last move, I will reserve judgment on any massive correction until later. A short term healthy pullback for now.

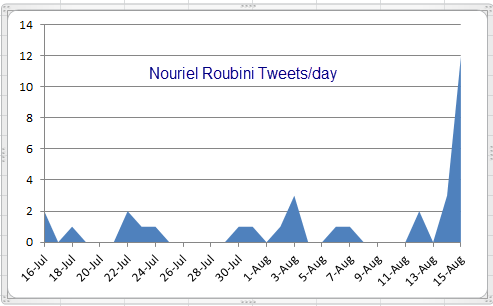

This is backed up by one other contra indicator that I have recently started following. It is the number of tweets/day from noted (Perma?) Bear Nouriel Roubini. Below is a one month chart of his activity, leaving out any retweets.

Quite a spike on Thursday. Now, just because this contra indicator has worked well in the past does not mean it will work well forever. But I have my hunch.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post