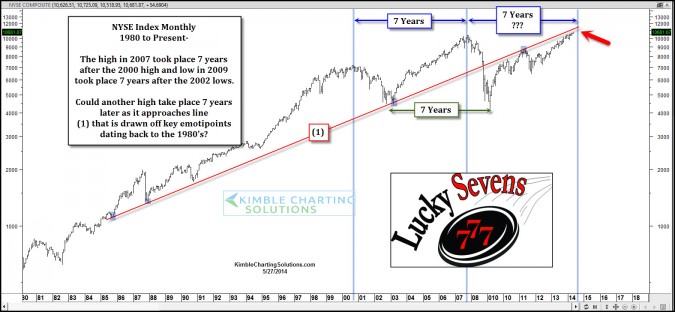

What do the highs in 2000 and 2007 and the lows in 2002 and 2009 have in common? Each took place 7 years apart in the broad-based NYSE Composite Index.

Odds are most likely slim that a key high takes place 7 years after the 2007 highs took place, based upon this cycle. I do find it interesting that line (1), which is drawn off several key emotipoints (emotional highs/lows) dating all the way back to the early 1980's, could be coming into place a few percent above current prices at a 7-year time window.

Currently the NYSE index and the NYSE advance/decline line are at/near all-time highs, acting healthy at this time. For the 7-year time window to have an impact again, some weakness in the Advance/Decline lines would need to start showing up.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.