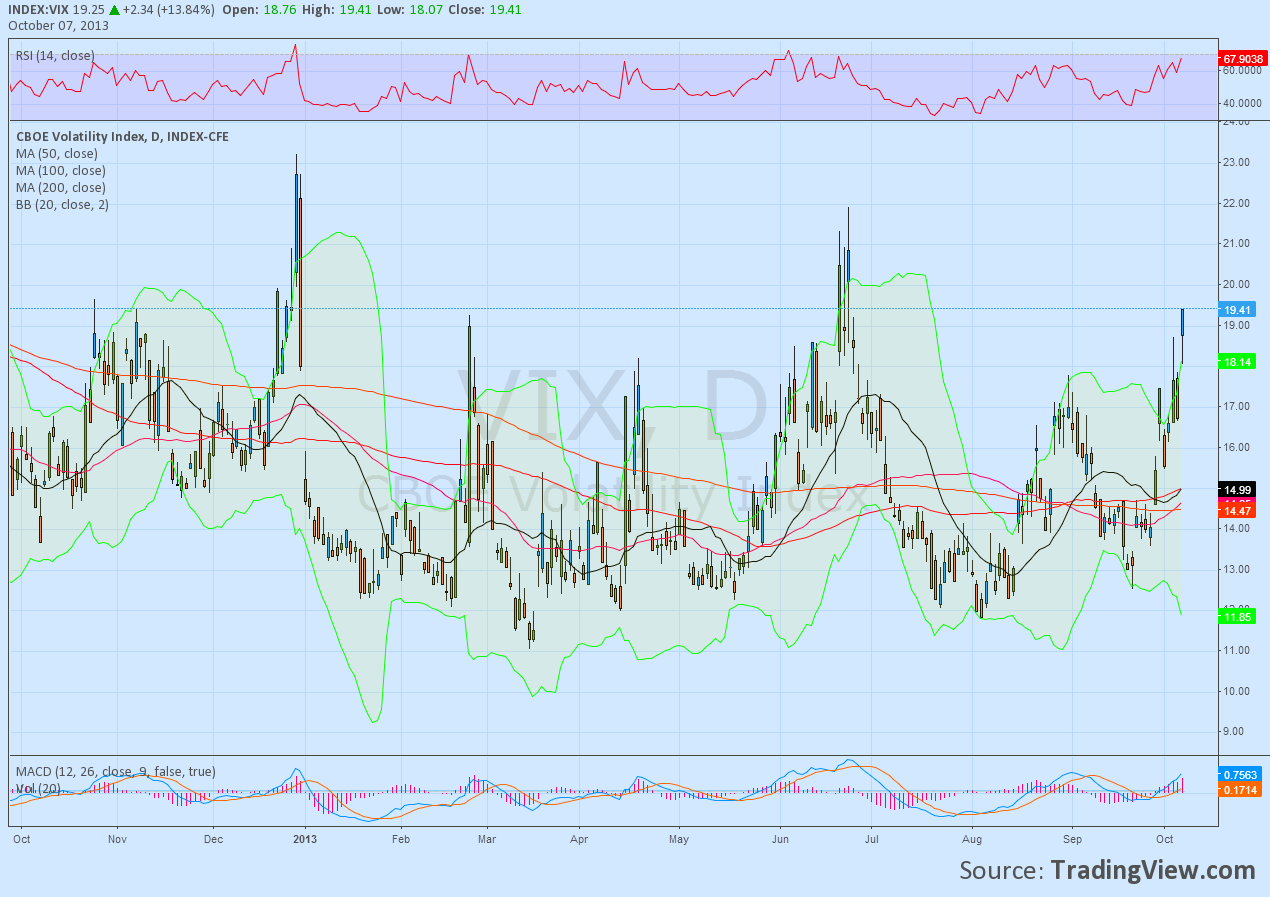

Yes it is. That is my answer. Traders in my sphere don’t seem to think so though. They want to buy Calls on the Volatility Index (VIX) as a hedge against their stock positions. In theory there is a link. But that link has to be pretty complex. If you own a index like the S&P 500 or Russell 2000 through their ETFs SPY and IWM, then buying VIX calls as a hedge is relying on the correlation of you r Index to the S&P 500 Puts and Calls and then their correlation to the VIX. If you have individual stocks then it is even more complex. Too complex for me. Why not just use S&P 500 Puts or SPY Puts or IWM Puts? I mention this because for whatever reason, and that may be the best guess, the Volatility Index is again overbought from a technical perspective. It is getting high on the RSI chart and I have discussed that frequently here so lets leave that

for now. But it is also short term overbought when looking at the Bollinger bands. Monday it closed out of the top of the Bollinger bands, and by a lot. Do you know how many times in the last year it has closed out of the Bollinger bands? 24. And each time it has moved back within them and SIGNIFICANTLY lower within 5 days. 4 of the last 5 peaks found it move over 30% lower. Most times it only takes a day for the reversal. Will it be different this time? Sure it could be. That is what everyone is betting on though isn’t it. If you are not involved maybe pick up a few VIX Puts to be the contrarian. Tell me your thoughts.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.