Tableau Software, Inc. (NYSE:DATA) Information Technology - Software | Reports May 5, After Market Closes

Key Takeaways

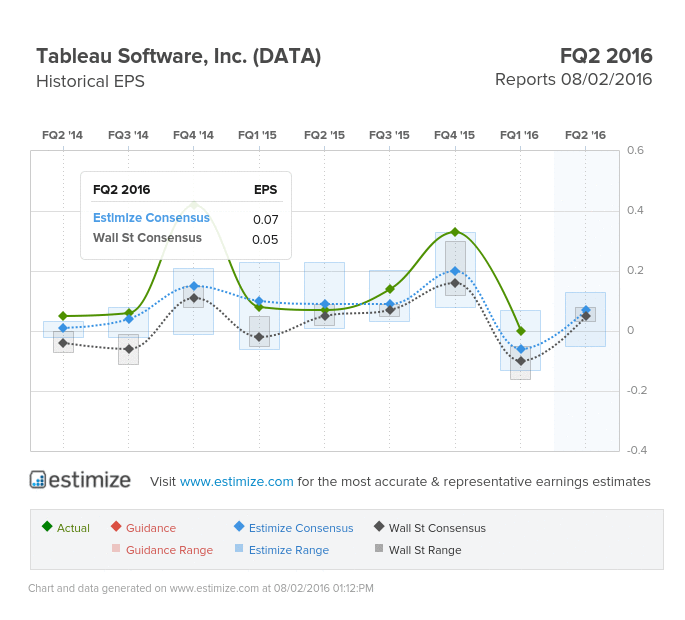

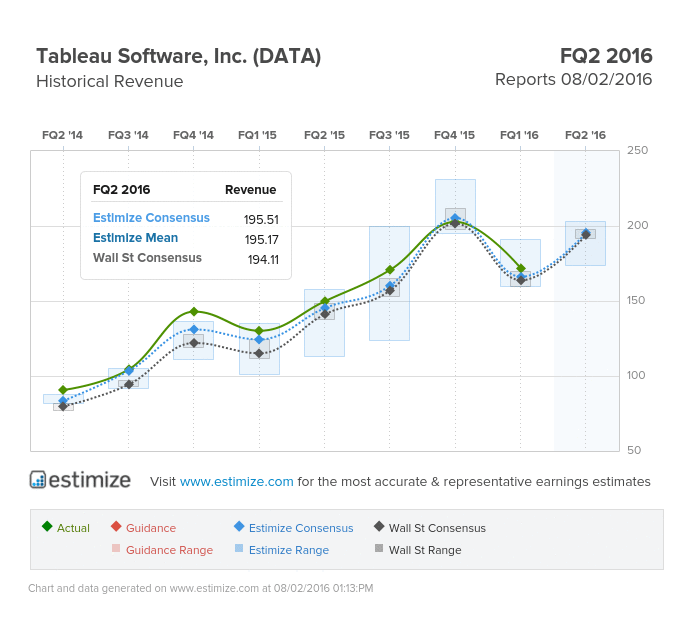

- The Estimize consensus is looking for earnings per share of 7 cents on $195.51 million in revenue, slightly higher than the Wall Street consensus

- This quarter featured an acquisitions of HyPer, the launch of Tableau 9.3 and debut of Android mobile, and analytics partnerships with the Lynda.com, Pluralsight, Udacity and General Assembly

- Just this week Deutsche Bank (DE:DBKGn) downgraded the stock to “hold” from “buy” on concerns of slow margin growth

Data visualization company, Tableau is scheduled to report second quarter earnings tonight, after the market closes. The stock is perpetually one of the most beaten down during earnings season. After Q4 earnings, shares dropped nearly 50%, only to drop an additional 10% following Q1 earnings. Early indications appear as if they are heading in the same direction ahead of tonight’s report. Just this week Deutsche Bank downgraded the stock to “hold” from “buy” on concerns of slow margin growth. For Tableau to stop the slow bleed, it will have to convince investors that this and future quarters can generate sustainable growth.

The Estimize consensus is looking for earnings per share of 7 cents, down 16% from the same period last year. That estimate has soared 138% since Tableau’s last report in May. Revenue is anticipated up 30% to $195.51 million, markedly slower than previous quarters. Shares of Tableau are down 50% in the past 12 months.

A large portion of the decline can be attributed to systemic obstacles that the whole industry is facing like currency headwinds, weak spending conditions and macroeconomic volatility. Meanwhile, Tableau also operates in a highly concentrated data visualization industry where it must compete with big tech companies like Oracle (NYSE:ORCL) and IBM (NYSE:IBM). The recently launched Business intelligence tool from Microsoft (NASDAQ:MSFT) has also put a great deal of pressure on Tableau.

Fortunately, Tableau holds a dominant position in data visualization tools with many industry leaders praising the product as leaps and bounds ahead of the competition. Tableau has been aggressive in expanding that lead with more strategic pricing and discounting measures on top of broader enterprise license agreements.

This quarter featured an acquisitions of HyPer, the launched of Tableau 9.3 and debut of Android mobile, and analytics partnerships with the Lynda.com, Pluralsight, Udacity and General Assembly.

Do you think DATA can beat estimates?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.