Trump has once again backed semiannual reporting. What could this mean for stocks?

Dow Theory says the market is in an upward trend if one of its averages -- industrial or transportation, for example -- advances above a previous important high. It is followed by a similar advance in the other.

N-Sync

Lately, the Dow and the Industrial Index's have been in sync, moving higher together.

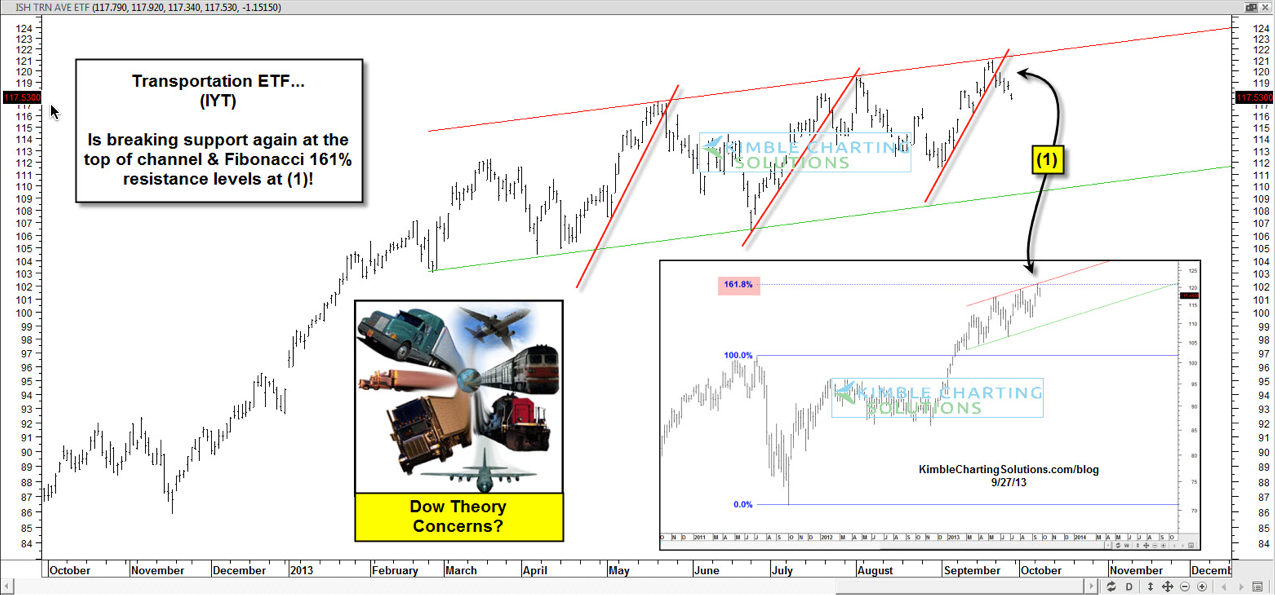

The iShares DJ Transport Average Index ETF (IYT) now finds itself at the top of channel and Fibonacci 161% extension resistance and a small break of support is taking place.

It's too early to say that a Dow-Theory breakdown is taking place, yet one should continue to watch the Transports very closely to see if further weakness continues and sends a negative Dow-Theory message.

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!