Square Inc (NYSE:SQ) Information Technology - IT Services | Reports March 9, After Market Closes

Key Takeaways

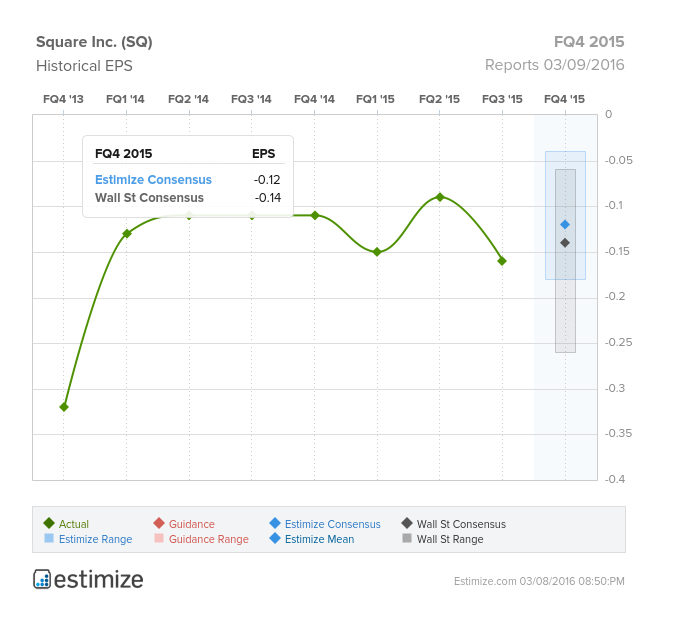

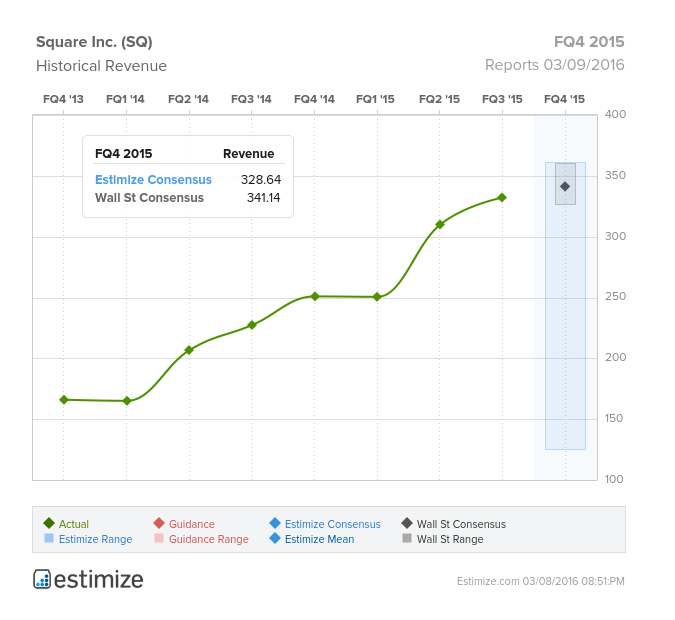

- The Estimize community is calling for EPS of -$0.12 and revenue of $328.64 million, 2 cents higher than the Street on the bottom line, and roughly $13 million lower on the top line.

- Square has had a difficult time moving away from its core traditional services, which make up 95% of its revenue, into more high growth sectors

- Visa revealing its stake in Square provided a much-needed boost to shares, which have declined 8.5% since its IPO in November 2015.

Digital payments platform Square (SQ) is scheduled to reported its fourth quarter earnings tomorrow, after the closing bell. Expectations have been low ahead the company’s first ever earnings call, over concerns whether Jack Dorsey can lead Square out of its post-IPO demise. This quarter, the Estimize community is calling for EPS of -$0.12 and revenue of $328.64 million, 2 cents higher than the Street on the bottom line, and roughly $13 million lower on the top line. However, our Select Consensus is showing sales estimates of $341.60 million, right in line with Wall Street. In its first publicly reported quarter, the Estimize community has been bearish on Square’s profitability, revising EPS estimates down 35% in the past 3 months. Compared to the same period last year, Square is expected to report an 11% loss on the bottom line, while sales are predicted to grow 31%.

Since IPOing less than 5 months ago, Square’s stock price has been all over the map. Despite missing its anticipated $17 IPO price target, shares performed remarkably well afterwards, only to fall back toward its $9 IPO price at the start of 2016. The Jack Dorsey-led company has had trouble proving it can be more than a payment merchant for small businesses and individuals. Currently, payment processing services make up 95% of the company’s revenue, while software and data products make up the remaining 5%. Software and data are expected to be a cash cow moving forward, as the company leverages these services to its existing user base. However, growth has not come easily for the mobile payment company. Prior to its IPO, the company revealed that the rate of revenue growth had slowed down in each quarter of 2015. Square did get a boost this week when Visa revealed it had a 9.99 % stake in the Class A shares of Square. Following the revelation, shares surged nearly 10%. Investors will be keen to know whether Jack Dorsey is leading Square in the right direction or down the rabbit hole he’s taken Twitter (NYSE:TWTR).

Do you think SQ can beat estimates? There is still time to get your estimate in here!