Lululemon Athletica (NASDAQ:LULU) Consumer Discretionary - Textiles, Apparel & Luxury Goods | Reports March 29, After Market Closes

Key Takeaways

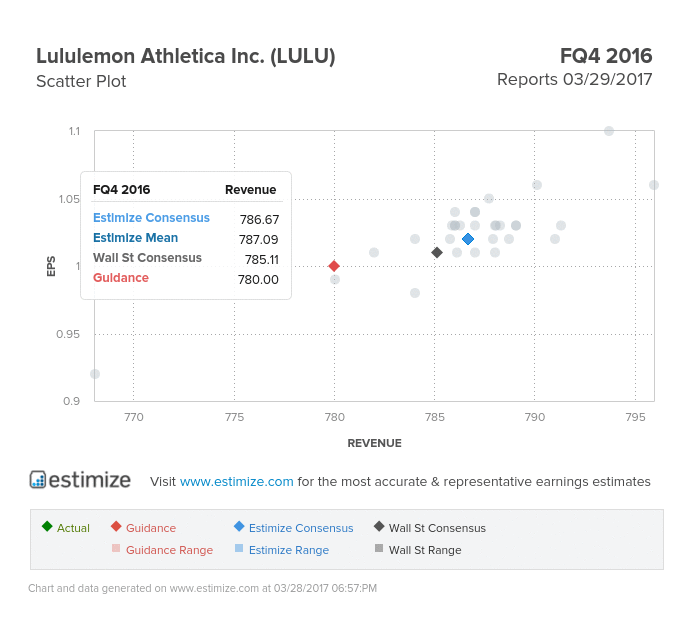

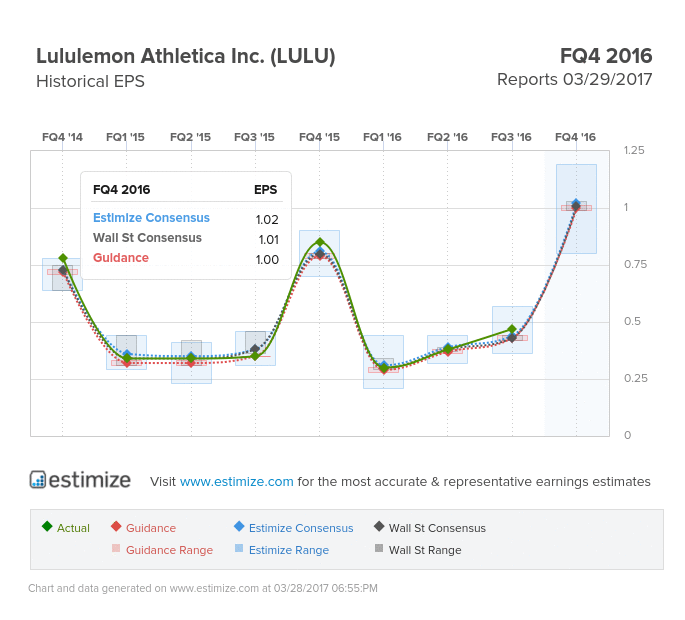

- The Estimize consensus is calling for earnings per share of $1.02 on $786.68 million in revenue, 1 cent higher than Wall Street on the bottom line and $2 million on the top

- Lululemon remains well positioned to sustain its high income core customers but must remain aggressive to stave off competitive threats from Nike, Under Armour and Gap’s Athleta brand

- The revamped womens leggings segment and the introduction of men’s clothing has accelerated same store sales growth and improved margins.

Lululemon headlines a slow week of earnings with its highly anticipated fourth quarter results tomorrow after the market closes. Analysts at Estimize expect the athleisure brand to turn in earnings of $1.02, reflecting a 20% increase from a year earlier. Estimate activity on earnings has been silent for the past 3 months despite relative weakness in the sector. Revenue for the period is forecasted to climb by 12% to $786.68 million, marking another quarter of double digit gains. In spite of strong quarterly results, shares have traded sideways for nearly 6 months and tend to stay flat during earnings season.

Investors often associate Lululemon’s success with the steady rise of athleisure, one of the fastest growing movements in the fashion and retail world in the past few years. Now that the market for athleisure has reached a saturation point, Lululemon must reinvent itself in a way that maintains the company’s core vision but also stimulates growth. The recent addition of men’s clothing helped generate new momentum on the top line whereas strong operational execution boosted the bottom line. Brand recognition, on the other hand, has shown zero signs of waning as management remains committed to introducing new clothing lines and enhancing the customer experience

This approach has been largely successful while other retailers continue to struggle. The most recent report topped the Estimize consensus on both the top and bottom line. Total comparable sales increased by 7 percent on the back of a 16% increase in direct to consumer channels. Lululemon opened 12 new stores during the quarter but also closed 2, netting 10 additional locations and about 390 total stores.

Lululemon still faces a number of near term headwinds that could pressure financial performance including currency fluctuations and increasing competition. Nike and Under Armour growing presence in the space may squeeze profitability if LULU is forced to slash prices and start offering sales.