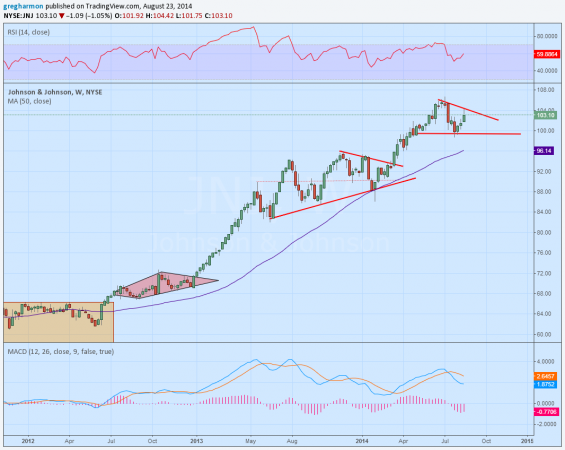

Johnson & Johnson (NYSE:JNJ) had been consolidating in a box for over 2 years when it hit my radar in late 2011 here. It took a little longer to move out of that box but since then has had a spectacular run higher from the mid sixties to over 100. But, the run does not seem to be over. In fact there are signs that it may be going through another short term consolidation phase before the next leg higher.

The chart above shows that the move to 105 in June pulled back and retested the 100 level in July. The price held and is moving back higher. Will it get caught at the falling trend resistance? Maybe. It went ex-dividend Friday though without much of a pullback. The momentum indicators are supportive of upside with a RSI rising and bullish and the MACD leveling after a pullback, and in positive territory. But a longer term trader or investor can deal with that by selling covered call options as it reverses to collect some premium. There is a natural stop just under 100, making the risk $3 less any premium sold. And how far can it go? The Measured Move out of the triangle it is making now would target 110 but the Point and Figure chart is carrying a price objective to at least 125. Who knew selling Band Aids, Listerine and Baby Powder could be so lucrative.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.