Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

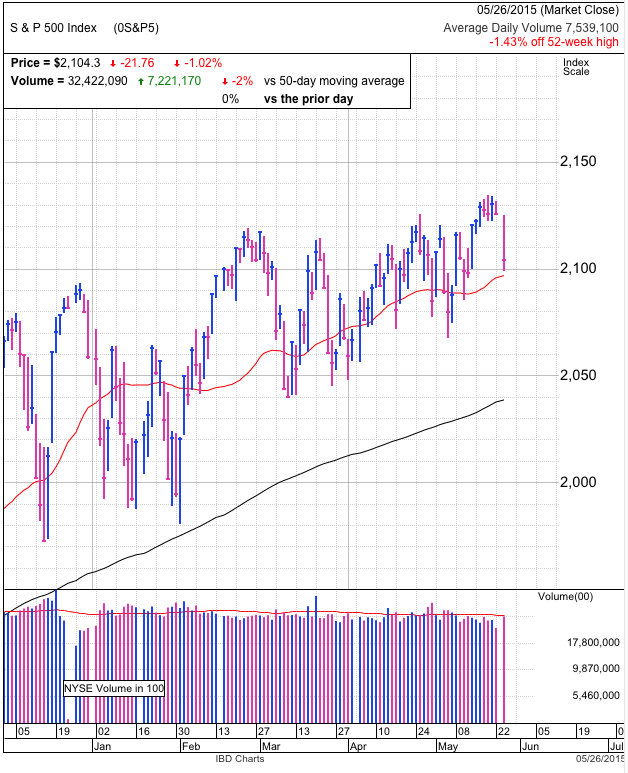

It was a dramatic day as the S&P 500 plunged 1% in the first session back from the long weekend. As unnerving as it felt, volume was below average and we are only 1.4% off of all-time highs. Hard to claim this was a crash by any stretch of the imagination, but in the market perception is reality, and today felt a whole lot worse than it looks.

Before the open, bullish sentiment S&P 500 stream already fell to 41% and AAII’s bullish sentiment hovered near 5-year lows. As much as people try to correlate record prices and bullishness, we are anything but bullish at these highs. But this is actually a common phenomena. Every rally feels extended and fragile at the far right edge of the chart. Only months later do buy-points become obvious. If this were easy, everyone would be rich.

The five months of sideways churn since the start of the year cooled off any overbought condition that crept into the market. While we could easily extend Tuesday’s selloff on Wednesday morning, using bearish sentiment as a guide, we are far closer to the end of the selling than the start. Once the last of the hopeful bulls bailout, supply will dry up and we will bounce. The best trades are the hardest to make and today it felt a lot easier to sell this weakness than buy it.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.