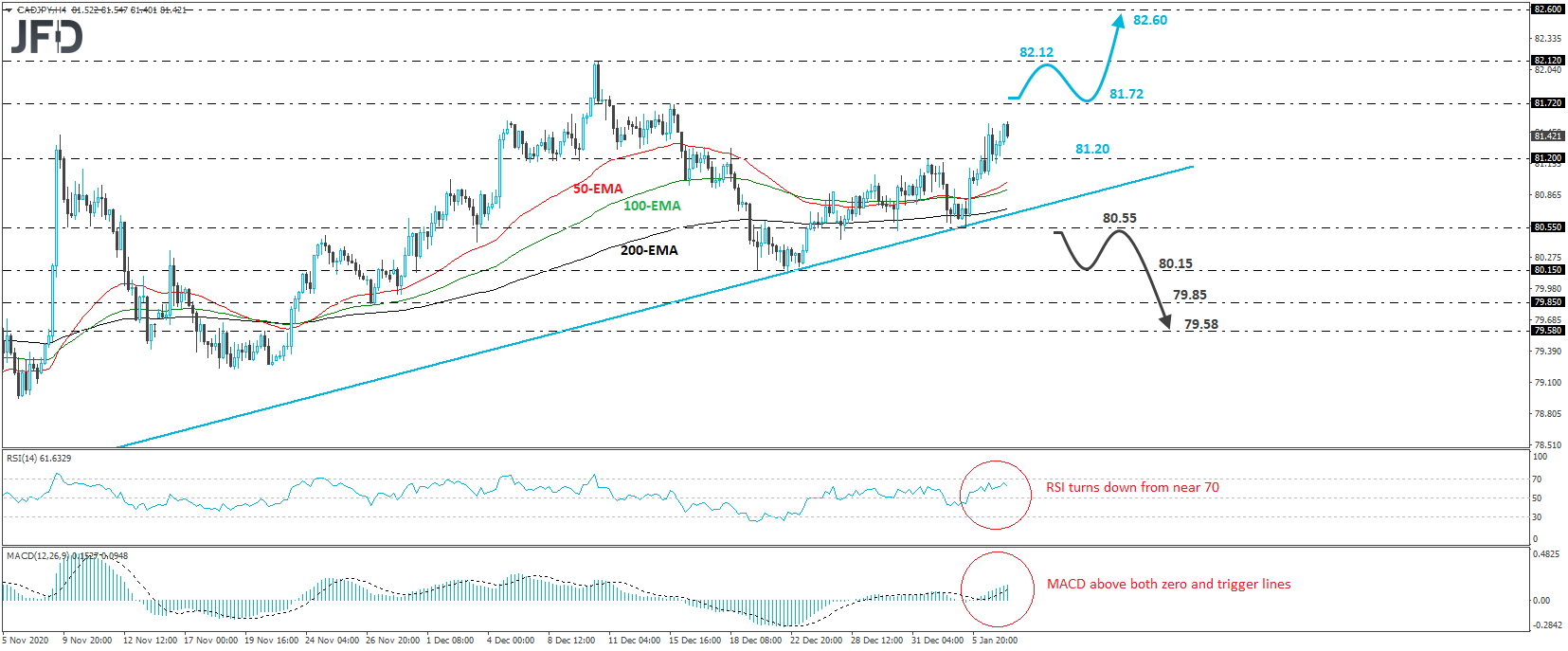

CAD/JPY traded higher today, but the advance was stopped before even the rate got close to the 81.72 resistance, marked by the high of Dec. 15. Overall, the pair continues to trade above the upside support line drawn from the low of Oct. 29, and thus, we would consider the near-term outlook to be positive.

If the bulls are strong enough to retake control at some point soon, we would expect them to challenge the 81.72 barrier, the break of which may allow advances towards the peak of Dec. 10, at 82.12. If the bulls are not willing to stop there either, then a break higher could open the path towards the inside swing low of Feb. 13, at around 82.60.

Shifting attention to our short-term oscillators, we see that the RSI turned down from slightly below 70, while the MACD, although above both its zero and trigger lines, shows signs that it could also top soon. Both indicators detect slowing upside speed, which suggests that some further retreat may be in the works before the next leg north.

However, in order to abandon the bullish case, we would like to see a clear dip below 80.55. This would confirm a forthcoming lower low on the 4-hour cart and may initially aim for the lows of Dec. 21 and 22, at around 80.15. A clear break below that barrier may extend the slide towards the 79.85 zone, near the low of Nov. 27. If that barrier doesn’t hold either, then the next stop may be at 79.58, marked by the inside swing high of Nov. 20.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.