Wells Fargo: Tesla’s short-term lift doesn’t resolve long-term concerns

I wrote about Apple (AAPL) and the AAPL:NDX ratio in my last Weekly Market Update.

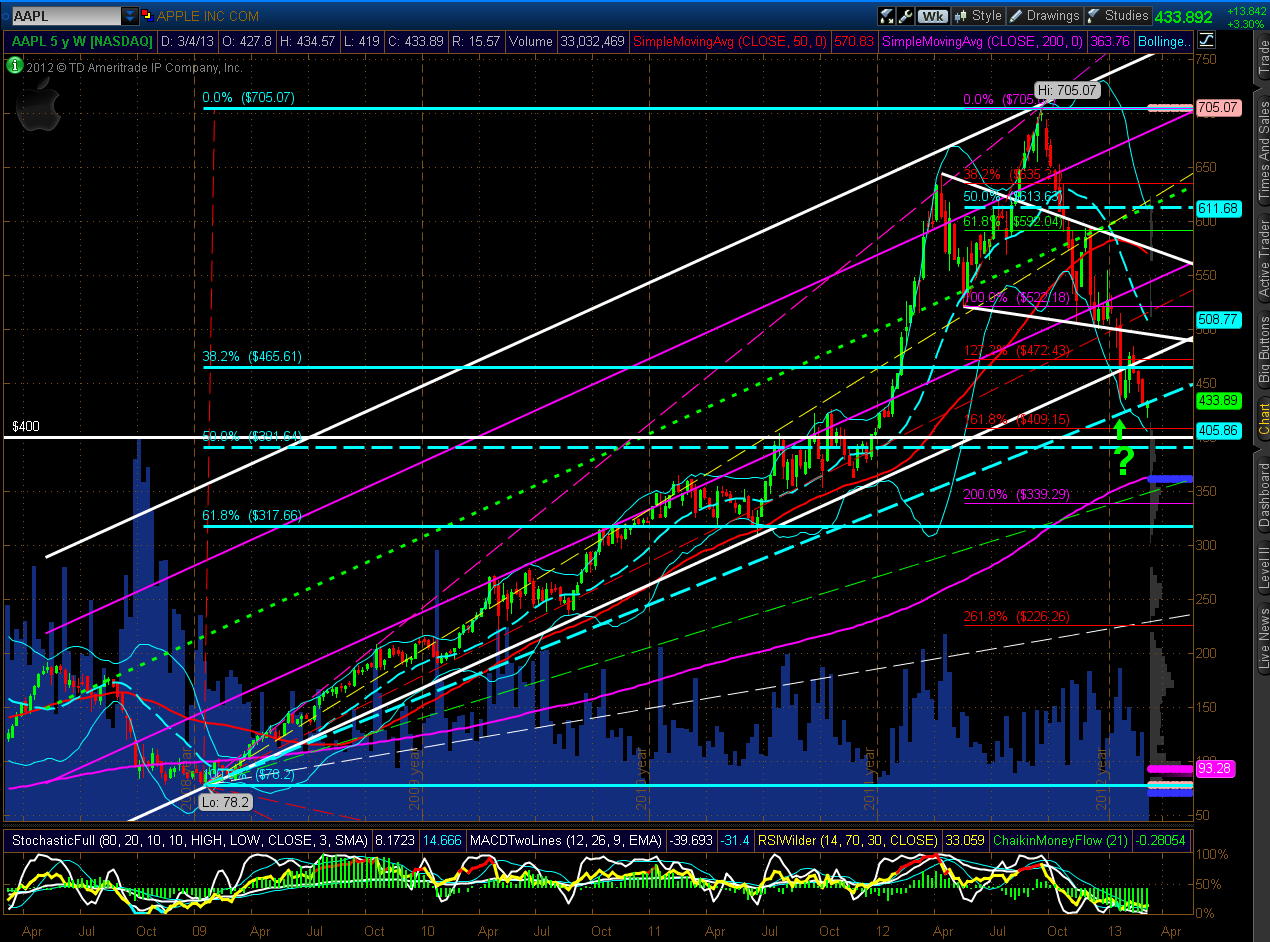

At the time of writing this post just after noon on Tuesday, AAPL has rallied a bit, as shown on this 5-Year Weekly chart, in conjunction with the rally in the Major Indices. However, it has done so without first testing its major support level at 400, so a bounce here may not be as strong a signal to indicate that AAPL's low has, in fact, been made, for now (although its low of 419 came close, so it may be close enough).

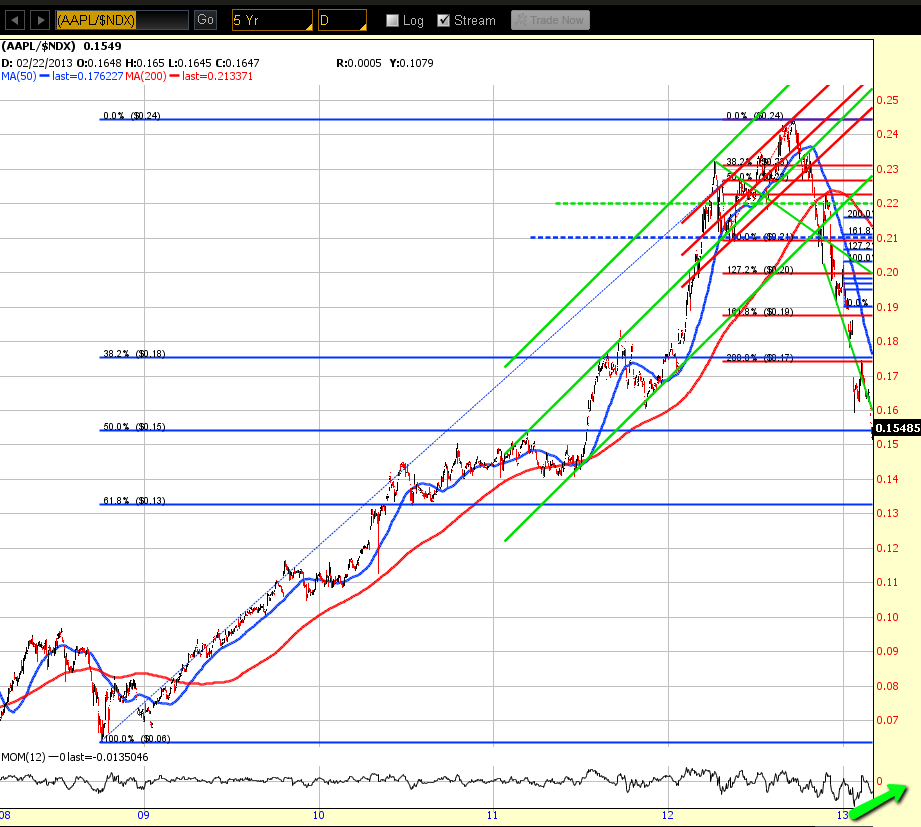

Yesterday's bounce occurred on a positive divergence of Momentum, as shown on the 10-day 10 minute ratio chart of AAPL:NDX below, as well as on positive MOM divergence, as shown on the 5-year Daily ratio chart below, to bring it back to just above major support.

We'll see if this major support holds, and whether AAPL can continue to rally...I'd like to see higher volumes enter on such a rally, however, to support such a move. Theoretically, we could see AAPL rally to a confluence level of the bottom of the channel and 2 Fibonacci retracement levels at 472ish (as shown on the Weekly chart of AAPL above).

AAPL is still not out of the woods yet, as it is still, technically, in a downtrend on the Daily and Weekly timeframes. As I mentioned in my above referenced post, a failure of AAPL below its major support level of 400 could send it tumbling down to around 350, then 300. It's one to watch to see if it supports any further rally in the Major Indices.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI