As consumers await to receive the shiny new iPhones they recently ordered, attention shifts to Apple's Taiwan-based primary supplier, Foxconn Technology Co. Ltd (otherwise known as Hon Hai Precision Industry Co). Can the company deliver on time? Or would the next factory closure disrupt production? After all, Apple's customers, particularly Americans don't like to wait.

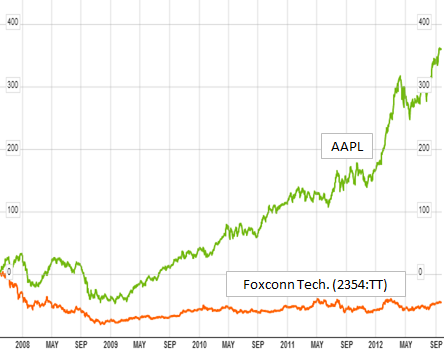

Foxconn employs some million workers in China to meet this demand for Apple's as well as Amazon's, Nintendo's, and Mocrosoft's products (iPad, iPhone, iPod, Kindle, PlayStation 3, and Xbox 360.) With its massive manufacturing capabilities and Apple as a major client, one would think that Foxconn's shares should have benefited at least somewhat from AAPL's parabolic growth. But they haven't.

In fact Foxconn's shares even lag the Taipei stock index (TWSE) over the past five years in spite of these huge orders from Apple. It seems that the bulk of product margin goes to Foxconn's large clients. Working with thin margins makes Foxconn vulnerable - as the share price clearly shows. Foxconn's story is littered with complaints of poor working conditions and worker abuses (even suicides) as well as riots and factory shutdowns.

Foxconn has invested heavily to improve conditions for workers - which hit its bottom line. But recently a reporter from the Shanghai Evening Post infiltrated a Foxconn factory and detailed his experience as an assembly line worker. A "rough" English translation of his story is available here.

Shanghai Evening Post: By my own calculations, I have to mark five iPhone plates every minute, at least. For every 10 hours, I have to accomplish 3,000 iPhone 5 back plates. There are total 4 production lines in charge of this process, 12 workers in every line. Each line can produce 36,000 iPhone 5 back plates in half a day, this is scary … I finally stopped working at 7 a.m. We were asked to gather again after work. The supervisor shout out loud in front of us: “Who wants to rest early at 5 a.m!? We are all here to earn money ! Let’s work harder !” I was thinking who on earth wants to work two extra hours overtime for only mere 27 yuan (USD 4) !?

An iPhone 5 back-plate run through in front of me almost every 3 seconds. I have to pickup the back-plate and marked 4 position points using the oil-based paint pen and put it back on the running belt swiftly within 3 seconds with no errors. After such repeat action for several hours, I have terrible neckache and muscle pain on my arm. A new worker who sat opposite of me gone exhausted and laid down for a short while.

The supervisor has noticed him and punished him by asking him to stand at one corner for 10 minutes like the old school days. We worked non-stop from midnight to the next morning 6 a.m but were still asked to keep on working as the production line is based on running belt and no one is allowed to stop. I’m so starving and fully exhausted.

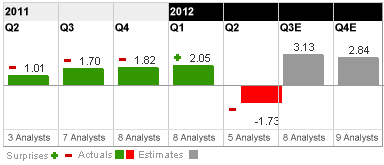

This story is fairly representative of China's high tech (and other) factories. In spite of the seemingly cheap labor, the days of easy money in China's tech manufacturing are over - it's all about scraping by on lower margins. Foxconn has underperformed analysts' expectations in 4 out of 5 past quarters. With high expectations for the second half of 2012, the pressure is on.

But there is only so much more that can be squeezed out of these production facilities and the workers employed there. Given that margins are already tight, what happens when workers - at least in some areas - successfully press for significantly better pay (particularly as food prices in China rise)? Over the past year salaries of workers at privately-owned businesses in China's urban regions grew 12.3% (adjusted for inflation!). At the same time iPhone prices are declining.

With Christmas season coming up, the "sweatshops" will be operating around the clock, and the risks of further worker discontent and factory shutdowns are on the rise. As a longer term strategy, Apple and others must be considering alternate suppliers outside of China, which does not bode well for China's manufacturing sector.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI