Intel (INTC) and Microsoft (MSFT) are two stocks that we have studied before and we believed in their upward potential. We recently posted an analysis on both those stocks and their bullish signals. Moreover, our subscribers received live tweets when I entered long and when I exited before the last big drop in prices. Now that the pressure is off, we believe that the upward potential is still intact and that this downward move was a chance of prices to make a correction.

Intel seems to have made a correction near the 61,8% retracement and started moving back upward. It will be a positive sign for bulls if prices manage to make a break out of the recent high at 22.42$. Short term stop is the recent low at 21.36$, whereas the longer term support level that should not break is the low at 20.75$.

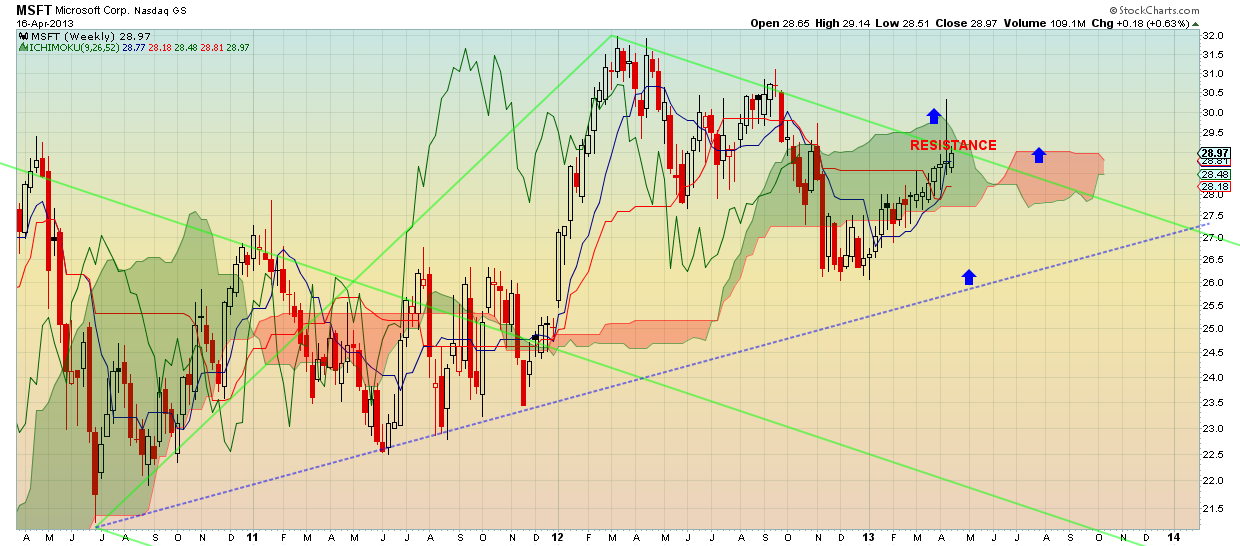

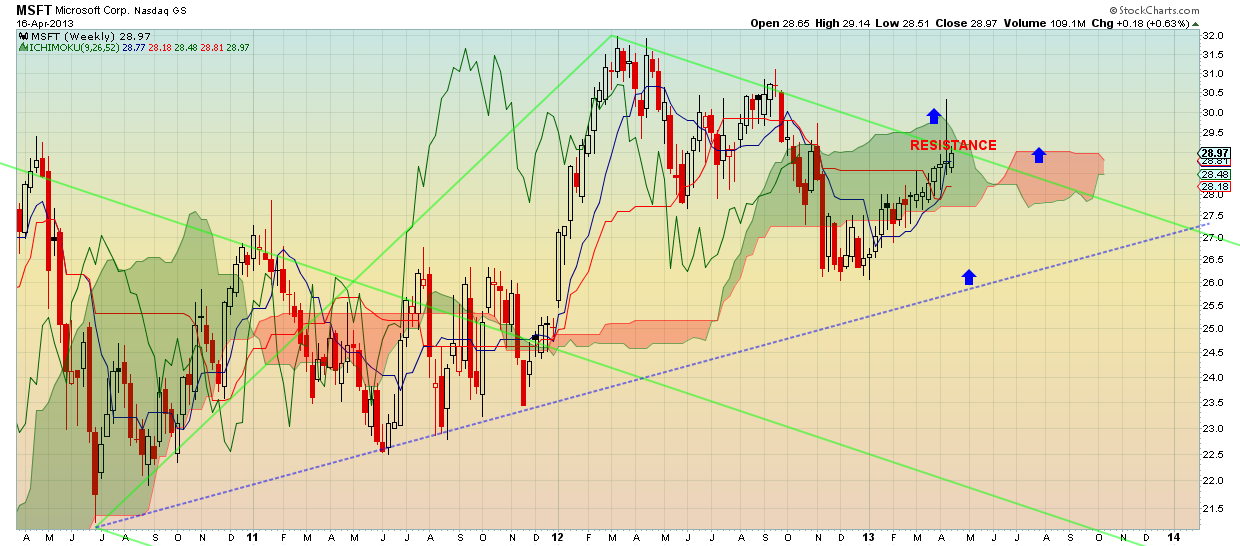

Microsoft on the other hand, made a deeper decline during the past week, but still has not changed our intermediate and short term view. In the daily chart the upward trend remains intact as long as prices trade above 28$. Although the decline was made with increased volume, bulls will need a lot of strength to overcome the resistance at 29.80-29$ area.

On a weekly level, although prices managed to pop out of the Ichimoku cloud and the downward sloping trend line, it finally ended the week below that resistance level. We are cautious when entering long positions as this failure is the only negative sign we see in this chart. This failure to break out supports the sequence of lower highs and lower lows, which is bearish. Therefore we remain neutral to bullish with the lower part of the Ichimoku cloud as our weekly support. Breaking out of the resistance will reinforce our bullish view.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Intel seems to have made a correction near the 61,8% retracement and started moving back upward. It will be a positive sign for bulls if prices manage to make a break out of the recent high at 22.42$. Short term stop is the recent low at 21.36$, whereas the longer term support level that should not break is the low at 20.75$.

Microsoft on the other hand, made a deeper decline during the past week, but still has not changed our intermediate and short term view. In the daily chart the upward trend remains intact as long as prices trade above 28$. Although the decline was made with increased volume, bulls will need a lot of strength to overcome the resistance at 29.80-29$ area.

On a weekly level, although prices managed to pop out of the Ichimoku cloud and the downward sloping trend line, it finally ended the week below that resistance level. We are cautious when entering long positions as this failure is the only negative sign we see in this chart. This failure to break out supports the sequence of lower highs and lower lows, which is bearish. Therefore we remain neutral to bullish with the lower part of the Ichimoku cloud as our weekly support. Breaking out of the resistance will reinforce our bullish view.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.