Chinese state media flags security risks from Nvidia’s H20 chips

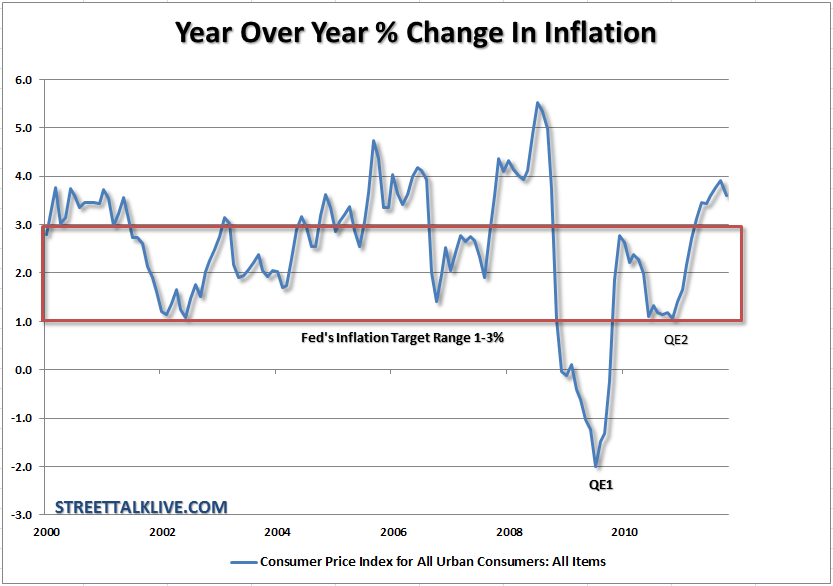

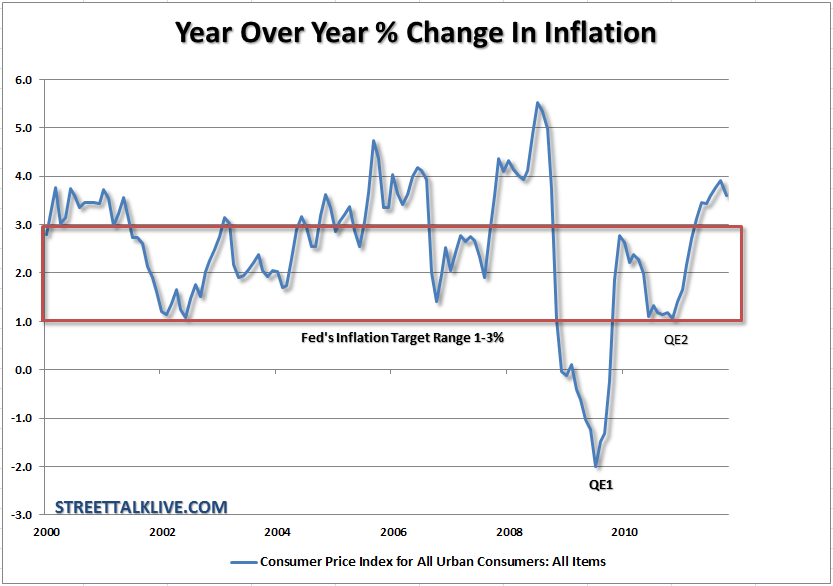

Consumer price inflation softened a touch in October at the headline level given softer oil prices during the month as we discussed yesterday. However, with oil passing the century mark today we will likely see rising headline inflation in the coming months. At the core, excluding food and energy, inflation actually rose 0.1% following a 0.3% bump in September.

This is important because we are now seeing rising inflationary pressures outside of the volatile food and energy costs. The surge in energy prices during the first couple of weeks of November is going to play potential havoc with CPI in the coming months and apply even more pressure to an already cash strapped consumer. We can see this if we look at the change by the major components for October - Energy declined 2.0%; Gasoline dropped 3.1% and Food Prices softened to a 0.1% rise. Those will all be reversed sharply in the next report.

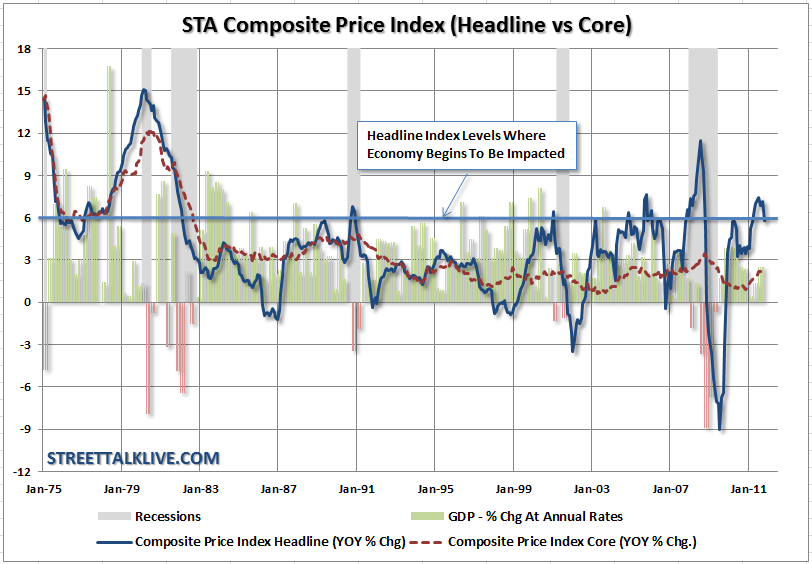

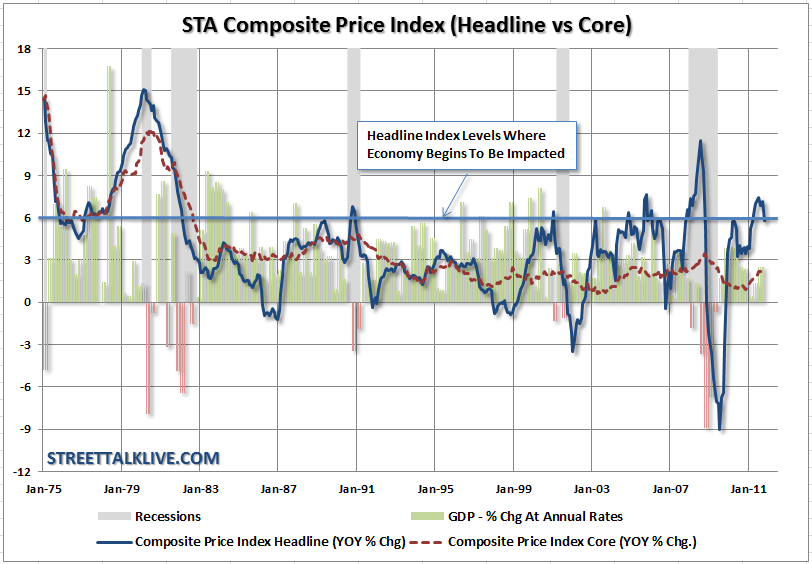

The composite inflation gauge (PPI and CPI) has reached a point to where the economy generally gets impacted. With the consumer already facing pressures with food and energy consuming more than a fifth of their wages and salaries any substantial increases in inflationary pressures coming directly from oil prices acts as an additional tax on the consumer. While retail sales may increase due to rising prices at the gas pump, grocery store and utility bills this isn't a health increase in spending that supports sustained economic growth.

The consumer was given a reprieve during the summer decline in oil prices even though more of their incomes were consumed by utilities and healthcare. However, with the core gauge showing rising inflationary pressures the jump in energy costs is coming at a bad time with individuals potentially trapped between necessities and the Christmas shopping retail season. We will see shortly just how strong the consumer really is.

This is important because we are now seeing rising inflationary pressures outside of the volatile food and energy costs. The surge in energy prices during the first couple of weeks of November is going to play potential havoc with CPI in the coming months and apply even more pressure to an already cash strapped consumer. We can see this if we look at the change by the major components for October - Energy declined 2.0%; Gasoline dropped 3.1% and Food Prices softened to a 0.1% rise. Those will all be reversed sharply in the next report.

The composite inflation gauge (PPI and CPI) has reached a point to where the economy generally gets impacted. With the consumer already facing pressures with food and energy consuming more than a fifth of their wages and salaries any substantial increases in inflationary pressures coming directly from oil prices acts as an additional tax on the consumer. While retail sales may increase due to rising prices at the gas pump, grocery store and utility bills this isn't a health increase in spending that supports sustained economic growth.

The consumer was given a reprieve during the summer decline in oil prices even though more of their incomes were consumed by utilities and healthcare. However, with the core gauge showing rising inflationary pressures the jump in energy costs is coming at a bad time with individuals potentially trapped between necessities and the Christmas shopping retail season. We will see shortly just how strong the consumer really is.