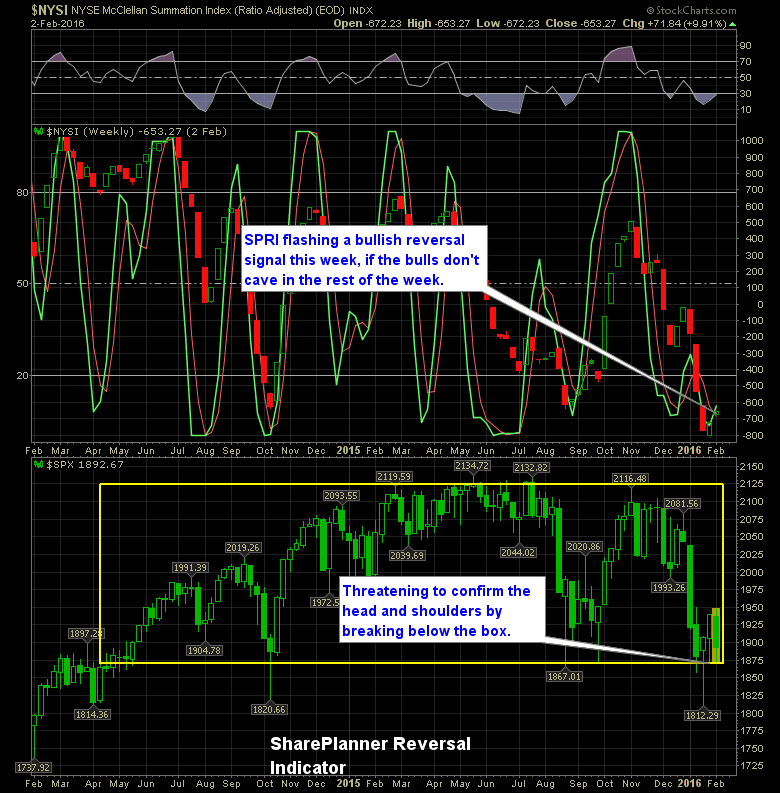

So far the SharePlanner Reversal indicator is taking the price action of the past two trading sessions into account and some strong bullishness from last week, to suggest that this market may have a short-term bottom in place. That can change if conditions continue to deteriorate throughout the remainder of the week though. If that happens, there is a good chance that the Weekly indicator below will not have actually formed a bullish reversal but instead, flat lined at the extremes.

It is a hard feat to pull that off but considering the market volatility of late, it is far from impossible. So take the bullish reading with a grain of salt for now. But if we rally hard at any point during the remainder of the week, it will probably confirm the reading saw on Wednesday.

If anything changes, I'll post the updated chart.

Here's The SPRI:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI