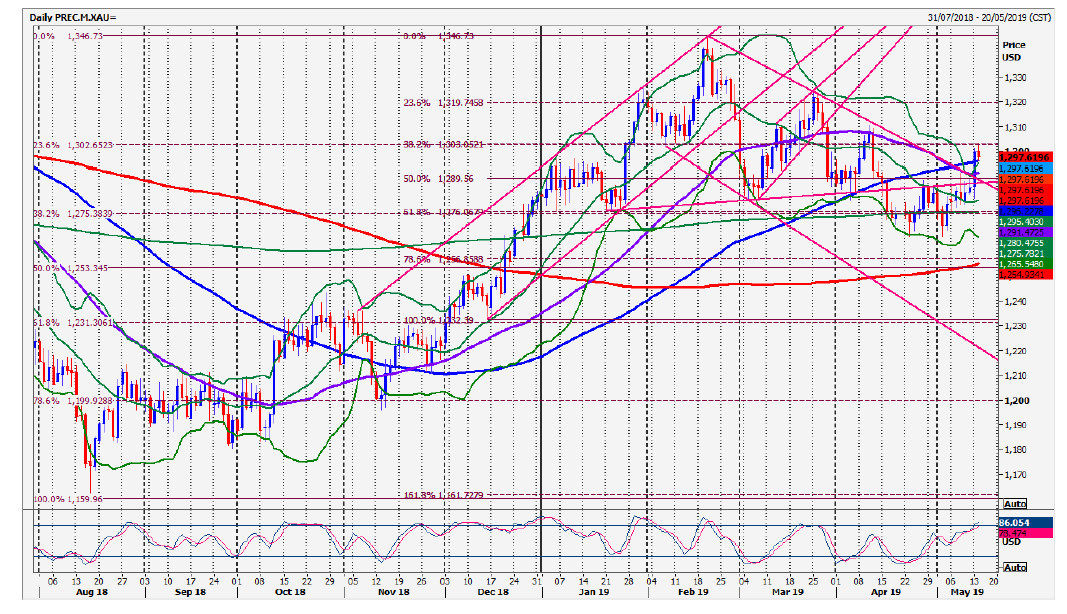

Gold appears to have been trading in a huge sideways trend over the past 3 years after the price bottomed right at the end of 2015.

More recently we saw a strong recovery from an August 2018 low of $1160 with prices peaking at $1346 six months later in February of this year. We seem to have experienced a healthy correction to the downside, over the past 2-3 months as prices dipped to $1265, just below the 500 day moving average support at $1275.

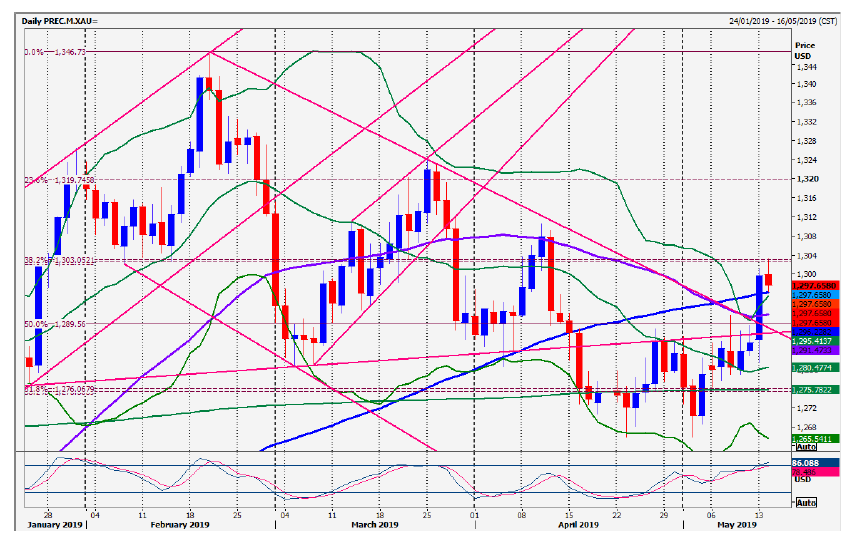

An excellent recovery this month saw Gold initially holding the 2-month trend line resistance at around $1290 at the end of last week. However, yesterday’s bullish breakout acts as a buy signal, as we beat the blue 100 day moving average at $1296 for further bullish confirmation.

Yesterday we hit and held minor Fibonacci resistance at $1303 as you can see in the daily chart above, but the downside should be limited after the medium term buy signal. We look for first support at $1296/95. If we unexpectedly continue lower look for an excellent buying opportunity at $1290/88.

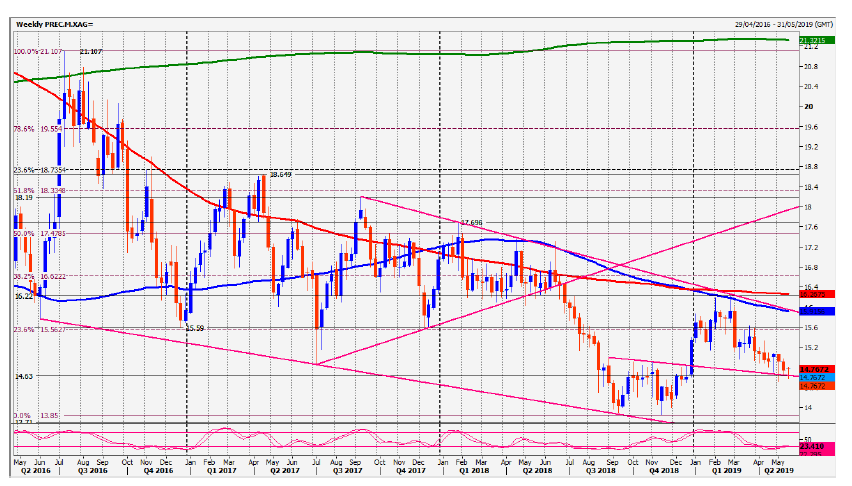

Bulls need a break above minor resistance at $1303 (should happen eventually) to target 1306, minor resistance at $1310 then $1317/19. Once through the March peak of $1324 we look for $1330/1333, $1336, $1341/42 and a retest of resistance at the recovery high at $1346. Silver has been in a bear trend since July 2016. A good recovery at the start of this year saw prices climb to strong resistance at the blue 100 and red 200 week moving averages and descending trend line dating back to September 2017, as you can see in the weekly chart below.

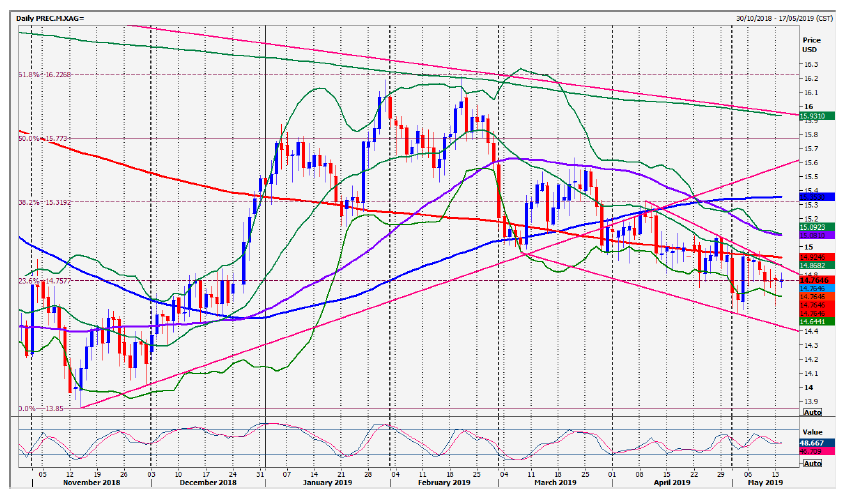

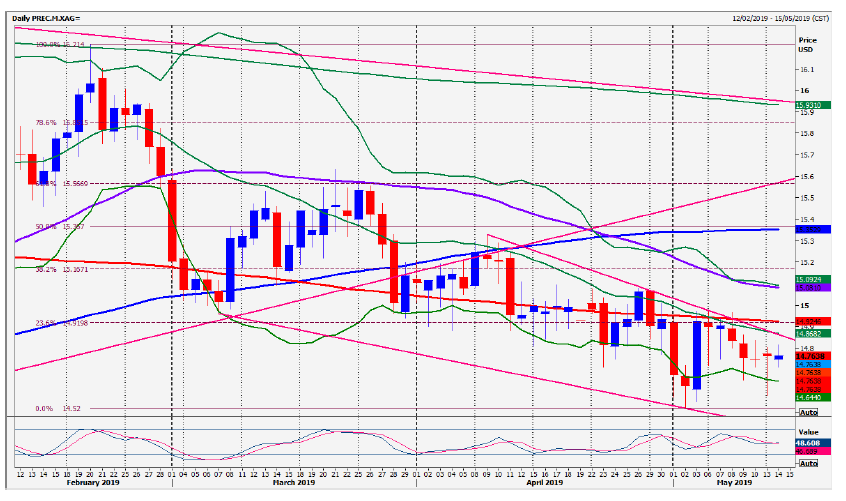

Not surprisingly we saw the bears retake control at this stage but prices have held the more minor September 2018 trend line support when tested over the past 3-4 weeks, in severely oversold conditions.

Bulls must tackle key resistance at $14.88/92 from the 1-month descending trend line and the red 200 day moving average plus the short term 23.6% Fibonacci level.

A break above $14.97 is a buy signal, therefore. Above the purple 55 day moving average and upper Bollinger band® at $15.10 confirms further gains to $15.17/20 and $15.30 first resistance at $15.35/38.

Holding below the first support at 1475 retests the May low of 1458/52. A break lower tests 2-month descending trend line support at $14.40. This is the last line of defense for bulls.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.