Trump announces ‘massive’ trade deal with Japan, tariff rate set at 15%

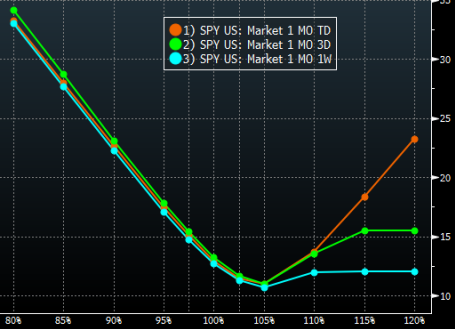

It looks as though the implied volatility on the up-side has spiked dramatically. One explanation proposed has been that as the equity rally stalled and people have sold some of their equity positions, they also bought back the covered calls they shorted earlier - bumping up implied vols.

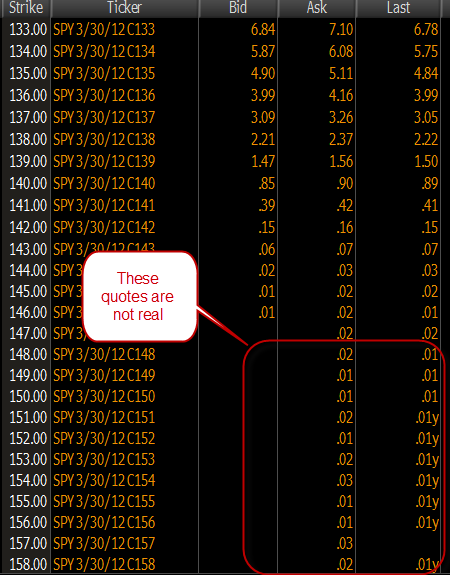

But there is a simpler explanation. The deep out-of-the-money options for a 1 month maturity are quoted at a couple of pennies but there are no trades at these levels. As SPY sold off a bit during the week, the options were still quoted at roughly the same levels and there were still no trades.

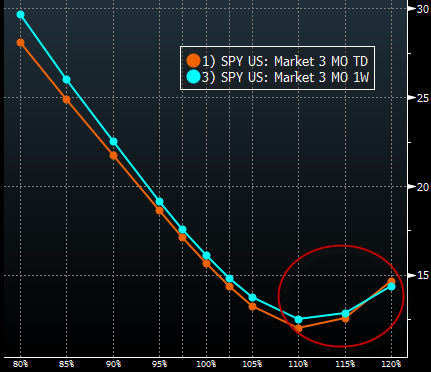

Now if options are "priced" at a constant level while the underlying drops, the implied volatility will increase. When options are quoted in pennies and little or no trading takes place, seeming distortions in implied volatility become common. But it's hardly an indication of anything fundamental going on in the market. With the 3-month maturities for example, where option premiums have real value, this distortion no longer exists.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.