The chart below compares the yield on the U.S. Treasury's 10-year zero coupon with the 10-year zero coupon inflation swap rate. The difference is the implied 10-year zero coupon real rate, which is becoming increasingly negative. We are not yet in a stagflation environment, but the indicator is certainly starting to point in that direction.

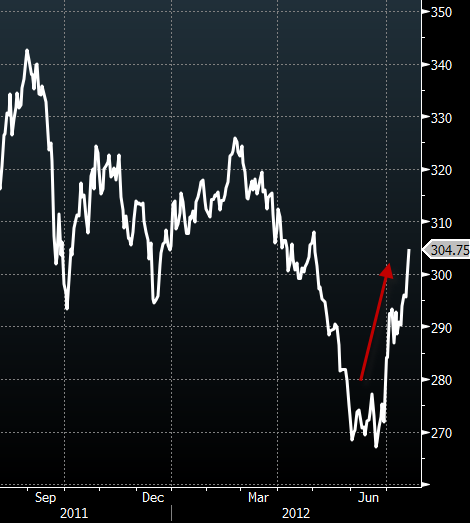

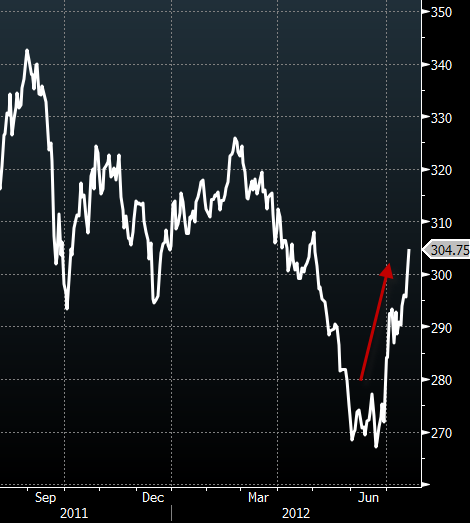

Just to put things into perspective, the CRB Commodity Index broke through 300 today and is now up 14% from its lows. As inflation expectations pick up (due to increasing rents and rising commodity prices), this push into negative real rate territory is only going to get worse.

Just to put things into perspective, the CRB Commodity Index broke through 300 today and is now up 14% from its lows. As inflation expectations pick up (due to increasing rents and rising commodity prices), this push into negative real rate territory is only going to get worse.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.