Trump slaps 30% tariffs on EU, Mexico

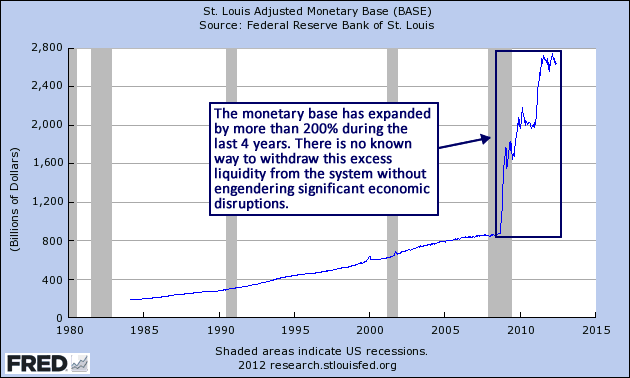

There is a historic experiment underway at the US Federal Reserve, and the US economy is the test subject. In response to the severe recession in 2008, Federal Reserve Chairman Bernanke initiated an unprecedented liquidity operation that continues today. As a result, during the last four years, the monetary base has expanded by more than 200 percent.

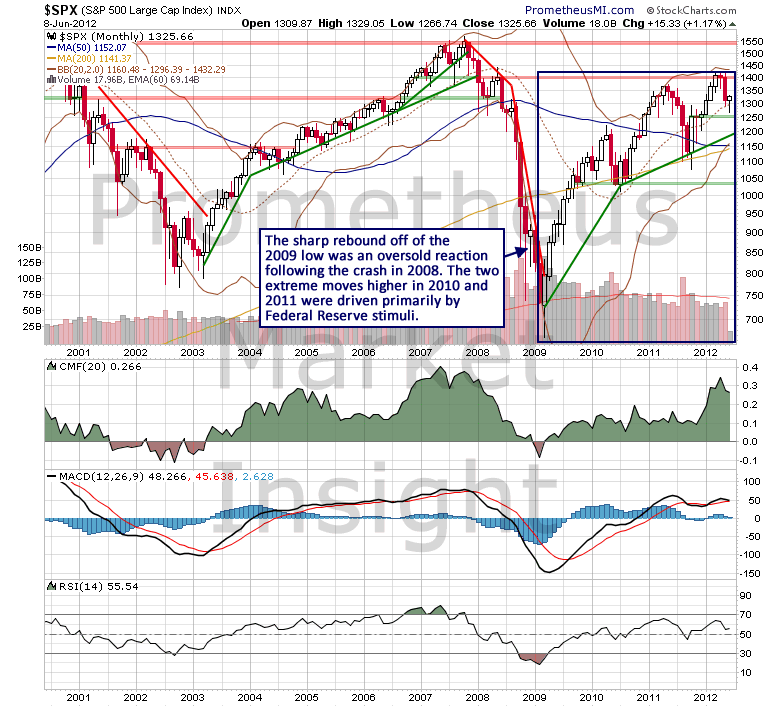

Chairman Bernanke has spent most of his career in academia, during which he studied the Great Depression of the 1930s and 1940s. As a result, he is terrified of deflation and he would prefer any other type of economic environment. He has stated in no uncertain terms that his objective during the last few years has been to inflate risk assets such as stocks in an attempt to spur a “virtuous circle” of economic growth. In one sense, the program is been a success, as the US stock market has moved sharply higher in response to the monetary stimulus programs.

The problem is that there is no meaningful statistical correlation between stock market gains and economic growth. Therefore, the market gains fueled by these programs tend to be transitory and vulnerable to the types of violent corrections that we have experienced since 2010. Even worse, the liquidity operations are creating massive structural imbalances and there is no known method to eliminate those imbalances without causing extreme economic disruptions. Consider the inflationary consequences of current monetary policy. The following graph from a recent commentary at the Hussman Funds website displays the relationship between the 3-month Treasury bill yield and liquidity preference.

Currently, the U.S. monetary base amounts to 17 cents per dollar of GDP – a level that is consistent with contained inflation only if short-term (3-month Treasury) yields are held below about 10 basis points. Think of it this way. The willingness of people to hold a given amount of base money, per dollar of nominal GDP, is intimately tied to the rate of return that they could get on an interest-bearing security. Higher interest rates reduce the demand for zero-interest cash. So if there is upward pressure on interest rates, and the Fed leaves the money supply alone, how do you reach equilibrium? Simple – nominal GDP becomes the adjustment variable. If there’s not enough real GDP growth to absorb the excess base money, prices rise to do the job.

Likewise, expanding the amount of base money per dollar of nominal GDP puts downward pressure on Treasury bill yields and short-term interest rates, but really only if there are no inflationary pressures in the system. Clearly, if inflationary pressures are present (suggesting that the monetary base is already too large), an expansion in the monetary base won’t produce lower interest rates. Rather, it will accelerate those inflationary pressures as nominal GDP is forced to keep up with the monetary base – even if real GDP isn’t growing at all. All hyperinflations are built on this dynamic.

Of course, Chairman Bernanke is confident that the Federal Reserve will be able to eliminate this massive monetary imbalance in a way that will prevent a debilitating surge in price inflation. The trillion dollar question is how? No such rebalancing operation on this unprecedented scale has ever been successfully undertaken in the history of the modern central banking system. Additionally, as an academic who has spent a lifetime focusing on economic theory, Bernanke has a tendency to expect markets to behave in well-defined manners and his exit strategy will undoubtedly be based upon that fundamental premise. Unfortunately, when market forces ultimately move to restore balance to the system, they will likely do so with an unforeseen speed and ferocity, leaving the Federal Reserve well behind the proverbial curve. At some point, several years from now, balance will be restored, setting the stage for the next structural expansion, but getting there will invariably involve significant economic turbulence and hardship.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.