Metals are setting up for that “Rip Your Face Off Rally”. The following charts for gold and silver show a very interesting setup that is unfolding as the US markets continue to strengthen: that the metals are showing strength in price and we can only assume this is related to some level of fear in the markets or expectations that the “Equities and Bitcoin Bubbles” are nearing an end.

Gold and silver have been one of our primary focuses for years. We warned of the “Rip Your Face Off” rally near the Third Quarter 2017 as our cycle analysis was bottoming in December.

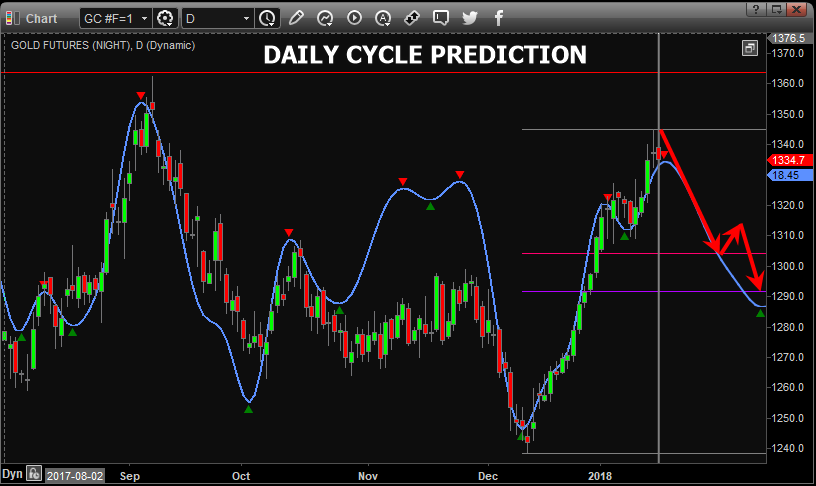

The recent rally in gold has been substantial and has managed to breach recent resistance levels near $1300-1310. At this point, we are expecting a moderate pullback in gold over the next few weeks to levels likely near or below the $1300 level before the next leg advances well above $1380. The presumed formation of Wave 3, if our analysis is correct, should prompt a massive move in the metals over the next 3~7 months with a number of pullbacks along the way.

Right now, it all depends on how gold reacts to the recent highs and how deep the next retracement in price is. We could see a $1270-1300 level price pullback before the next leg higher executes. This would be the best entry zone for both traders and long-term investors.

Silver is the “forgotten shiny metal” by many. As we have been warning our readers, this next move in the metals market should be a massive Wave 3 (or completed Wave 5 that will prompt a Wave B correction). Either way, this next move could end substantially higher than where current prices have been consolidating. Because of the expected continued rally in the US equities markets and because of the strong growth in the economic fundamentals, we believe the next contraction phase in the metals will be a very opportunistic buy entry zone for traders.

Silver, which has not shown the volatility or price activity that gold has recently shown, is one of those markets that many people forget about. Yet silver has so much more opportunity for massive price gains as related to the setups that are currently playing out in the US and global markets. As fear builds and global markets react to the "Everything Bubble", crypto volatility, global market concerns and global political concerns, the metals are certainly going to be an interesting and opportunistic play for traders.

As you can see from this silver weekly chart, the setup in silver is similar to the gold chart, yet the price activity in silver is very much more muted in volatility than gold. We believe that silver, when the move happens, will show substantial price acceleration to the upside while gold continues to rally.

2018 is setting up to be a very good year for both traders and long-term investors as the opportunities for skilled and strategic trades is astounding.