Nuance Communications Inc. (NUAN) is set to report FQ1 2014 earnings after the market closes on Monday, February 10th. Nuance Communications is an American software and communications technologies company. Nuance stock got a boost in January when the company preannounced better than expected December sales. However, in the 4 trading days following the report the stock’s 8% gains were completely erased. This quarter Wall Street is expecting Nuance to report slightly less revenue than FQ1 last year and 40% less profit.

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

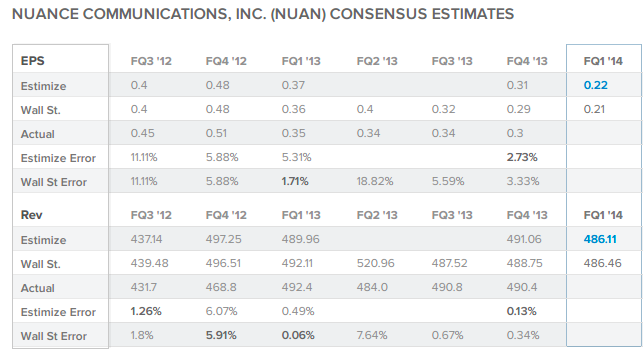

The current Wall Street consensus expectation is for HAS to report 21c EPS and $486.46M revenue while the current Estimize.com consensus from Buy Side and Independent contributing analysts is 22c EPS and $486.11M revenue. This quarter the buy-side as represented by the Estimize.com community is expecting HAS beat the Street’s expectations on profit but come up slightly short on revenue.

By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations. It has been confirmed by an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing a smaller differential compared to previous quarters.

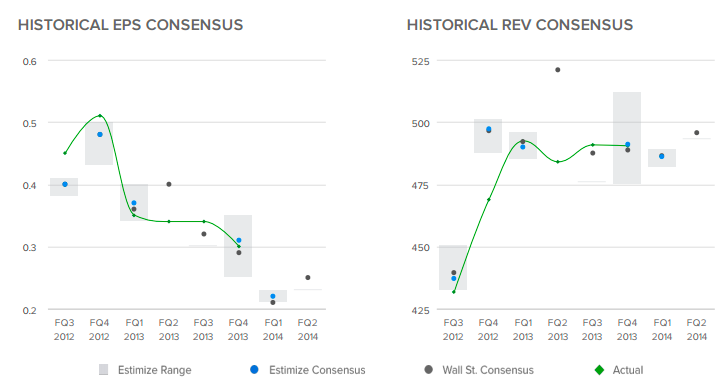

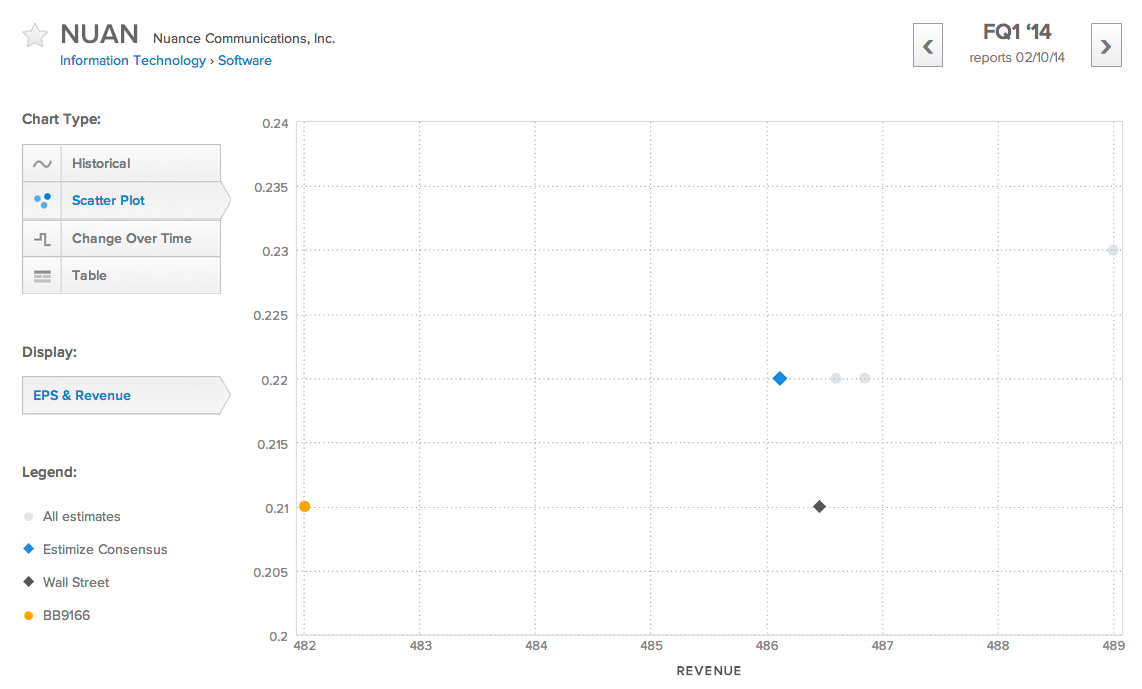

The distribution of estimates published by analysts on the Estimize.com platform range from 21c to 23c EPS and $482.00M to $489.00M in revenues. This quarter we’re seeing a smaller distribution of estimates compared to other quarters.

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A narrower distribution of estimates signaling more agreement in the market, which could mean less volatility post earnings.

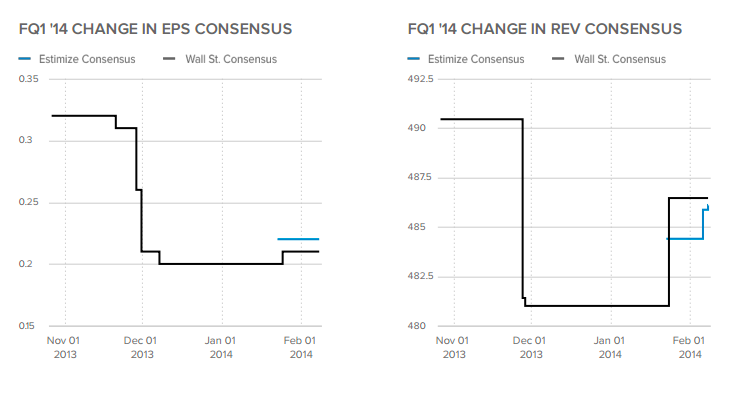

Throughout the quarter the EPS estimate from Wall Street decreased from 32c to 21c while the Estimize consensus remained flat at 22c. Over the same time period Wall Street reduced its revenue expectation from $490.45M to $486.86M while the Estimize forecast increased at the end of the period from $484.40M to $486.11M. Timeliness is correlated with accuracy and rising analyst expectations at the end of a quarter are often a bullish indicator.

The analyst with the highest estimate confidence rating this quarter is BB9166 who projects 21c EPS and $482.00M in revenue. In the Winter 2014 season BB9166 rated as the 20th best analyst and is ranked 57th overall among over 3,800 contributing analysts. Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case BB9166 is expecting NUAN to report in-line with Wall Street on profit but come up short on sales.

This quarter the Estimize community expects Nuance to match Wall Street’s consensus on revenue and beat the profit forecast by a small margin. However, both groups expect Nuance’s year over profit to be down by a considerable amount and the company will need to continue to cut costs to restore EPS to previous levels.

Get access to estimates for HAS published by your Buy Side and Independent analyst peers and follow the rest of earnings season by heading over to Estimize.com. Register for free to create your own estimates and see how you stack up to Wall Street.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI