CVS Caremark Corp. (CVS) is set to report FQ4 2013 earnings before the market opens on Tuesday, February 11th. CVS Caremark is an American pharmacy retailer and health care company. Earlier this month CVS announced that it would discontinue tobacco sales. In a statement President and CEO Larry J. Merlo said “We came to the decision that cigarettes and providing health care just don’t go together in the same setting.” While this decision may have an annual impact of roughly $2 billion on CVS’s top line in the future, analysts are expecting 4-5% year over year revenue growth this period. Here’s how investors are expecting CVS Caremark to report Tuesday morning.

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

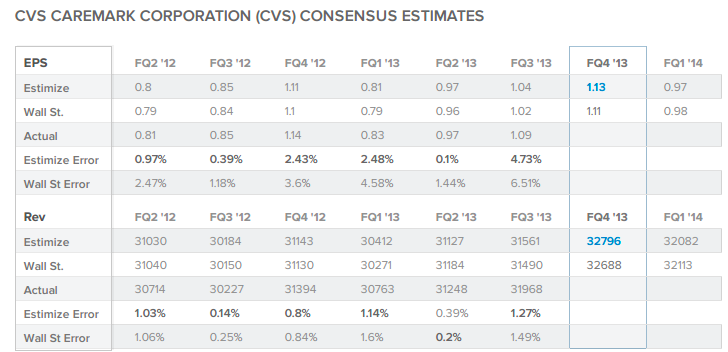

The current Wall Street consensus expectation is for CVS to report $1.11 EPS and $32.688B revenue while the current Estimize.com consensus from 16 Buy Side and Independent contributing analysts is $1.13 EPS and $32.796B revenue. This quarter the buy-side as represented by the Estimize.com community is expecting CVS to beat the Wall Street consensus on both EPS and revenue.

Throughout the previous 6 quarters the consensus from Estimize.com has been more accurate than Wall Street in forecasting CVS’s profit in each quarter and has been more accurate in predicting revenue 5 times. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations. It has been confirmed by an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

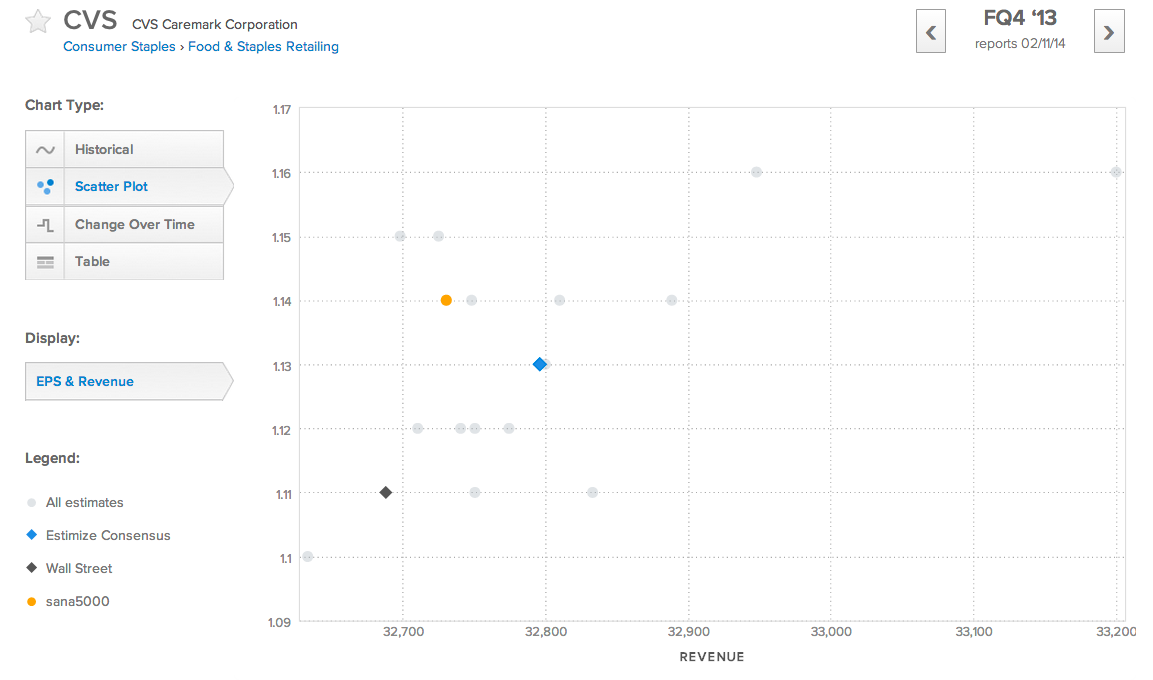

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing a moderate differential compared to previous quarters.

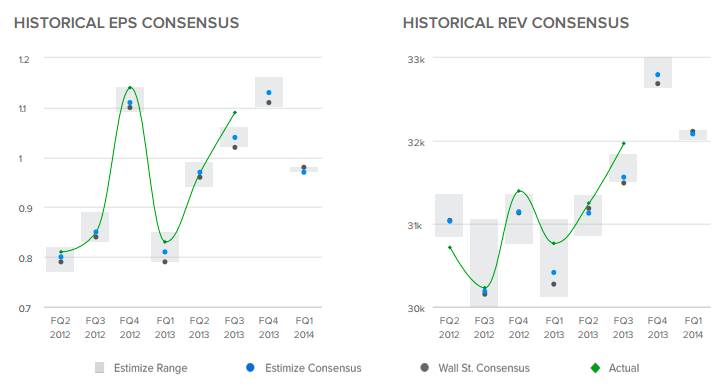

The distribution of estimates published by analysts on the Estimize.com platform range from $1.10 to $1.16 EPS and $32.633B to $33.200B in revenues. This quarter we’re seeing an average distribution of estimates compared to other quarters.

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A wider distribution of estimates signaling less agreement in the market, which could mean greater volatility post earnings.

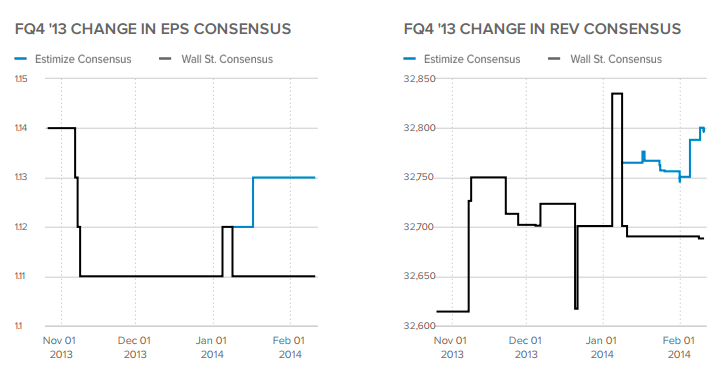

Throughout the quarter the EPS estimate from Wall Street decreased from $1.14 to $1.11 while the Estimize consensus inched up from $1.12 to $1.13. Over the same time period Wall Street increased its revenue expectation from $32.614B to $32.688B while the Estimize forecast pushed higher from $32.765B to $32.796B. Timeliness is correlated with accuracy and upward analyst revisions at the end of a quarter are often a bullish indicator.

The analyst with the highest estimate confidence rating this quarter is sana5000 who projects $1.14 EPS and $32.730B in revenue. In the Winter 2014 season sana5000 rated as the 51st best analyst and is ranked 55th overall among over 3,800 contributing analysts. Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case sana5000 is expecting CVS Caremark beat the Estimize.com consensus on profit but report less revenue.

This quarter contributing analysts on the Estimize.com platform are expecting CVS to beat Wall Street expectations on both the top and bottom line. Over the past 6 quarters CVS has beaten Wall Street expectations on profit every time and has outperformed the Wall Street revenue consensus 5 times. Throughout the same time period the Estimize.com consensus has been more accurate than Wall Street all 6 times on profit and 5 times on revenue without always predicting CVS will beat the Street on revenue. This period analysts are expecting another quarter of 4-5% revenue growth from CVS.

Get access to estimates for CVS published by your Buy Side and Independent analyst peers and follow the rest of earnings season by heading over to Estimize.com. Register for free to create your own estimates and see how you stack up to Wall Street.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.