Trump says U.K. would fight for U.S., doubts EU commitment

Clearly one of these does not belong. If you thought the German DAX then you are right. That is if you were thinking about things in the USA. But if you are thinking about the stock market then you have to bring it back in. In this view although Andre 3000 is a styling dude, his 3000 is nothing like the numbers 2000, 10000, and 17000.

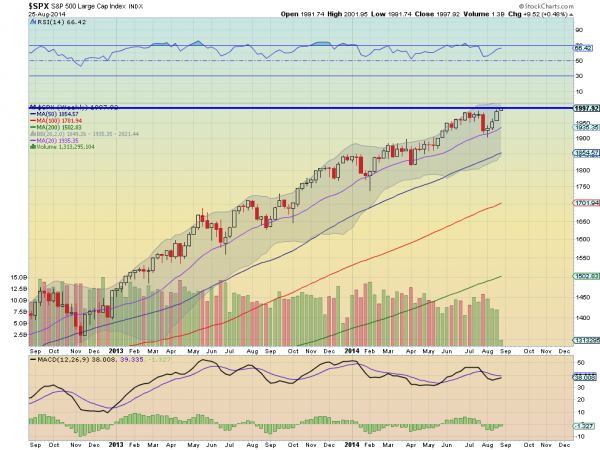

Markets, for no other reason than a psychological one, can have problems when they get close to round numbers. And these three ginormous markets are great to illustrate the point. The S&P 500 chart below shows that it stalled as it approached 2000 in July. It is there again now. It could certainly blow through to the upside but do not be surprised if it holds here for a while or retraces again.

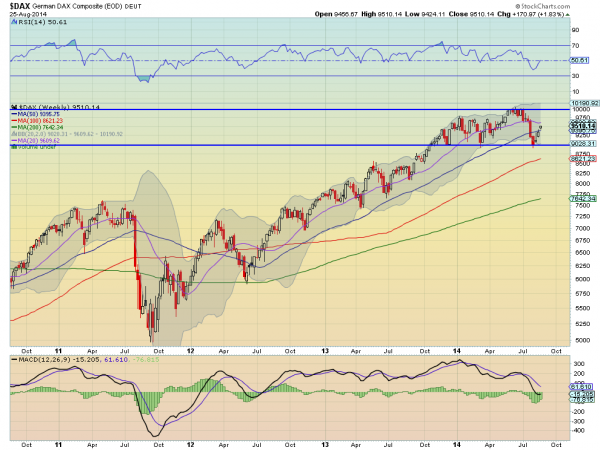

The German DAX fell back as it hit 10000 this spring. It sat there for 7 weeks first. That is some resistance. And where did the pullbacks find support? 9000. It works from above as well.

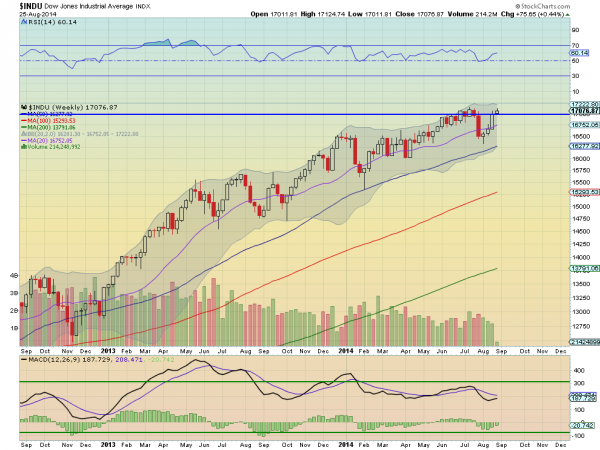

Finally the Dow Jones Industrials hit 17000 in early June and stayed there for 7 weeks before pulling back. The Dow is now back at 17000 again.

None of these indexes had any prior history at these round numbers. Yet each experienced aspects of crowd psychology that told many to sell because the index hit a round number. Silly? Perhaps. But certainly a sign if you did not believe before that sentiment plays a bug factor in the markets.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI