Last three months were sort of a roller coaster for precious metals investors – gold and silver hit a local bottom at the beginning of November and it looked like nothing could stop a strong rally to follow. Yet the fears concerning the “fiscal cliff” issue seem to have won and stopped the prices at the end of November. Moreover, gold and silver correlations structure that used to propel the rally got distorted and even though the dollar weakened and the general stock market got stronger, precious metals were unable to react.

As it turned out that the end of 2012 was not the end of the U.S. economy and the “fiscal cliff” was a mere scarecrow and not the doom of the financial markets, a rally begun. Will it be the long-awaited rally that could bring precious metals to their new all-time high?

There are no certainties on any market, but as the correlations seem to be returning to normal, it gets more and more likely. This is because precious metals are not the only assets that have gone up in price recently – the general stock market, in fact, seems to be doing even better and the dollar is in a downtrend.

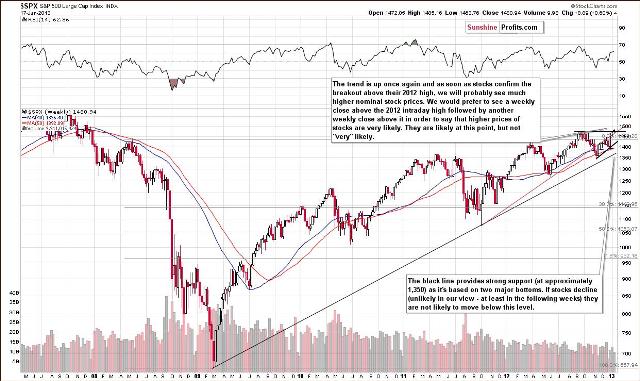

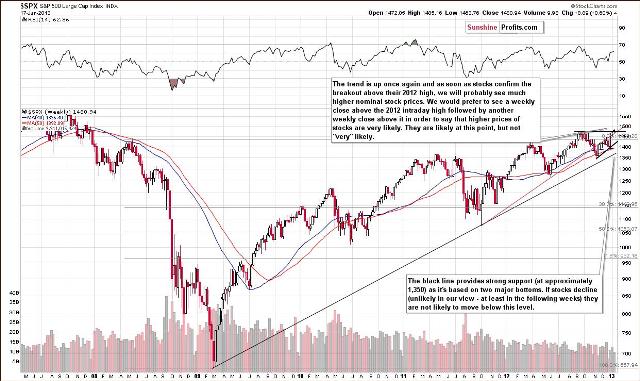

To see what the markets themselves can tell us, let’s jump straight into today’s technical part – we’ll start with the general stock market, using S&P 500 Index as a proxy (charts courtesy by http://stockcharts.com).

Stocks closed above their 2012 high (on Thursday) last week, even when considering intra-day price levels. This is a bullish phenomenon which is not yet confirmed. We prefer to wait and see that stocks close above this level next week as well, before saying that the breakout is completed, but the situation is clearly more bullish than not at this time.

It’s also more bullish than it was last week because back then we only had an unconfirmed breakout above the highest closing price of 2012. This week we have it confirmed and an additoinal, unconfirmed breakout.

Let’s now have a look at the financial sector (Broker/Dealer Index serves as a proxy here) chart, a sector which often leads stocks higher or lower.

Recent moves here have been strong to the upside. The financials have broken out above the declining resistance line and verified it. Weekly closing prices have been there for three weeks. With RSI levels now above 70, some consolidation is possible but will not necessarily be seen immediately.

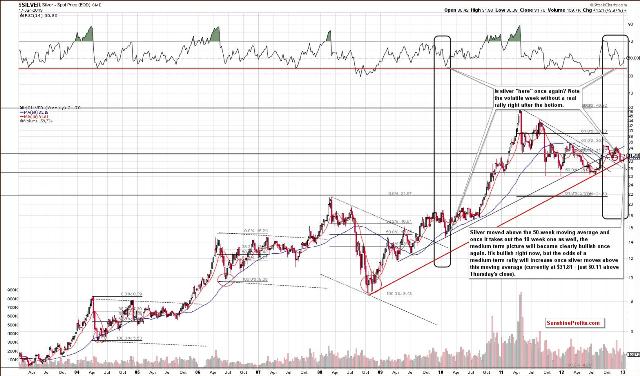

Let’s move on to the silver market – we’ll start with the long-term chart.

As we have previously mentioned, recent trading patterns here have been similar to early 2010 and this continues to be the case. Back then, lower prices were not seen again once the bottom was reached and the rally began. This could very well be the case once again.

The correction was very significant from the very long-term perspective. Silver appears ready to rally once again but prices have not yet broken out above the 10-week, 50-day moving average. Only a small rally is needed to accomplish this, and the picture will then be further approved.

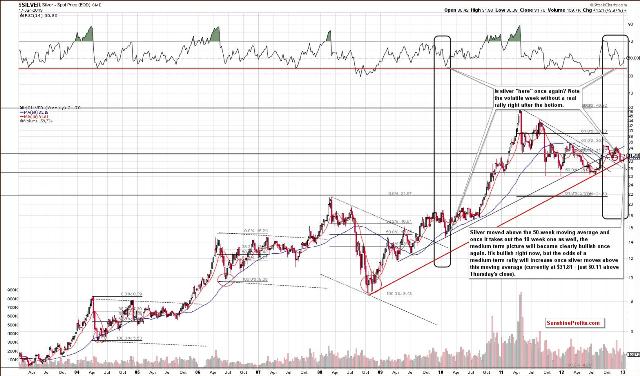

To finish off, we take a shot at projecting possible long-term moves on the white metals market.

We include a second very long-term silver chart today because if this is the final bottom (the long-term support line suggests so) and if after a prolonged consolidation, we get a rally similar to 2010-2011, we could be looking at a rally to the $77 level. This may not happen, but several technical tools align and such a move is not out of the question. Now, there could be a breakdown.

Weakness or consolidation and the indications do not say the rally is very likely to happen, but such a rally would not be out of tune with historical patterns. In other words, it would appear quite normal. This is a very early heads-up and something to keep in mind, the next time you hear that silver can’t move so high – it can and it can do it quickly.

Those new to the market may think this is impossible, but $10 silver was similarly “impossible” when its price was less than $5 for years. Now, $10 seems impossible because it’s too low a price. If you are long silver for the long run as we are, this picture should make holding silver easier.

Summing up, the outlook is bullish for the general stock market, and this is supported by the financial sector as well. Even though correlations are not in their normal state yet, recent moves indicate that they are moving back there, hence the implications are bullish for the precious metals sector. The picture for silver looks favorable as well for the long and medium-term. The short-term is a bit unclear, at least based on the above charts, as the recent rally may be followed by a brief consolidation.

As it turned out that the end of 2012 was not the end of the U.S. economy and the “fiscal cliff” was a mere scarecrow and not the doom of the financial markets, a rally begun. Will it be the long-awaited rally that could bring precious metals to their new all-time high?

There are no certainties on any market, but as the correlations seem to be returning to normal, it gets more and more likely. This is because precious metals are not the only assets that have gone up in price recently – the general stock market, in fact, seems to be doing even better and the dollar is in a downtrend.

To see what the markets themselves can tell us, let’s jump straight into today’s technical part – we’ll start with the general stock market, using S&P 500 Index as a proxy (charts courtesy by http://stockcharts.com).

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Stocks closed above their 2012 high (on Thursday) last week, even when considering intra-day price levels. This is a bullish phenomenon which is not yet confirmed. We prefer to wait and see that stocks close above this level next week as well, before saying that the breakout is completed, but the situation is clearly more bullish than not at this time.

It’s also more bullish than it was last week because back then we only had an unconfirmed breakout above the highest closing price of 2012. This week we have it confirmed and an additoinal, unconfirmed breakout.

Let’s now have a look at the financial sector (Broker/Dealer Index serves as a proxy here) chart, a sector which often leads stocks higher or lower.

Recent moves here have been strong to the upside. The financials have broken out above the declining resistance line and verified it. Weekly closing prices have been there for three weeks. With RSI levels now above 70, some consolidation is possible but will not necessarily be seen immediately.

Let’s move on to the silver market – we’ll start with the long-term chart.

As we have previously mentioned, recent trading patterns here have been similar to early 2010 and this continues to be the case. Back then, lower prices were not seen again once the bottom was reached and the rally began. This could very well be the case once again.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The correction was very significant from the very long-term perspective. Silver appears ready to rally once again but prices have not yet broken out above the 10-week, 50-day moving average. Only a small rally is needed to accomplish this, and the picture will then be further approved.

To finish off, we take a shot at projecting possible long-term moves on the white metals market.

We include a second very long-term silver chart today because if this is the final bottom (the long-term support line suggests so) and if after a prolonged consolidation, we get a rally similar to 2010-2011, we could be looking at a rally to the $77 level. This may not happen, but several technical tools align and such a move is not out of the question. Now, there could be a breakdown.

Weakness or consolidation and the indications do not say the rally is very likely to happen, but such a rally would not be out of tune with historical patterns. In other words, it would appear quite normal. This is a very early heads-up and something to keep in mind, the next time you hear that silver can’t move so high – it can and it can do it quickly.

Those new to the market may think this is impossible, but $10 silver was similarly “impossible” when its price was less than $5 for years. Now, $10 seems impossible because it’s too low a price. If you are long silver for the long run as we are, this picture should make holding silver easier.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Summing up, the outlook is bullish for the general stock market, and this is supported by the financial sector as well. Even though correlations are not in their normal state yet, recent moves indicate that they are moving back there, hence the implications are bullish for the precious metals sector. The picture for silver looks favorable as well for the long and medium-term. The short-term is a bit unclear, at least based on the above charts, as the recent rally may be followed by a brief consolidation.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.