What’s wrong with the housing market?

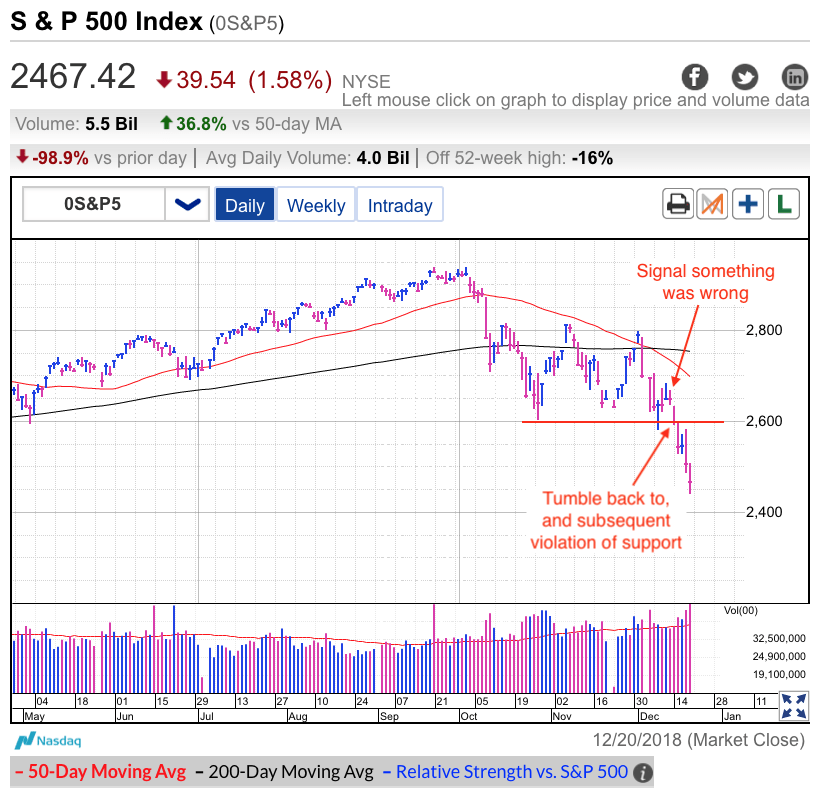

Thursday was another brutal session for the S&P 500, and we now find ourselves 16% under the October highs. The latest fears stem from Trump’s threats to shut down the government if Congress doesn’t fund his wall. These headlines pile on the already fragile sentiment brought on by Trump’s trade war and the Fed’s latest round of rate hikes.

October’s stock crash was initially triggered by a spike 10-year Treasury rates. The ironic thing is interest rates have done nothing but tumble since then. But despite the reprieve in rates, the market has not been able to find its footing given the relentless barrage of bad news. In addition to the problems I already mentioned, Trump’s trade war is slowing global growth, and the US had a high profile Chinese executive arrested. Mix in fears the US economy is overheating, contracting, or somehow doing both at the same time and it becomes the perfect cocktail for impulsive herd selling.

I will be the first to admit I never expected the dip to get this carried away. But this isn’t a surprise. The market has a nasty habit of pushing things so much further than what is reasonable. And clearly that is the case here.

But just because I’m bullish doesn’t prevent me from profiting from this dip. While the initial selloff caught me off guard, the subsequent volatility created a rich hunting ground. I told readers in October that too much damage was done to sentiment in the first round of the selloff and we should not expect a quick return to the highs. That told us to greet every rebound with suspicion and be taking profits, not chasing prices higher. And the same applied to each dip, rather than sell the fear, I was buying it. Buy the dip. Sell the rip. Repeat.

I was, and continue to be bullish, so that made me reluctant to short the bounces, but even just buying the dips has been quite profitable and the extreme volatility allowed me to do in hours what it took weeks to achieve in a slower market. But even though I was bullish, I still had key levels I was watching. Last week after the market closed at 2,650, I wrote the post, “What this market needs to do to keep my faith“:

the last three day’s has seen early gains fizzle and we closed well under the intraday highs. Multiple weak closes is never an encouraging sign. And as usual, the market is giving us conflicting signals. It is up to us to determine what it means.

I really like how decisively the market held support this week. But I’m disappointed we couldn’t add to those gains and these weak closes are a concern. What does this mean for what comes next? Unfortunately, this is one of those situations where we don’t have enough information and we need to see what the market does next.

A decisive rally Friday tells us all is well and we are on our way back up to 2,800. But a fourth weak close means a near-term test of 2,600 is ahead.

The next day the market gave up early gains and finished flat. That warned us something was wrong and we should avoid the market. A day later, prices stumbled to 2,600 support and it’s been downhill ever since.

But that was then and this is now. What readers really want to know is what comes next.

While I like these discounts, the looming holidays complicate the situation. What would normally be an attractive buying opportunity might struggle to get off the ground since big money already left for Aspen. Their absence puts impulsive retail investors in charge and that is rarely a good thing. Luckily, these little guys have small accounts and their emotional buying and selling cannot take us very far.

We saw similar emotional selling knock 100 points off the market during the Thanksgiving week. But a few days after the holiday, the market rallied 170-points when big money returned to work and started snapping up the discounts. No doubt we could see the same thing this time around. Unfortunately, January’s reprieve is still a ways off and until then we are subject to the whims of impulsive retail traders. But as I said, the saving graces is retail traders don’t have a lot of money and it won’t take them long to run out of things to sell. Once they’re out, the selling pressure evaporates and prices stabilize.

Or we could run around like chickens with our head cut off. You decide.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI