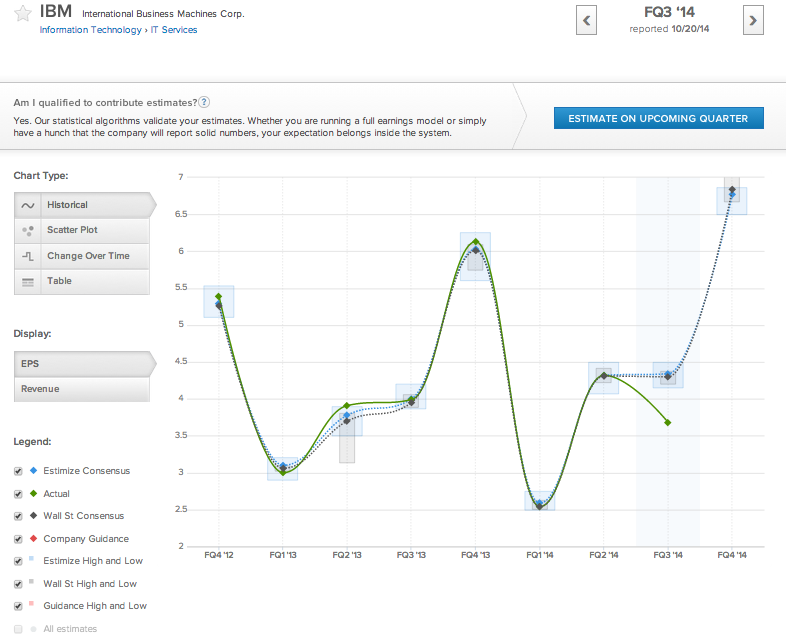

International Business Machines (NYSE:IBM) reported disappointed earnings Monday morning dragging the company’s stock price 7% lower. The highlighted quarter in the graph above shows just how bad this earnings report was. Contributing analysts on Estimize were looking for earnings of $4.34 per share, but IBM only managed to earn $3.68. Profits were largely stifled by weakness in the hardware division and a charge to sell off its semiconductor business.

This was IBM’s worst report relative to analyst expectations in recent memory and comes alongside a decision to offload the company’s chip business to GlobalFoundries. The bad news is that IBM isn’t selling its semiconductor manufacturing business for a profit. IBM was losing money on chip production and has agreed to pay GlobalFoundries $1.5 billion to take its toxic wing off its hands.

The bright side is that by dumping its losing business, IBM gives itself flexibility to put capital to work in segments with more potential. IBM will forfeit some of its patents to GlobalFoundries as part of the deal, but will continue to invest in semiconductor research. CEO Virginia Rometty commented that IBM will increasingly focus on businesses with higher expected growth including the cloud, data, analytics, mobile, and security.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.