Having gotten through the fiscal cliff debacle by the skin of its teeth (somehow passing a deal that both raises taxes AND the deficit), the US political class is now playing chicken with the debt ceiling.

The media, as it likes to do, continues to rave about social issues (gun control being the latest), ignoring the fact that the US would be in technical default already if Treasury Secretary Tim Geithner hadn’t already raided various funds for some $200 billion.

We’re not here to debate social issues, but it’s telling that a US default, something that would affect every American, gets less airtime than assault rifles, which affect less than 5% of the population.

The market, is already giving us hints of what the likely outcome will be. Despite start of the year buying and a seasonal bias, the rallies of the last few days have been very weak, usually peaking out mid-day and then retreating.

More telling however is the big picture view of the S&P 500 where it is tracing out virtually the exact same pattern as it staged going into the failed debt ceiling talks of 2011.

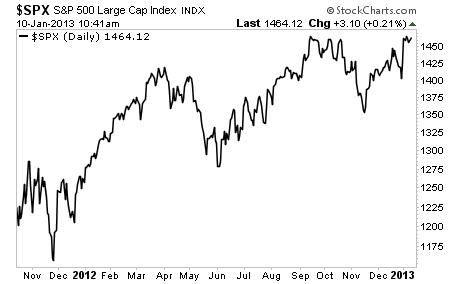

Here’s the S&P 500’s recent action:

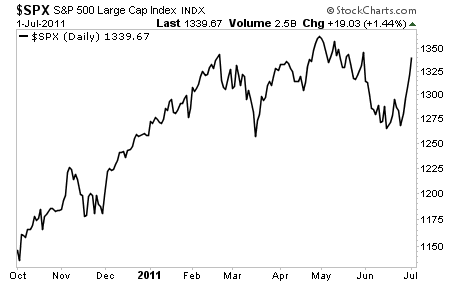

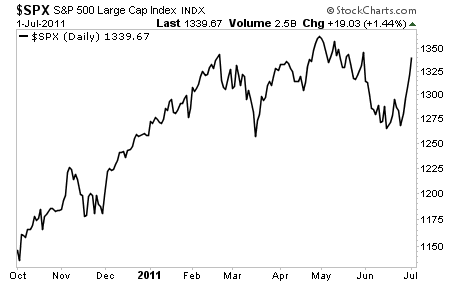

Here’s the market action going into the 2011 debt ceiling debacle:

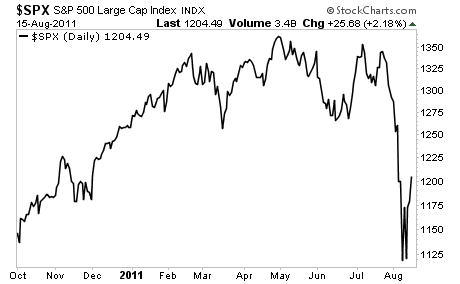

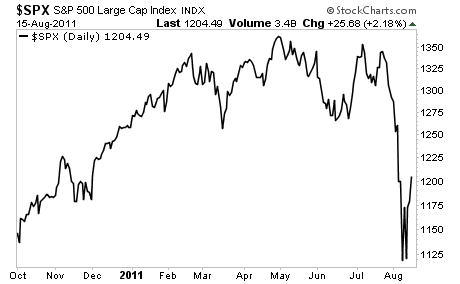

Here’s what followed:

History doesn’t necessarily repeat, but it often rhymes. And the fiscal cliff situation has made it clear that when it comes to issues such as cutting the deficit and debt, US politicians are totally clueless.

Remember, Congress hasn’t passed a budget in four years, which incidentally goes a long ways towards explaining why we’re about to breach the debt ceiling again. The notion that these folks are somehow going to “get religion” about the debt situation will very likely prove to be as misguided as the hope that the fiscal cliff deal would do anything to help the economy.

The media, as it likes to do, continues to rave about social issues (gun control being the latest), ignoring the fact that the US would be in technical default already if Treasury Secretary Tim Geithner hadn’t already raided various funds for some $200 billion.

We’re not here to debate social issues, but it’s telling that a US default, something that would affect every American, gets less airtime than assault rifles, which affect less than 5% of the population.

The market, is already giving us hints of what the likely outcome will be. Despite start of the year buying and a seasonal bias, the rallies of the last few days have been very weak, usually peaking out mid-day and then retreating.

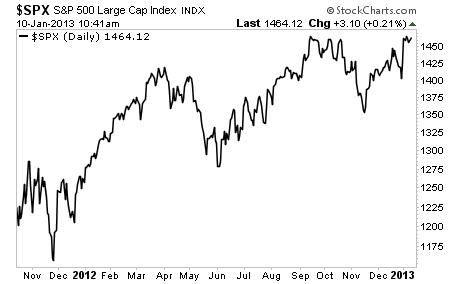

More telling however is the big picture view of the S&P 500 where it is tracing out virtually the exact same pattern as it staged going into the failed debt ceiling talks of 2011.

Here’s the S&P 500’s recent action:

Here’s the market action going into the 2011 debt ceiling debacle:

Here’s what followed:

History doesn’t necessarily repeat, but it often rhymes. And the fiscal cliff situation has made it clear that when it comes to issues such as cutting the deficit and debt, US politicians are totally clueless.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Remember, Congress hasn’t passed a budget in four years, which incidentally goes a long ways towards explaining why we’re about to breach the debt ceiling again. The notion that these folks are somehow going to “get religion” about the debt situation will very likely prove to be as misguided as the hope that the fiscal cliff deal would do anything to help the economy.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.