On Wednesday both International Business Machines (NYSE:IBM) and Facebook Inc (NASDAQ:FB) announced new initiatives to spur innovation in app development. IBM announced the 25 finalists of The Watson Mobile Developer Challenge and Facebook announced that if you are a developer and want to build a mobile app, they will willingly hand over $30,000 worth of services to get you kick started. Facebook’s gambit to take over the mobile apps industry from the ground of up is a classic example of Mark Zuckerberg’s strategy to innovate by firing on all cylinders. Unfortunately IBM’s mobile app development initiative for Watson is a bit of a joke.

The Watson supercomputer itself has so much potential. It has advanced cognitive computing capabilities and can actually teach itself by analyzing Big Data. We all saw what Watson could do on Jeopardy, the thing is incredibly impressive. Watson can even understand and process natural language, it frequently called upon entire database of Wikipedia to answer questions on the show in real time. If developers could find meaningful ways to integrate the power of Watson into mobile apps, theoretically we could solve some really important problems. But regrettably all of the worst qualities of IBM have manifest themselves in The Watson Mobile Developer Challenge.

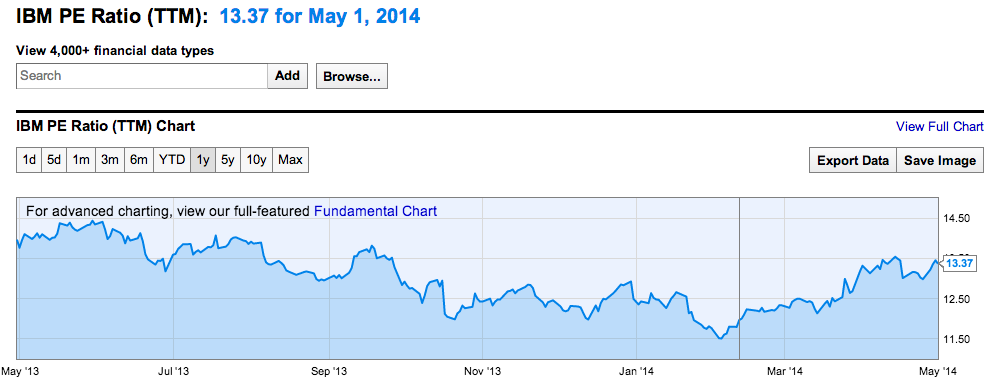

Last year the market was asking a lot of questions of IBM. The share price trended down from late March highs all the way through mid December. Investors really weren’t quite sure which direction IBM wanted to go in and were getting fed up with the lack of a clean plan. Big Blue is one of the largest companies in the world and they do a lot of things very well ranging from consulting services to building extremely advanced hardware (like Watson). However these strengths are balanced out by a few weaknesses.

One of the problems with IBM is that as a company they move slowly. It took them much longer for IBM than their competitors to realize that it was time to get serious about cloud services. 3 months ago IBM finally announced that it would sell off its low end server business and invest $1.2 billion in 15 data centers across the globe to bolster its cloud computing capabilities. Since the announcement IBM stock has had a great performance increasing from an early February low of $172.19 to $195.24 for a 13.4% gain in just over a 3 month period. It wouldn’t be fair to talk about the short term performance of IBM without also mentioning the broad sell off in high flier tech and social stocks and the rotation into what investors are calling “old tech”, the more established tech companies with more modest price to earnings valuations like IBM.

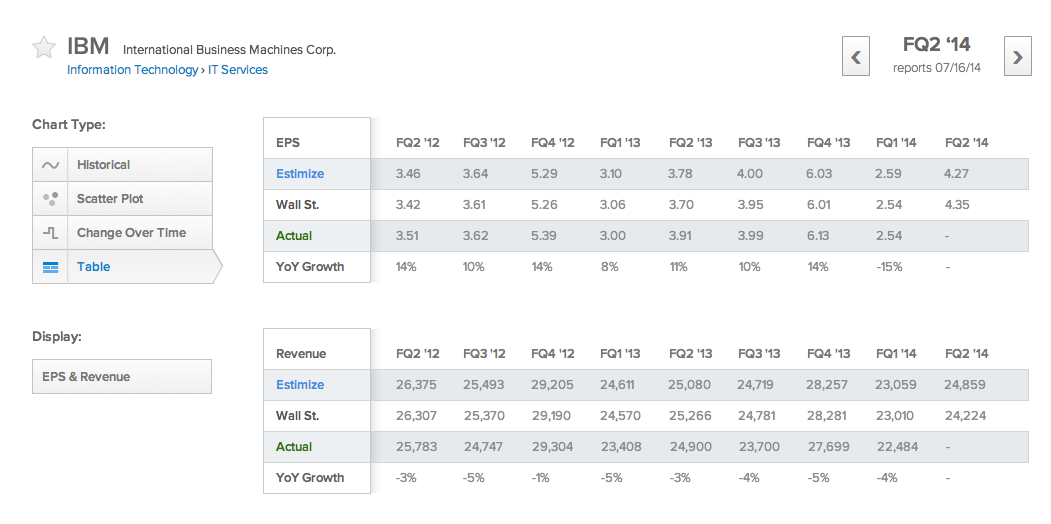

The chart above from ycharts shows the price to earnings ratio for IBM over time. The ratio of the price investors are willing to pay for a stock to the company’s current earnings is often an indicator of growth expectations and perceived profitability further down the road. This chart supports the idea that the market was losing confidence in IBM last year, the price to earnings valuation that the market was giving IBM was slipping until January when IBM finally decided to get serious about the cloud and open up Watson to developers. Now sentiment is starting to pick back up around IBM, but it’s probably mostly because of the push into cloud services which is a proven and hot industry. Over the past 2 years IBM’s revenue has fallen on a year over year basis in every quarter but it seems the firm’s outlook is finally starting to turn around.

The pace at which IBM is “opening up” Watson to development is painfully slow. Just to give you an idea about the frustration around Watson, one of IBM’s first consumer facing applications of its supercomputer was to make a space age food truck. Sure a super food truck may be cool but it’s not what consumers demand on a scalable level. Instead of learning how to make the ultimate kimchi taco, how about doing something a bit more helpful and/or profitable. It seems that IBM just has no idea what its doing in terms of building consumer applications based on Watson. And the new “developer initiative”, if we can even call it that, will only allow 3 lucky winners 90 day access to Watson’s APIs. This is not how you make money, it’s a gimmick.

In the new HBO show Silicon Valley there’s a scene where the CEO of a brand new compression algorithm company learns that the venture capitalist backing him may be investing in other compression algorithm startups as well. One of his friends helps explain the logic to him by comparing the investments to baby sea turtles being born on the beach. Most of the hatchlings will get picked off by the birds before they ever make it to the ocean. It’s strictly a numbers game, but the benefit to the species of the baby seaturtles who make it to the sea outweighs the costs of the ones who get eaten. Since sea turtles are still around today, it’s pretty clear that their reproductive strategy works. IBM could learn a thing a two from the sea turtles. What Big Blue should do is give access to any developer who wants to use the power of Watson in exchange for revenue sharing, equity, or a monthly charge. That’s kind of along the lines of what Facebook is doing with its developer initiative.

Facebook is just giving away $30,000 worth of services to any developer who wants to build a mobile app and are selected into the FbStart program. Facebook even said in their official announcement that the apps don’t even need to be integrated with Facebook. This is kind of crazy. Here Facebook is continuing its aggressive strategy focused around the inevitable unbundling of their one big Facebook app into specialized apps that offer best in class experiences for individual product and service verticals. Which program do you think will produce better apps? IBM’s 3 hand picked winners with 90 days access to the Watson API or Facebook’s army of developers? Even Watson itself would bet on Facebook here. You can read more about the unbundling strategy Mark Zuckerberg has outlined here on our blog.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI