Bed Bath & Beyond (BBBY) stock made a steep climb in 2013. The domestic merchandise retailer’s stock jumped from $56.53 to $80.30 last year. Most analysts believe the bull market of 2013 will continue into 2014 with more modest gains, BBBY will be one of the first companies to report quarterly financial results in the new year. Bed Bath & Beyond is expected to report their FQ3’2014 earnings release on Wednesday, January 8th after the market closes.

The information below is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors.

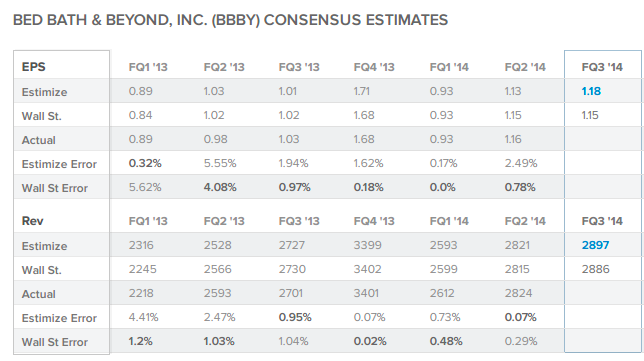

The current Wall Street consensus expectation is for BBBY to report $1.15 EPS and $2.886B revenue while the current Estimize consensus from 19 Buy Side and Independent contributing analysts is $1.18 EPS and $2.897B revenue.

By tapping into a wider range of contributors including hedge-fund analysts, asset managers, students, and non professional investors the Estimize community has built a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing an average differential between the consensuses.

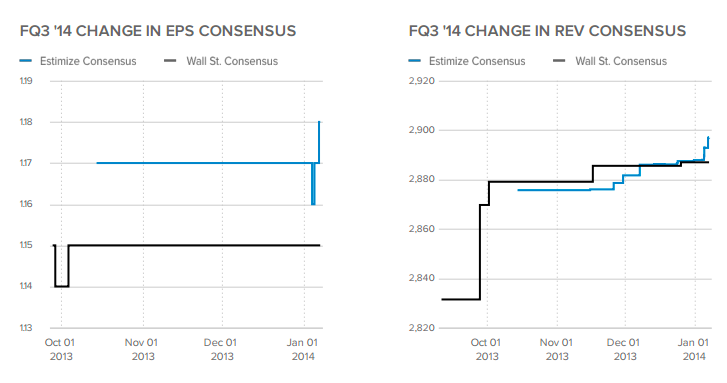

Over the past four months the Wall Street consensus trend for EPS has fallen and returned to its starting point of $1.15 while Wall Street revenue expectations have increased from $2.831B to $2.886B. The Estimize EPS consensus has edged higher from $1.17 to $1.18 while the revenue consensus has increased from $2.876B to $2.897B at the end of quarter. Timeliness of estimates is correlated with accuracy and upwards analyst revisions going into an earnings release are often a bullish indicator.

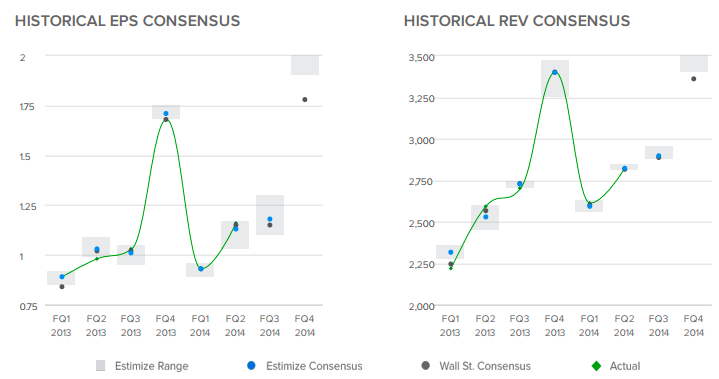

The distribution of estimates published by analysts on Estimize range from $1.10 to $1.30 EPS and $2.876B to $2.956B in revenues. This quarter we’re seeing a larger than usual distribution of estimates for BBBY. The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A wider distribution signaling the potential for greater volatility post earnings, a smaller vice versa. In this case market expectations are divided for Bed Bath & Beyond and we could see considerable volatility depending on what kind of earnings they report on Wednesday.

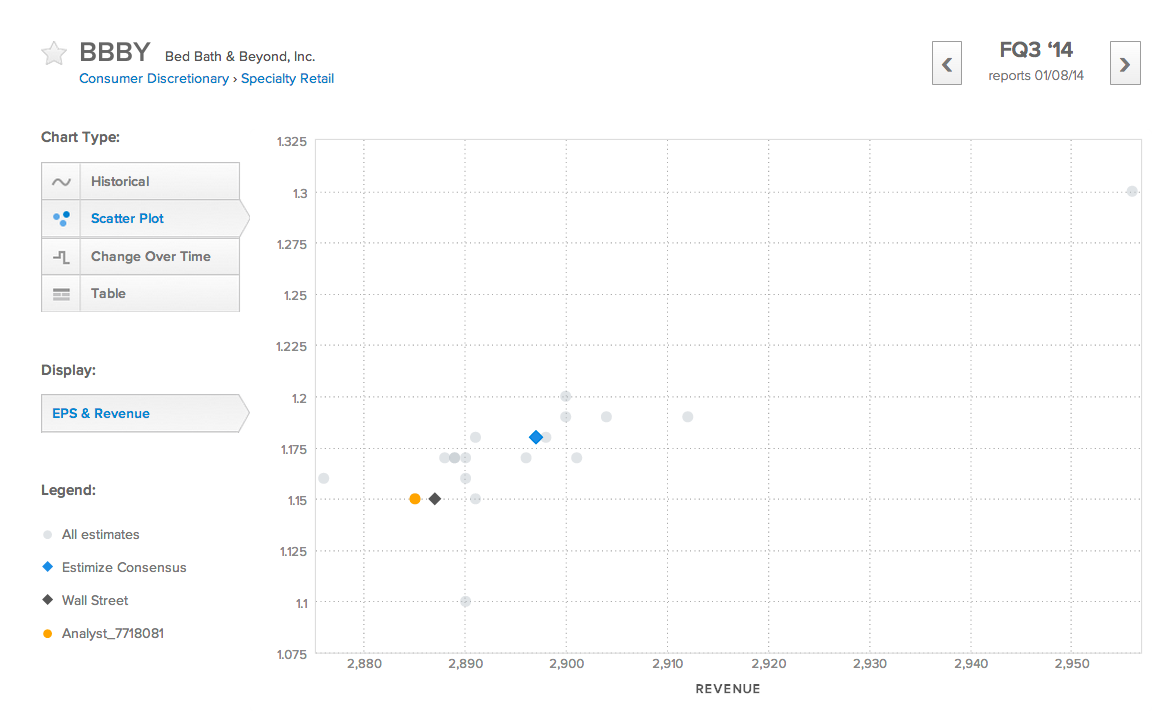

The analyst with the highest estimate confidence rating this quarter is Analyst_7718081 who projects $1.15 EPS and $2.885B in revenue. Estimate confidence ratings are calculated through algorithms developed by our deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case the analyst with the top confidence rating is taking the opposite view of the Estimize consensus, our top rated estimate is expecting BBBY to report inline with Wall Street on profit but to come up slightly short on revenue.

This quarter the Estimize community is expecting Bed Bath and Beyond to beat Wall Street on both the top and bottom line. Throughout the past 8 quarters BBBY has met or exceeded the Wall Street profit consensus 7 times and the Estimize contributing analysts are expecting them to do it again. Over the same period BBBY has met or exceeded the Wall Street revenue expectations 5 times.

Get access to estimates for Bed Bath & Beyond published by your Buy Side and Independent analyst peers, and register for free to make your own estimates to see how you stack up to Wall Street by heading over to Estimize now.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI