On Tuesday the S&P 500 rebounded from Monday’s fizzle and is recovering from a brief bout of Turkish worries. The names have changed, but the story is the same. A small European country is struggling and threatening to take the rest of Europe down with it. These headlines were the catalysts for last week’s tumble from the highs.

While we are still under last week’s highs, fear of Turkey’s economic collapse has been contained. A one day bounce is far from conclusive, but three days into this selloff and we are down less than 1%. That means most traders are definitely not overreacting to these headlines. This remains a “half-full market” and most owners are willing to give it the benefit of doubt.

While these Turkish headlines are new and impossible to predict, it was still possible for a savvy trader to sidestep this dip. I wrote the following last Thursday when stocks were at record highs and before Turkey hijacked the front page of the financial section:

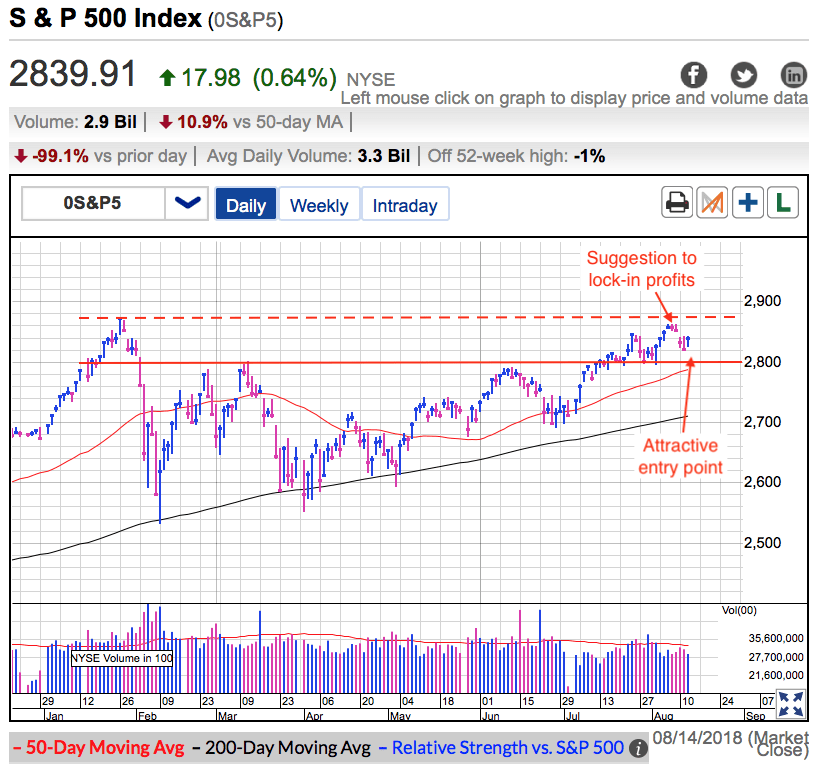

Even though the market left most of its concerns behind as we climbed to these highs, that actually makes this a more dangerous place buy. Smart traders buy discounts, they don’t chase premium prices. Risk is a function of height and this week’s gains made this one of the riskiest places to buy all year. Now don’t get me wrong, I’m most definitely not calling a top or predicting and imminent collapse. But what I am saying is we rallied up to resistance and it is normal and healthy for the market to pause and even dip a little.

I don’t have a crystal ball so I don’t know if we stall at current levels, or if we break through 2,880 resistance and stall above it. Either way it doesn’t really matter because the risk/reward has shifted against us and this is a better place to be taking profits than adding new money. It is a fool’s errand to try and decide if the peak will be 2,862, 2,875, or 2,892. The point is ‘good enough is good enough’ and that is all that matters. And the thing to remember is we cannot buy the next dip if we don’t have any cash. Buy weakness, sell strength, and repeat until a good year becomes a great year.

But just because we slipped from the highs doesn’t mean we need to run for the hills. As expected, the selling has been limited and we didn’t even fall to 2,800 support. As with every other headline over the last six months, owners are reluctant to sell. After years of selling prematurely and regretting it, most traders have learned to hold no matter what. That has been the smartest way for long-term investors to navigate these dips and it doesn’t look like anything changed yet.

Turkey is a small nation and by itself it cannot take down the global economy. No doubt it could cause a lot of pain for some European banks, but there is no reason to think the ECB won’t come to the rescue this time too. That is why the market’s reaction to these headlines has been so muted.

That said, the danger with the above assumption is it means very little risk has been priced in. If everything works out, the upside is limited because we didn’t dip very far. But this complacency leaves us vulnerable if things do not go as planned. I don’t expect this situation to make much of a dent in the global economy, but we have to monitor it closely because if the situation deteriorates, it will weigh on stocks. Unlike Trump’s trade war, larger Turkish risks have definitely not been priced in.

The trader in me misses the days when headlines like these would lead to widespread predictions of another economic collapse. Unfortunately the days of 10% swings in the indexes are long gone. Now the best we get is a 1% dip. The stability is great for care-free holding of long-term positions, but for trading opportunities, there is a lot to be desired.

The dip to 2,820 and subsequent bounce presented us with a fairly weak risk/reward. Day traders could have profited from this few hour move, but for me I’m waiting for something more worthwhile.

While it already looks like the Turkish selloff is dead, we need to hold this bounce for a few more days to be certain. There is a chance this bounce could fizzle and we continue slipping back to 2,800 support. If that happens, that will be a far more attractive entry point. Until then I will keep watching, waiting, and hoping for that next profitable opportunity.

As for our longer-term positions. There is nothing to see here. Stick with what has been working and ignore the noise. The market is still setting up for a strong rally into year-end.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI