Yesterday was another day of bad economic data with the ISM report showing the worst employment figure since September 2009.

The bulls believe that bad economic data means more QE. The problem with this is that they’re ignoring the fact that this current spat of bad data is coming out while QE 3 and QE 4 are occurring.

At any other time in the last four years, bad news could open the door to more QE as every QE plan had a fixed timeline in place. So there was always the possibility of more QE coming if economic data worsened once a particular program came to an end.

However, today the Fed is already running two QE programs that are correctively pumping $85+ billion into the system per month. So the fact that bad economic data is coming out now indicates QE is losing is effect.

This does NOT open the door to more QE now. If the Fed tapers QE in the future then yes, it might engage in more QE later down the road. But the idea that the Fed will increase QE when it’s already running $85 billion a month is misguided.

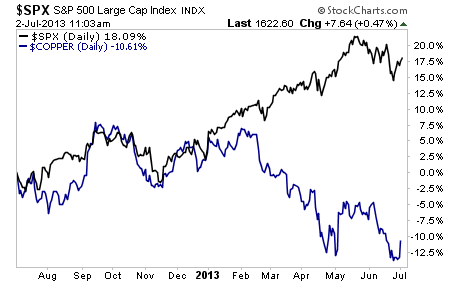

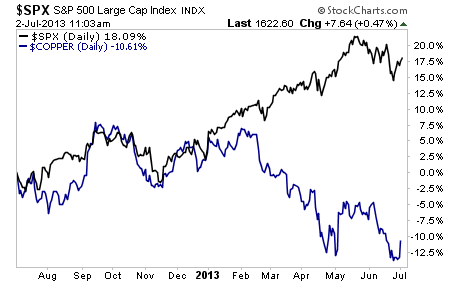

Copper, the commodity with a PhD in economics, gets this. Stocks do not.

Guess which asset class is in for a surprise in the coming months?

The bulls believe that bad economic data means more QE. The problem with this is that they’re ignoring the fact that this current spat of bad data is coming out while QE 3 and QE 4 are occurring.

At any other time in the last four years, bad news could open the door to more QE as every QE plan had a fixed timeline in place. So there was always the possibility of more QE coming if economic data worsened once a particular program came to an end.

However, today the Fed is already running two QE programs that are correctively pumping $85+ billion into the system per month. So the fact that bad economic data is coming out now indicates QE is losing is effect.

This does NOT open the door to more QE now. If the Fed tapers QE in the future then yes, it might engage in more QE later down the road. But the idea that the Fed will increase QE when it’s already running $85 billion a month is misguided.

Copper, the commodity with a PhD in economics, gets this. Stocks do not.

Guess which asset class is in for a surprise in the coming months?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.