Nvidia shares jump after resuming H20 sales in China, announcing new processor

Many of the leading home-builder stocks came under some early-morning selling pressure as the National Association of Realtors said home sales fell 1.2 percent to an annual rate of 5.08 million units. This news seems to be having a slightly negative effect on the leading home-builder stocks such as Toll Brothers Inc. (TOL), M/I Homes Inc. (MHO), Lennar Corporation (LEN) and the Ryland Group, Inc. (RYL).

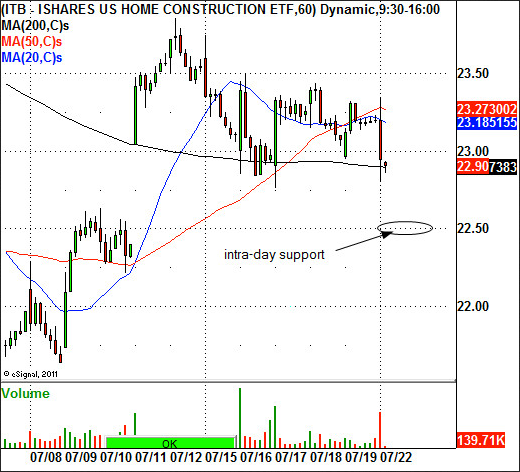

Traders that want to track the home-builder sector can follow the iShares Dow Jones US Home Construction ETF (ITB). Today, ITB is trading lower by 0.36 cents to $22.87 a share. Day traders can watch for intra-day support around the $22.50 level.

Leading Indicator?

Traders should follow the home-builder sector very closely as it is such an important part of the U.S. economy. A fair case can be made that the home-builder stocks are a leading indicator for the economic recovery and the stock market. Currently, the leading home-builder stocks have been in a trading range since the start of the year. The key daily chart support level for the ITB is around the $20.00 level. Any significant break below that important support area could spell serious problems for the home-builder sector and the U.S. economy.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI