We showed you chart a yesterday suggesting markets are grossly overvalued, to me it is obvious and self explanatory.

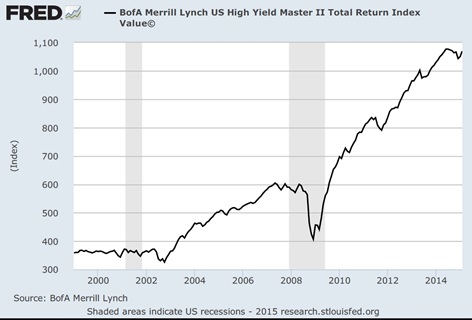

To make the point even more stark, take a gander at this chart of the “high yield” index.

For those who don’t know, it is proper to replace the words “high yield” with “junk bonds”. These are THE most risky, lowest rated credits there are and have soared as investors have chased yield. Does this look like a bubble to you? Has your broker suggested this arena as a way to “diversify” or to strive for added yield …safely? Do you think the smart money is chasing these blindly?

A list of billionaires and very savvy investors must have already seen these or ones quite similar as over the last year or more they have been “lining up” and getting out. The list is long, Carl Icahn, George Soros, Stanley Druckenmiller, Sam Zell, Ray Dalio, Kyle Bass, and even the quintessential establishment figure Alan Greenspan… and it’s getting longer.

A couple of names were added to the list this past week, first, the famed hedge fund manager Paul Tudor Jones said the current “market mania will end in revolution, taxes or war“ Most importantly he said, “this gap between the 1% and the rest of America, and between the US and the rest of the world, cannot and will not persist. we’re in the middle of a disastrous market mania“.

Do you understand what he is saying? Have you heard this before on many occasions …in my writings? In plain English without actually using the word, Paul Tudor Jones is forecasting we have a “reset” in our future.

Another name added to the list and far more shocking was former Dallas Fed member Richard Fisher. He was interviewed one day after his retirement and it was a doozy!

Please watch this interview, for the first 2:10 it was mostly niceties and he towed the Fed line quite well. The remainder, while not totally spilling the beans was VERY telling. He said the Fed is “uber accommodative, and investors are lazy for relying on the Fed”. He iced this cake when he said the markets are “hyper overpriced” amongst other goodies!

… And to think, it only took him one day of retirement to start telling some very real truths! (He also immediately joined the board of Pepsi Cola (PS:PIP)) I could only think to myself, what does he really think? I would love to play a round of golf with Mr. Fisher and get a little bit of cold Rocky Mountain (truth serum) Ale into him to hear the rest of the story. Might the timing of his retirement say anything to the thoughtful?

In any case, “they know”. They all know and I would say they “have known” for years. The truly bright knew before 2007 where this is all going but how do you stop a speeding freight train running toward a cliff where the tracks cease to even exist? There is still time to correct your position. You can still sell your stocks and bonds. You can still buy gold and silver and have them delivered to you. You can still move your bank balances into real assets with no leverage.

You can still move to protect yourselves, the question is “how much” time is left? I don’t know. The list of names above probably don’t know either as some have been as boisterous as I have been since 2007. The key is to look at the charts at the very top and understand “what” is coming. This is not going to be a crash of the real estate markets. It won’t be a crash of a “sector” of the stock market nor just the stock market. We will not watch as the bond markets seize up singularly nor will we see our currency collapsed and not affecting any other asset class.

No, what we have coming is a collapse of everything we have worked for and everything we have built and saved over our own lifetimes and that of our ancestors. All of our financial markets are connected and none will be spared. Another aspect is ALL foreign markets and their economies are tied together with everyone else’s …you could say “we are the world”! Nothing will be left unaffected. The only thing you need to know and understand is this, gold has always been money and always ultimately seen to be the most liquid safe haven on God’s green Earth. Man has never before in history been involved in a more dangerous and all engulfing mania based on a Ponzi scheme. It matters not when nor how it ends because it will end …badly What matters is how you are positioned when it does!

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI