Broadcom jumps on OpenAI pact report, strong fiscal Q3 results and outlook

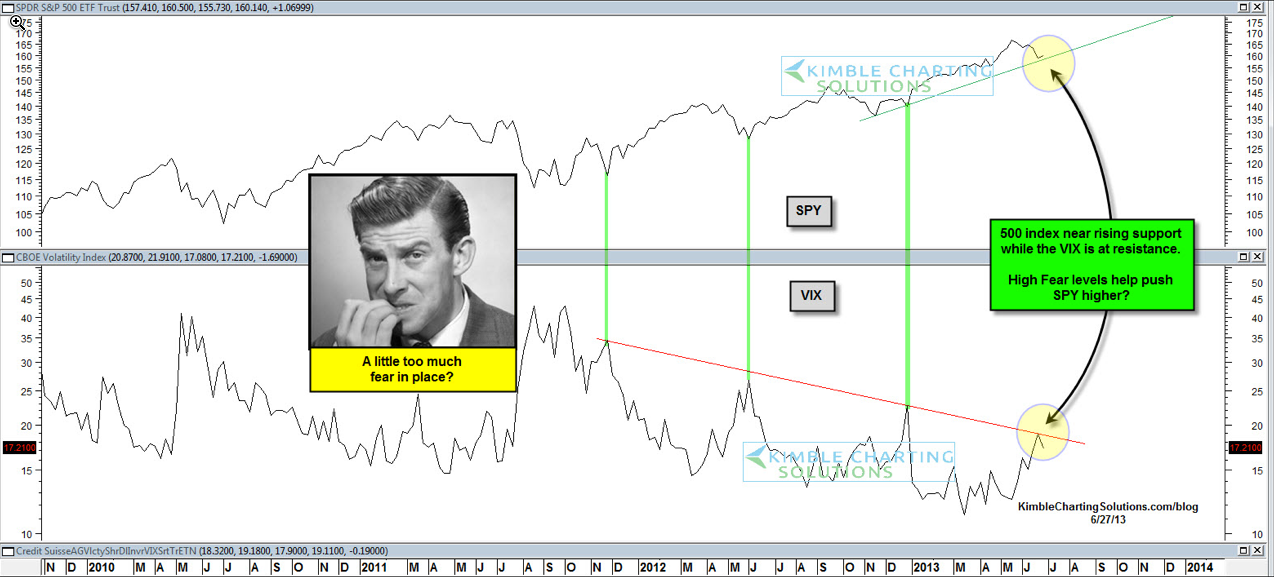

The fear index (VIX) has moved higher over the past month, hitting a falling resistance line that has stopped its rise in price over the past couple of years. At the same time, the S&P 500 is near its rising support line that has been in place since the lows last fall.

Will these high fear levels help push the S&P 500 higher from here?

Short The Fear

The Power of the Pattern is suggesting that shorting Fear, here, with a stop above falling resistance could be a decent trade for a while.

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!