After a relatively quiet and less than stellar 2017 for initial public offerings (IPOs), 2018 looks to be both more promising and potentially more exciting, with a pack of 'Unicorns'—Zscaler, Dropbox and Spotify— leading the charge. Unicorns are the designation given to start-ups with $1-billion or greater valuations.

Zscaler (NASDAQ:ZS), a provider of cybersecurity solutions and the first Unicorn out of the gate, went public this past Friday. It priced at $16 but finished its first day of trading up 106% at $33, though as of Tuesday's close shares were trading at $30.38. Its market cap when it IPO'd was $2.5 billion; currently that's grown to $3.27B.

Dropbox's (NASDAQ:DBX) IPO is scheduled for this coming Friday, March 23rd. Yesterday we took a closer look at Dropbox's fundamentals, on the eve of its already oversubscribed IPO.

Today we'll consider Spotify's (NYSE:SPOT) more unusual path to the public markets, via a direct listing which is expected to occur on Tuesday, April 3rd. As we'll explain below, this route is potentially more volatile and much riskier for private investors. Even if you don't mind the extra risk, the central question still can't be ignored: should you even invest in Spotify when it goes public?

Spotify: Growing Platform, No Real Profits...Yet

For those rare few who've never heard of the company, Spotify is a music streaming service, and a good one at that. It offers free music streaming with limited functionality and minimal ads, or a premium service for $9.99, which goes up to $14.99 for a family plan good for up to 5 users (making it $3 per person on the family plan, instead of the single user's fee of $9.99).

Spotify is based in Sweden. Arguably, it's the second most well-known Swedish company after IKEA. Spotify has been around since 2008 so it's not exactly a start-up. Private valuations for the company are as high as $20 billion.

Digging into Spotify's F-1 pre-IPO filings reveals the inner workings of the company. It's not all good.

Starting with the good, Spotify has 71 million paid subscribers, almost double the number of Apple Music (NASDAQ:AAPL) subscribers, which was 36 million at last count. Wall Street loves growth and Spotify delivers handsomely on that front: + 46% growth in paid subscribers over the past year. Churn is down to 5.5%, from 6.6% last year. Annual revenues are nearly $5 billion, up almost 40% from last year.

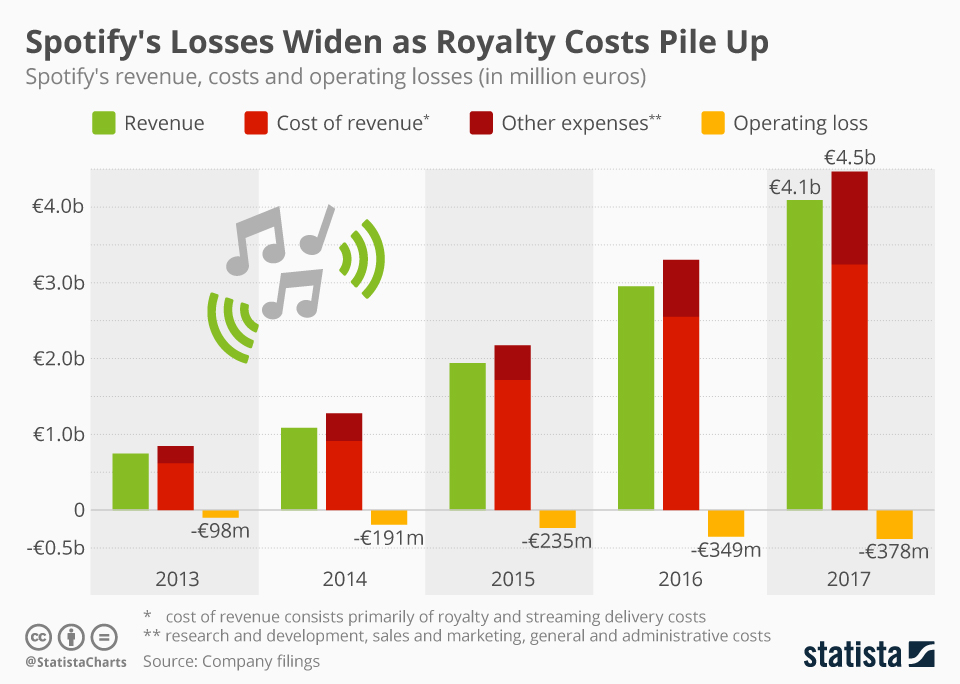

Unfortunately, there are a few negatives too. While Spotify is clearly strong on the revenue front, that still wasn't enough to make it profitable. It lost $1.5 billion dollars last year.

Average revenue per paying user is down 14% over the past year, as more subscribers move to the better-value family plan.

Perhaps even more crippling, cost of revenue in the form of music royalties is very high and getting higher. Last year, this line item—which includes royalties and distribution costs—amounted to a hefty 79% of Spotify's total revenue, leaving the company with gross margins of 21%, before all other expenses.

Put simply, Spotify is a growing platform that hasn't yet been able to make money. That might be acceptable, except that there are already massive concerns about its ability to expand revenue given the user trend toward Spotify's more cost-effective family plan. Obviously, this could become a hurdle toward future profitability.

As well, Spotify's competitive environment is particularly tough—Apple, Amazon (NASDAQ:AMZN), and Alphabet (NASDAQ:GOOGL) are the primary competitors. Apple already has its own streaming service along with a huge, very sticky ecosystem that it can count on. Likewise, Amazon has Amazon Music as well as an estimated 90 million Prime members who, with that membership, receive their streaming Amazon Music for free. Not to be outdone, Alphabet has a similar streaming service in Google Music.

All three mega cap competitors are big enough and wealthy enough to support a money-losing, streaming music operation. After all, what's $1.5 billion a year in the greater scheme of things to Apple, Amazon or Google? Not much.

On the other hand, for Spotify it's everything. Spotify could cut down on the cost of royalty fees by pulling a Netflix (NASDAQ:NFLX) and creating a music label of its own, but that’s a whole other direction and one it hasn't necessarily considered or is equipped to pursue.

There are two, blatant red flags surrounding the technical structure of Spotify's IPO. To begin with their offering includes a split between voting and non-voting shares, something we cautioned about right before Snap's (NYSE:SNAP) IPO in early March 2017. It remains a point of concern today, for both companies. Issuing shares with diminished or no voting rights is a clear signal by founders and insiders that they want to keep decisions closely held, without any public interference.

As well, Spotify's decision to do what's known as a 'Direct IPO,' in which no investment banks are involved and shares are sold directly from current stakeholders and owners to the public, is highly unusual. To begin with, it creates the feeling that insiders are looking to cash out.

In addition, those who already own shares, having gotten in privately, posses a lot more information than what's available to the public right now. When the seller has the advantage of insider knowledge, the old adage applies...caveat emptor or buyer beware. Anyone thinking of acquiring shares when the stock goes public ought to also consider the worst possible outcome.

Finally, direct selling is expected to create extreme volatility during the first few days after the stock goes public. Usually, investment banks provide stability by underwriting a stock. Spotify will IPO without a security blanket protecting it from volatility. We aren't certain exactly what that will look like, but Snap had underwriters and it would be an understatement to say the stock was volatile after its IPO.

Conclusion: As a rule, I'm not a fan of investing in IPOs. I could be, but only under extraordinary circumstances and when all the stars align.

Spotify's multiple red flags will keep me out of this one. I'll see how the price moves and will wait for a few quarterly reports to give me a sense of where growth and profitability are headed. If all the stars align, maybe then I'll consider committing.