FedEx Corporation (NYSE:FDX) reports its FQ4 ’15 results before the opening bell this morning and the result is expected to be strong. FedEx is a global player in the shipping and freight industries with a majority of revenues being derived from its Express & Ground Segments.

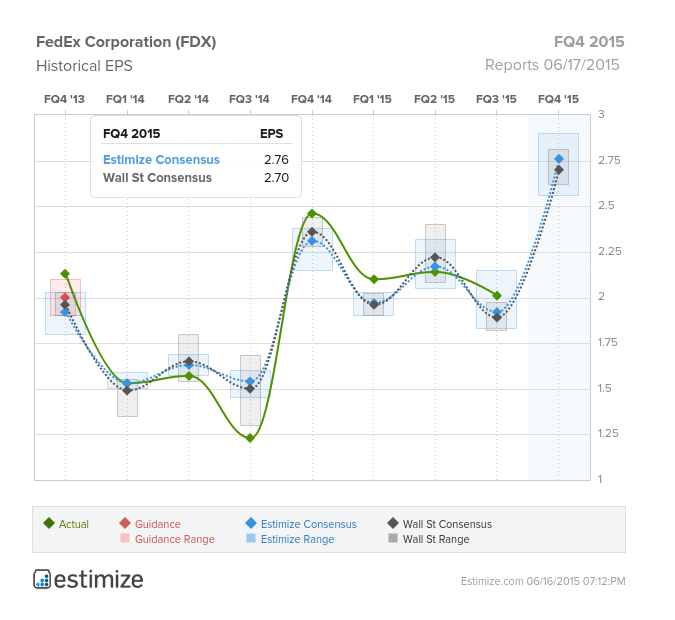

In anticipation of today’s result, both the Estimize community and the Wall Street sell-side analysts predict a strong uplift in earnings per share (EPS) for the quarter to $2.76 and $2.70, respectively, from $2.46 in the year-ago quarter.

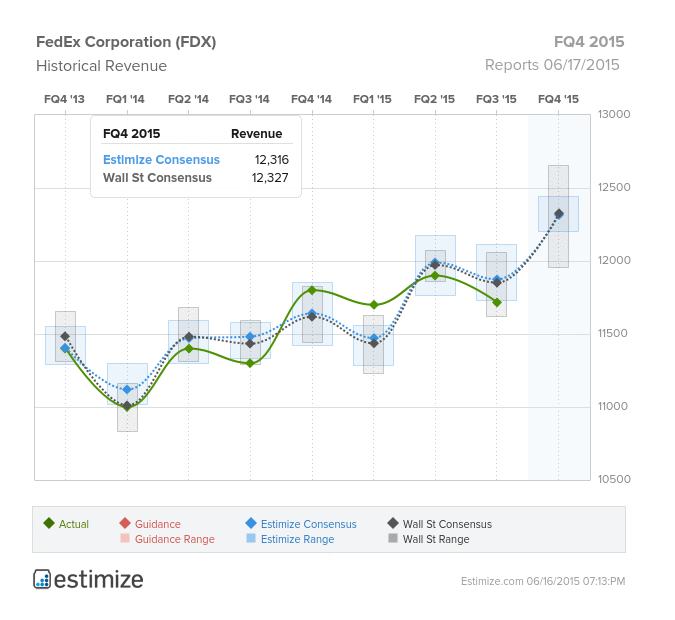

Dissimilar to the EPS estimates, the Estimize community predicts a revenue figure of $12.318B, which is slightly below the Wall Street consensus of $12.327B.

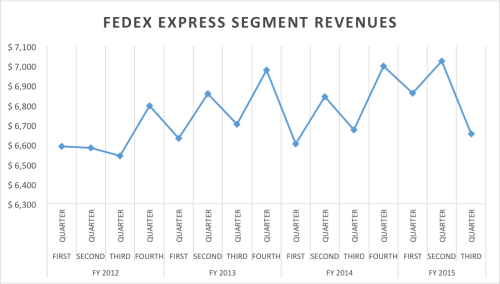

Investors will be eager to hear management’s overall outlook as concerns surrounding the company’s ability to grow revenues from its Express Segment in a slowing global economic environment persist. The Express Segment is FedEx’s premium offering and is the largest contributor to top-line revenues. Despite of the company’s strong position in this market globally, FedEx has relied upon cost cutting to stimulate net income advances in this business unit. The company has struggled to expand revenues from its Express business over the past three years, a constant concern for investors.

The positive earnings outlook can be attributed to a number of factors including but not limited to the continued benefits of management’s profit improvement strategy. Further, depressed oil prices globally are translating to lower expenses and therefore boosting margins. Year to date (YTD) the stock has performed comparatively well posting a 5.0% capital gain relative to the S&P 500 which has delivered a lackluster 1.47%. This should come as no surprise due to the company’s better-than-expected FQ3 ‘15 EPS figure. The stock has rallied since its intraday low on March 27 when it touched $164.51 and is now trading $181.90.

Today’s result may be a catalyst for the stock and a sign for things to come. The Estimize community is predicting a 37.71% uplift in earnings from the FQ3 ’15 figure. If the reported figures tomorrow are in-line with consensus, the stock will likely trade higher as a result.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.