AT&T Inc. (T) is set to report FQ4 2013 earnings after the market closes on Tuesday, January 28th. Due to increased pressure in the mobile phone industry AT&T has recently made changes to its service contracts to allow users to upgrade phones after 6 months. Verizon (VZ) and T-Mobile (TMUS) were ahead of the curve with these adoptions and AT&T may have lost some customers as a result. On the bright side for the business, allowing users to upgrade their phones should boost sales because early upgraders will need to pay the full price of new phones, not a subsidized rate. Plans to connect cars to the AT&T network may be a big part of the future, recently an exclusive multi-year deal was signed with Tesla (TSLA) to connect the high end electric cars to the wireless network. Here’s what the buy-side expects AT&T to report Tuesday.

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

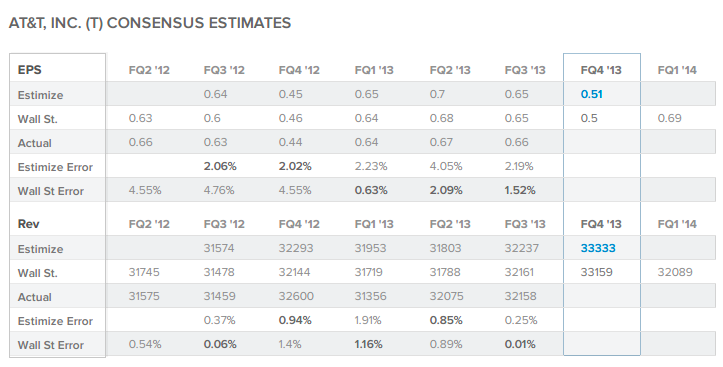

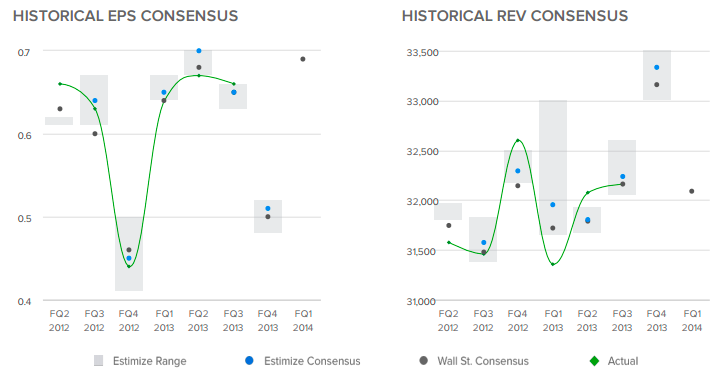

The current Wall Street consensus expectation is for AT&T to report 50c EPS and $33.33159B revenue while the current Estimize.com consensus from 10 Buy Side and Independent contributing analysts is 51c EPS and $33.333B revenue. This quarter the buy-side as represented by the Estimize.com communtiy is expecting AT&T to beat Wall Street expectations by a small margin on both profit and revenue.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing a small differential between the 2 groups’ forecasts.

By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations. It has been confirmed by an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

The distribution of estimates published by analysts on Estimize range from 48c to 52c EPS and $33.004B to $33.500B in revenues. This quarter we’re seeing a moderate distribution of estimates compared to previous quarters.

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A larger distribution of estimates signaling less agreement in the market, which could mean greater volatility post earnings.

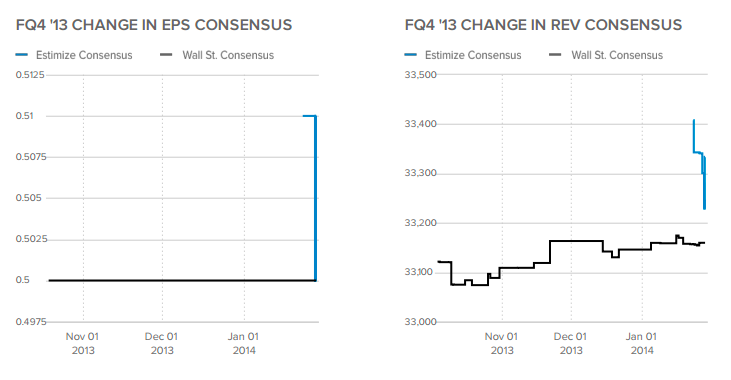

The Wall Street EPS consensus remained flat throughout the quarter at 50c while the Wall Street revenue consensus increased from $33.122B to $33.159B. The Estimize EPS consensus returned to its starting point of 51c while the Estimize revenue consensus dropped from $33.408B to $33.333B. Timeliness is correlated with accuracy and near the end of the quarter we the two groups’ revenue consensuses converging.

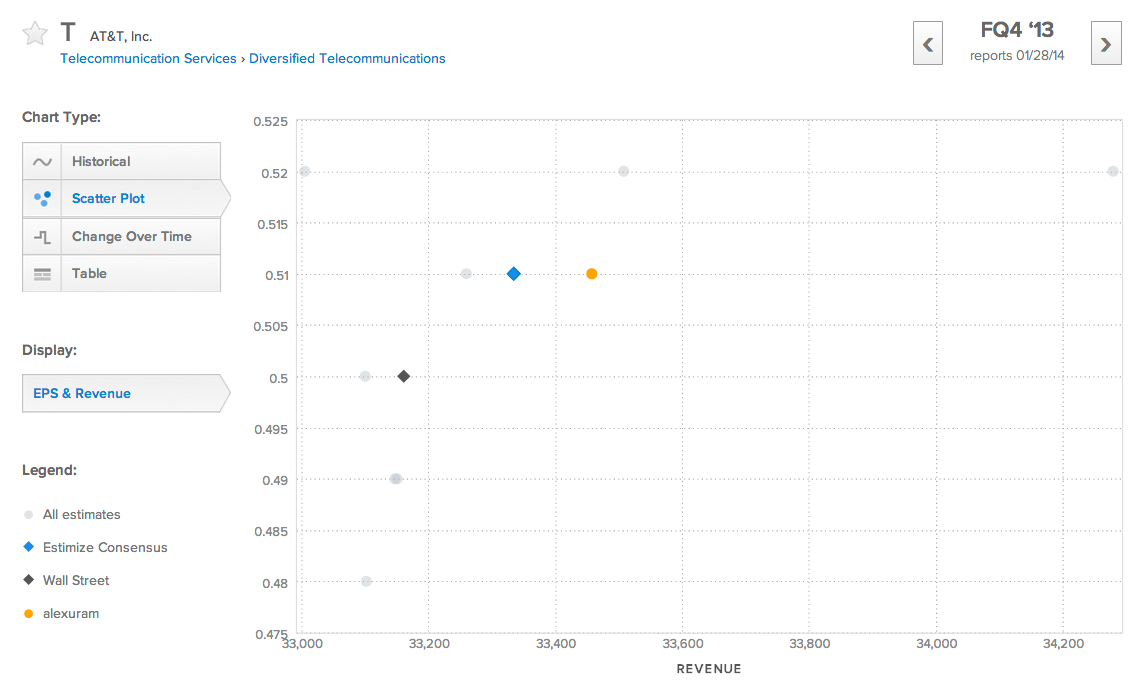

The analyst with the highest estimate confidence rating this quarter is alexuram who projects 51c EPS and $33.457B in revenue. In the Winter 2014 season, alexuram is currently ranked as the 24th best analyst and is ranked 21st overall among over 3,500 contributing analysts. Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case the highest rated estimate is expecting AT&T to report inline with Estimize on EPS but exceeded both groups’ expectations for revenue.

Get access to estimates for AT&T published by your Buy Side and Independent analyst peers and follow the rest of earnings season by heading over to Estimize.com. Register for free to create your own estimates and see how you stack up to Wall Street.