Dollar General (DG) is having a formidable year. The stock price has steadily climbed up since January going from $44.21 to $56.29. Weaker-than-expected earnings from other retailers at the opening of the holiday season have contributed to a recent dip in price going into the FQ3 2013 earnings report on December 5.

The information below is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors. You can share your own estimates as well by visiting www.estimize.com.

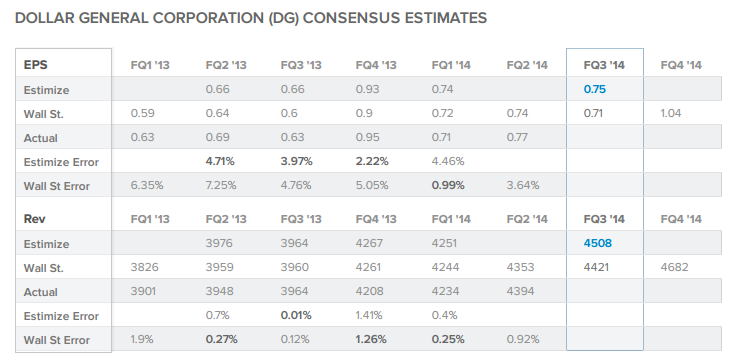

The current Wall Street consensus expectation is for DG to report 71c EPS and $4.422B Revenue while the current Estimize consensus from 7 Buy Side and Independent contributing analysts is 75c EPS and $4.508B Revenue.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case, we’re seeing an about equal sized differential between the Estimize and Wall Street numbers compared to previous quarters.

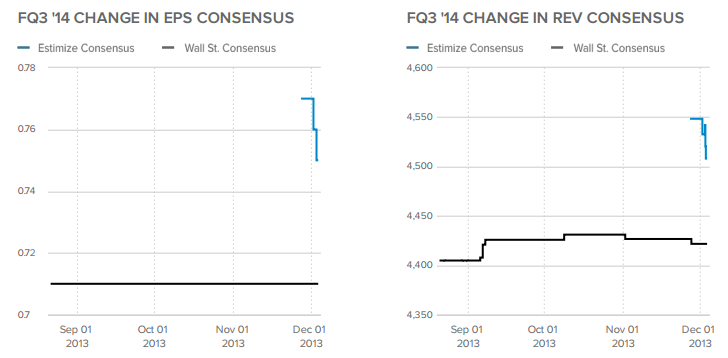

Over the past 4 months the Wall Street consensus trend for EPS has remained flat at 71c while Wall Street revenue expectations have increased from $4.405B to $4.422B. It is important to note, however, that the past 2 revisions have both been downgrades. The Estimize EPS and Revenue consensuses have both fallen significantly as we approach the end of the quarter. EPS has gone from 75c to 73c and the Revenue target has dropped from $4.548B to $4.508B.

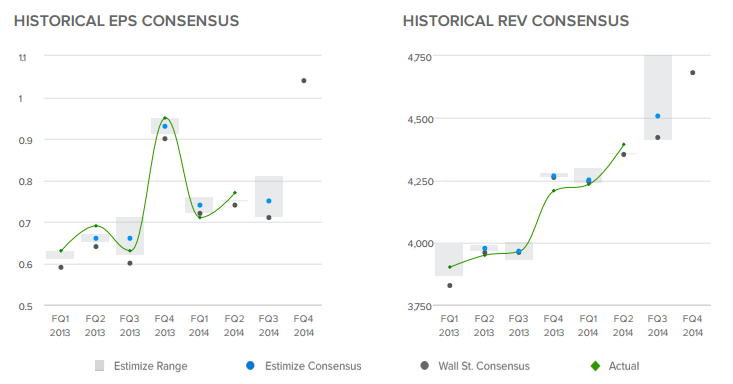

Over the previous 8 quarters, DG has beaten the Wall Street consensus for EPS 7 times while beating the Wall Street Revenue consensus 5 times. Over the past 4 quarters for which there have been sufficient data DG has beaten the Estimize EPS consensus 2 times. Over the same time period DG has failed to meet the Estimize Revenue consensus 3 times and was predicted perfectly once.

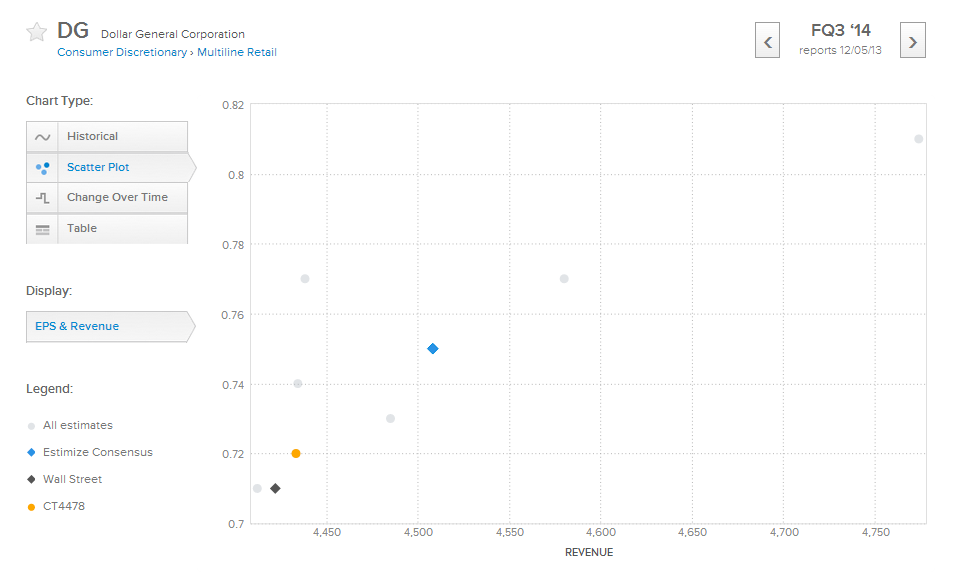

The distribution of estimates published by analysts on Estimize range from 71c to 81c EPS and $4.412B to $4.774B Revenues. We’re seeing a wider than normal distribution of estimates this quarter for Dollar General. The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A wider distribution signaling the potential for greater volatility post earnings, a smaller vice versa.

The analyst with the highest estimate confidence rating this quarter is CT4478 who projects 72c EPS and $4.433B Revenue. Estimize confidence ratings are calculated through algorithms developed by our deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy.

Over the past two years Dollar General has beaten the Wall Street expectations for EPS 7 times and the data from Estimize suggests that it will beat the Street again on Thursday. With that being said, keep an eye on the earnings expectations as predicted by Buy Side and Independent analysts going into the report. If expectations continue to fall on Estimize we could see a further decline in the stock price leading up to Thursday.

Original Post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI