Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

The Issue Of fees

A Bitcoin ACH

The second challenge is that a trustable and regulated financial services company would need to get involved and store a large supply of bitcoins to make the transfers possible in an instant. To avoid liquidity problems the company would need to hold about 2 times the largest allowed transfer worth of bitcoins. Maybe that means they hold $2million of bitcoin and cap individuals to transferring a maximum of $1 million once per minute each.

Hedging Risk

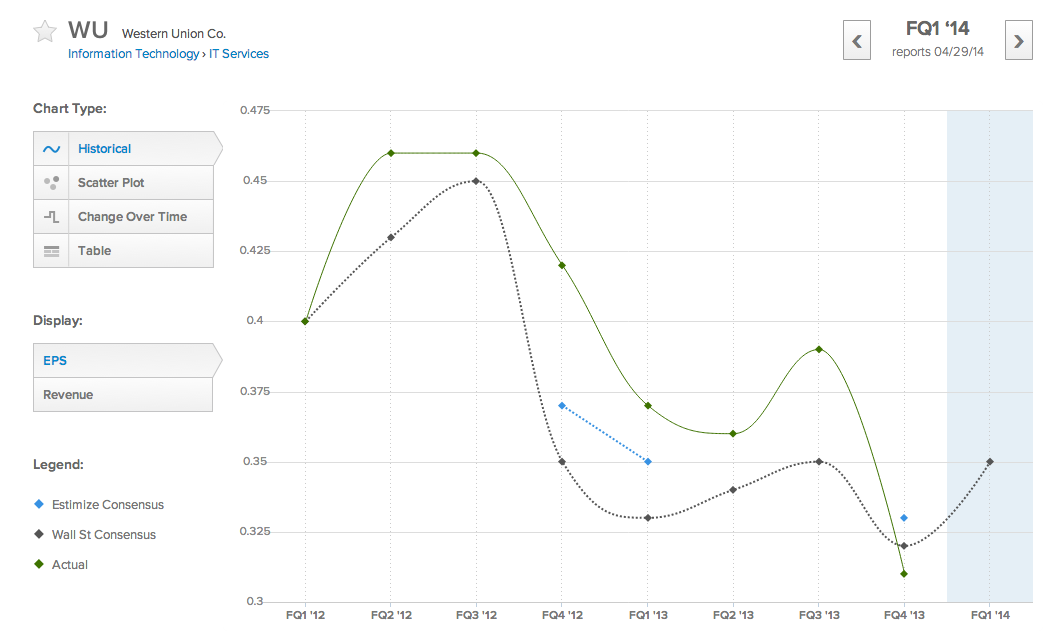

The final and perhaps most daunting barrier is that the transfer company will need to find a way to mitigate or hedge the currency risk of holding all the bitcoins. No one wants to take on a couple million of dollars of currency risk for only a few cents on every transaction. But it seems obvious that $30 wire transfers will soon be a thing of the past. Check out the Western Union Company (NYSE:WU) EPS graph, this thing could wipe them off the map.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.